Before she bought her first iPhone, Deborah Obishai, who works as a secretary, used to download music from bootleg sites like Trendy Beatz and Flexy Music. One of her biggest disappointments when she made the phone switch was realising she could only stream music, so she tried the YouTube Music app. Despite its frustrating ads and the absence of certain features like downloads or the ability to play music in the background, Obishai insists on not subscribing to the premium on the streaming platform, which costs ₦1,100 monthly — the equivalent of a dollar.

Across the country, there are millions of music lovers like Obishai, who download songs from stream ripping sites or use the free tiers of music streaming services due to inability to afford such subscriptions or plain disregard for the value of the art. According to a report, Nigerians spend an average of 31 hours weekly — much more than the global average of 20.7 hours — listening to music, especially Afrobeats. And while there are now more people who are paying for music streaming platforms than five years ago, it’s not nearly enough revenue for the kind of growth the industry is witnessing.

The global music industry is dancing to the rhythm of streaming, with 67.3% of all music revenue worldwide generated from digital subscriptions to streaming platforms. In March 2024, The International Federation of the Phonographic Industry (IFPI) released the Global Music Report for 2023, which disclosed that streaming brought in 67% of the $28.6 billion realised in 2023, leaving the sales of physical copies and performance rights trailing behind with 17.8% and 9.5% respectively.

Sub-Saharan Africa had the fastest growth out of all global regions. It was the only one to surpass 20% growth as revenues climbed by 24.7%, fuelled by the growing popularity of Afrobeats and Amapiano tunes worldwide. Interestingly, while the Nigerian music industry is the largest on the continent, consistently churning out global hits and achieving billboard ranks; South Africa, the second largest music industry, has remained the most profitable music market in the region, bringing in the bigger bucks. According to the report, the rainbow nation contributes 77% to music revenue in sub-Saharan Africa — an impressive 19.9% growth from the previous year.

Joey Akan, a music journalist, isn’t surprised by this twist, as he shared that the Nigerian music industry has a long way to go before reaching profitability like its well-oiled South African counterpart.

“South Africans have a more structured industry. They have all their collection society rights which is basically a fanbase that values music and a government that punishes piracy. If you put all of these together, you have a better environment for music to generate more money,” he shared with TechCabal.

“It’s taken us about 30 years to build what this industry currently is, while South Africans were able to clock the system and build a functional industry which works for them. We have the artists to brag about, as well as the fanbases and cultural commitment to Afrobeats, but are missing one of the most important elements, which is the [revenue] numbers. This is why we cannot have access to certain deals and attract certain investments.”

