Markets managed to absorb a somewhat hotter-than-expected U.S. consumer inflation reading for December without much drama.

Now more attention can turn to the corporate earnings season, which slips into gear on Friday, led by financials.

If company results and forecasts are reasonably well-received by investors then the S&P 500 may reach a new closing record.

The benchmark on Thursday closed just 16 points, or less than 0.4%, off its previous peak of 4796.56, set at the start of January 2022.

So, given no significant earnings shocks, and if the market remains comfortable with Federal Reserve rate-cut projections, it makes sense to favor risk assets, according to Societe Generale.

Fundamental signals continue to improve, say the cross-asset strategy team at SocGen, led by head of U.S. equity strategy Manish Kabra. For example jobless claims, one of the key indicators of an imminent U.S. recession, are still far from alarming levels

But be warned, he adds, the sources of volatility are set to increase in the second and third quarters.

There are two main reasons for this, says the French bank in a note published before Thursday’s release of the U.S. consumer price index report.

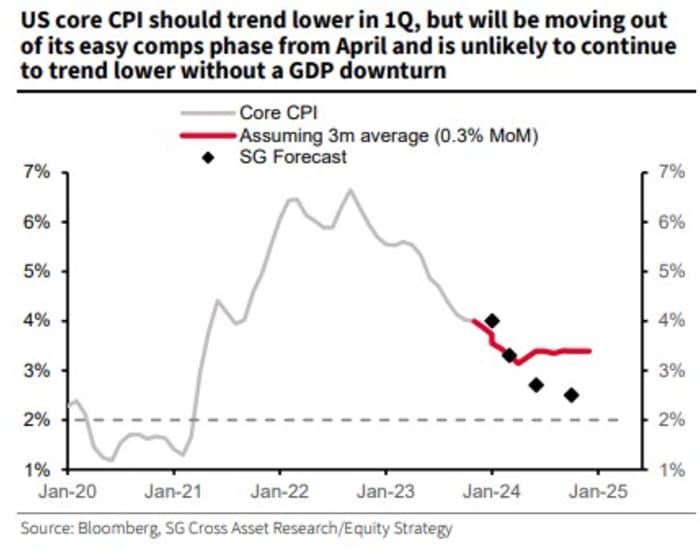

First, U.S. disinflation, which has been the main driver of the rate cut hopes, may stall as “CPI moves out of its ‘easy comps’ phase in April,” says SocGen. “In the absence of recession it is unlikely to continue to trend lower, so bond market volatility will probably rise.”

Source: SocGen.

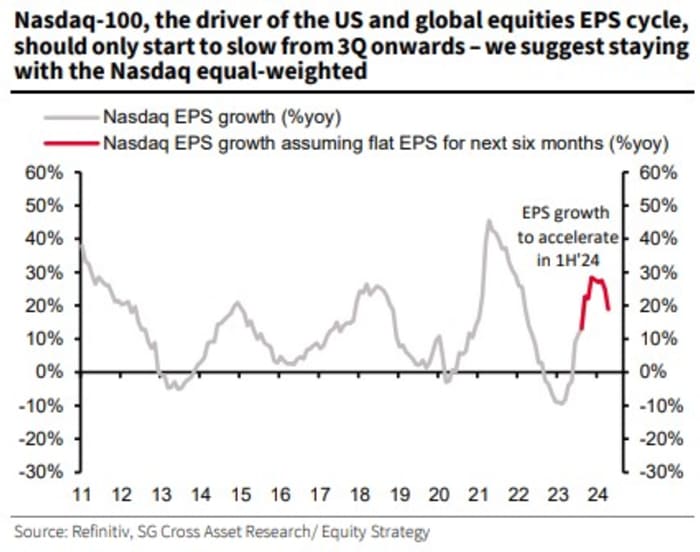

Second, the Nasdaq-100

NDX,

which with its heavy weighting of mega tech stocks, has been the main driver of U.S. equities’ earnings per share cycle, will also face tougher EPS comparisons after the second quarter, “and is therefore likely to show a slower pace of growth from 3Q onwards,” says SocGen.

Source: SocGen.

Importantly, Kabra and colleagues see a soft landing for the U.S. economy not delivering the slashing of borrowing costs that investors seem to be betting on.

“Non-recession Fed rate cuts are adjustments and not the start of the cutting cycle that the market is discounting,” the SocGen team emphasize.

Investors, therefore, should use the current “everything rally [to] keep the rational, sell the trash,” such as highly leveraged assets like high-yield credit and highly-indebted U.S. small caps, SocGen concludes.

The Russell 2000 Small-Cap index

RUT,

in which about 40% of companies are unprofitable, is up 12.8% over the last three months. The ARK Innovation ETF

ARKK,

is up 20.8% over the same period.