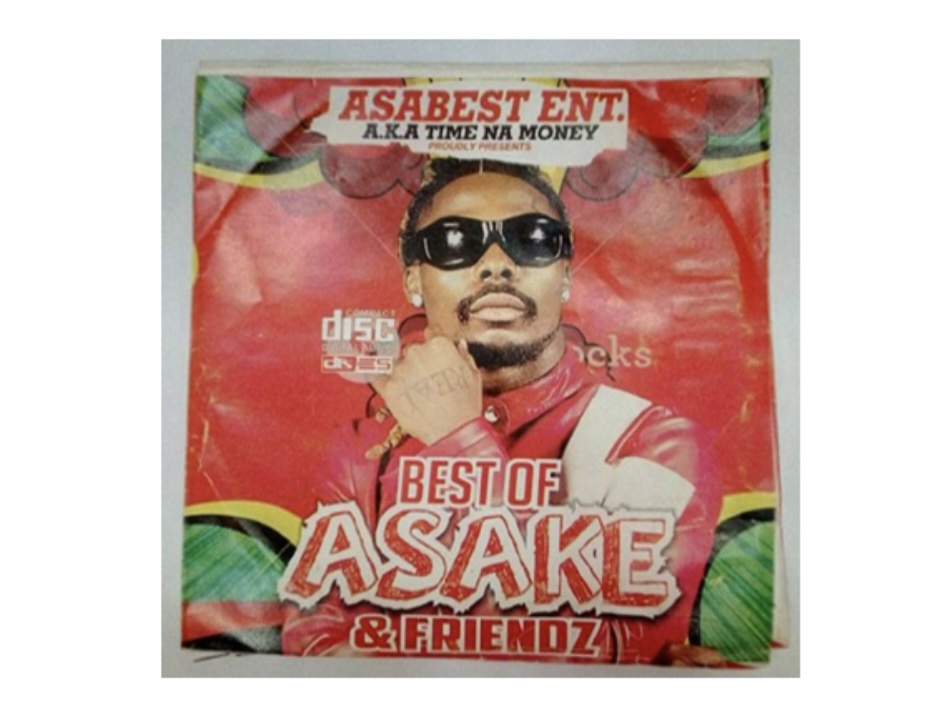

While creatives across the world tussle with the illegal distribution of their work, Nigerian artists deal with a much more sophisticated version where bootlegged versions of their music might be even more popular than the original versions on streaming platforms. Nigeria was named the worst place in Africa to be a creative as it has the largest market in Africa for goods which infringe on intellectual property rights. Original physical copies of albums are almost nonexistent in the Nigerian industry, as pirated copies are already the norm.

A pirated copy of Asake’s music

A pirated copy of Asake’s music

Outside of the lack of regard for the value of music, Akan believes that the broader economy also has played a climacteric role in music revenue for the two countries as richer countries are more likely to have higher-yielding industries. The South African rand is stronger than the Nigerian naira, with one rand equaling over 70 naira.

“It’s not new information that in Nigeria, everything competes with food,” he said. “The money the average Nigerian will pay for Apple Music can be diverted to pay for lunch.”

This means that for music artists in Nigeria, the biggest revenue opportunity lies in their music reaching international audiences across the Atlantic who bring in the juicier revenue; as the majority of their local fans cannot afford to pay for these streaming services.

*Kamal Chude, a popular artiste in Lagos is yet to get the “streaming cake” even after four years of making music, as he doesn’t consider the his earnings significant enough to withdraw yet. *Chude, who is in a two-year contract with a local distribution company he says isn’t transparent at all, has found himself still doing the bulk of the distribution work for his music despite having a 70:30 revenue split agreement.

“I worked with them on one song, which is my biggest so far, and there isn’t much to show for it on the backends. I didn’t even get access to it until I brought my lawyer into the conversation. We checked the logs and found out that the streaming platforms that were on the list were not up to five. Meanwhile, the song was available on all the Digital Service Providers (DSPs) you can think of,” he shared.

Will partnerships save the music industry?

Distribution and record companies play a vital role in boosting artists and nurturing the industry’s growth, especially in today’s hyper-competitive global market, where social media platforms like TikTok are changing the game with their content-heavy environment.

Tunji Balogun, Chairman & CEO, of Def Jam Recordings, shared that one of the strategies that can be deployed for this growth is forging partnerships.

“When it comes to music coming out of Sub-Saharan Africa, we’ve partnered with a label from Nigeria called Native. I felt strongly that I wanted to work with people that have a genuine connection to the culture on the continent,” he shared.

In September 2023, Def Jam signed a Nigerian rapper, Odumodublvck, who was one of the biggest new artists on the continent with over 252 million Spotify streams. Two of his songs, Declan Rice and Blood on the Dance Floor, were some of the top-streamed Nigerian songs in 2023.

Capital will always move to where it’ll find a profit, and more global labels are partnering with local names. Seventeen months after Def Jam and Native Records signed a partnership deal, Mavin Records, another heavyweight in the music ring, announced that the majority of its stake had been acquired by Universal Music Group (UMG) in a deal that is speculated to be worth about $125 million. The deal, which is expected to close in the fourth quarter of 2024, will give Mavin artists unhindered access to the resources at UMG, furthering their reach.

This is excellent for the industry, except that it feels like deja vu for industry professionals like Akan. The journalist cuts through the positivity with blunt honesty, and shares that until the structural problems are solved, the challenges in the industry will erode all positive development.

“We need to increase the numbers we have outside their [the West’s] influence. We need to know that they can take whatever percentage of our money and numbers or this crop of artists, and we’ll still have the base to successfully nurture new artists and make money independently in the future.”

Get the best African tech newsletters in your inbox

>>> Read full article>>>

Copyright for syndicated content belongs to the linked Source : TechCabal – https://techcabal.com/2024/04/06/nigeria-leads-in-musical-hits-south-africa-rakes-in-streaming-cash/