Markets

U.S. stock-index futures

ES00,

-0.21%

YM00,

-0.28%

NQ00,

-0.36%

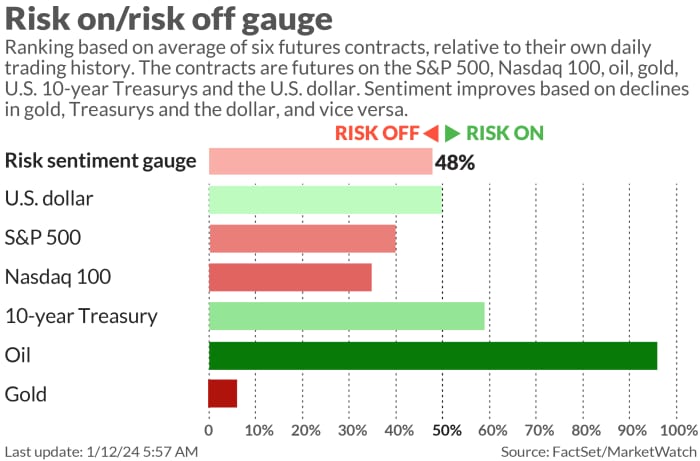

are mildly mixed as benchmark Treasury yields

BX:TMUBMUSD10Y

hold just below 4%. The dollar

DXY

is a touch higher, while oil prices

CL.1,

+4.44%

rally and gold

GC00,

+1.56%

trades just shy of $2,050 an ounce.

Key asset performance

Last

5d

1m

YTD

1y

S&P 500

4,780.24

1.95%

1.29%

0.22%

20.01%

Nasdaq Composite

14,970.19

3.17%

1.41%

-0.27%

36.08%

10 year Treasury

3.978

-6.80

6.39

9.68

47.24

Gold

2,044.90

-0.38%

0.55%

-1.30%

6.34%

Oil

74.77

1.11%

4.17%

4.82%

-6.61%

Data: MarketWatch. Treasury yields change expressed in basis points

For more market updates plus actionable trade ideas for stocks, options and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

The fourth quarter 2023 corporate earnings season kicks into gear with big banks to the fore, including JPMorgan Chase

JPM,

-0.42%,

Citigroup

C,

-1.77%

and Wells Fargo

WFC,

-0.08%,

reporting before the opening bell on Wall Street.

Brent crude

BRN00,

+4.28%

moved back above $80 a barrel after the U.S. and allies struck back at Yemen’s Houthi following the militia’s attacks on shipping in the Red Sea.

Tesla shares

TSLA,

-2.87%

are down more than 2% in premarket trading after reports the EV maker had cut the price of two cars in China.

BlackRock

BLK,

+0.03%

struck a cash-and-stock deal to buy Global Infrastructure Partners.

Burberry

BRBY,

-9.63%

shares fell nearly 9% after the fashion house cut its guidance, saying global luxury demand continued to slow during December’s key trading period.

U.S. economic data due on Friday includes producer prices data for December, published at 8:30 a.m. Eastern.

Minneapolis Fed President Neel Kashkari is due to speak at 10 a.m.

Taiwan will hold an election on Saturday that may prove crucial to U.S./China relations.

U.S. markets will be closed on Monday for Martin Luther King, Jr day.

Best of the web

The AI octopus.

Hunt for critical minerals draws world powers to Saudi Arabia.

Why the $6 trillion pile of cash in money-market funds isn’t heading to the stock market.

The chart

Japan’s Nikkei 225 stock index

JP:NIK

on Friday hit its highest level since February 1990. But things are looking stretched. The benchmark’s 14-day relative strength index (bottom line), a gauge of momentum, moved to 75, well above the overbought threshold of 70. Though, as we saw last year, it can go higher.

Source: Factset

Top tickers

Here were the most active stock-market tickers on MarketWatch as of 6 a.m. Eastern.

Ticker

Security name

TSLA,

-2.87%

Tesla

NVDA,

+0.87%

Nvidia

INFY,

+3.98%

Infosys

MARA,

-12.60%

Marathon Digital

NIO,

-0.13%

NIO

AAPL,

-0.32%

Apple

GME,

-3.05%

GameStop

AMC,

-4.28%

AMC Entertainment

AMZN,

+0.94%

Amazon.com

COIN,

-6.70%

Coinbase Global

Random reads

Ten-foot aliens in Brazil.

Meanwhile, in the Amazon, valley of 2,000 year-old cities found.

Like dressing up? Reckon you’re blue-blooded? Crave bananas? There’s a job for you.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

>>> Read full article>>>

Copyright for syndicated content belongs to the linked Source : MarketWatch – https://www.marketwatch.com/story/keep-the-rational-sell-the-trash-and-be-aware-of-the-two-most-important-charts-for-2024-says-socgen-af5a743c?mod=mw_rss_topstories