Home Fossil Energy ‘Win-win’ gas supply deal paving the way for first phase of Alaska’s LNG project

Great Bear Pantheon, a wholly-owned subsidiary of London-listed Pantheon Resources, which owns two Alaskan oil and gas fields, has entered into a gas sales precedent agreement (GSPA) with 8 Star Alaska, a subsidiary of the state-owned Alaska Gasline Development Corporation (AGDC), the developer of a liquefied natural gas (LNG) project in the U.S. northernmost state.

Illustration; Source: Alaska Gasline Development Corporation (AGDC)

Illustration; Source: Alaska Gasline Development Corporation (AGDC)

The GSPA sets forth the key commercial terms to be incorporated into the binding take-or-pay gas sales agreement (GSA) for the AGDC-led Alaska LNG project to receive gas from Pantheon’s Alaskan oil and gas fields, Kodiak and Ahpun.

Under the agreement, Pantheon is expected to supply up to 500 million cubic feet per day (mmcfd) of natural gas at a maximum base price of $1 per million BTU (mmBtu) in 2024 dollars. Additionally, the companies agreed on minimum daily contract volumes to calculate the level of the take-or-pay obligation.

The contract period for natural gas deliveries is set to 20 years, with extension options, and it was highlighted that Alaska could reduce the natural gas unit price below $1 per mmBtu by cooperating with Pantheon to decrease the cost of project financing.

The initial term of the GSPA is either June 30, 2025, or the execution date of the definitive GSA, whichever occurs first. The contract is set to automatically renew for additional one-year terms until either firm provides a notice of termination.

Phase 1 – First order of business for Alaska LNG

The contract focuses on the potential Phase 1 segment of the Alaska LNG project, prioritizing the in-state pipeline stage of Alaska LNG consisting of the 42-inch pipeline from the North Slope to Southcentral Alaska.

AGDC President, Frank Richards, noted: “This agreement solidifies the commercial foundation needed for the Phase 1 portion of Alaska LNG and provides enough pipeline-ready natural gas, at beneficial consumer rates, to resolve Southcentral Alaska’s looming energy shortage as soon as 2029.”

As Phase 1 does not entail the construction of an LNG plant, its capex requirement and construction timeframe are lower, enabling gas transportation as early as 2029.

“Phasing Alaska LNG by leading with the construction of the pipeline will make Alaska LNG’s export components more attractive to LNG developers and investors, and this agreement will help unlock the project’s substantial economic, environmental, and energy security benefits for international markets as well as for Alaska,” added Richards.

FID key to go ahead with GSA

Before moving on to the GSA, both AGDC and Pantheon are required to reach final investment decisions (FIDs) for their respective projects. Furthermore, permits and regulatory approvals need to be obtained for Alaska LNG to receive gas from Pantheon’s fields.

The GSA is expected to be concluded following a FID, planned for mid-2025, which will be preceded by the Alaskan firm’s front-end engineering and design (FEED). Pantheon’s strategy for achieving funding to FID and beyond is anticipated to be developed by the end of this month.

David Hobbs, Pantheon Executive Chairman, stated: “When we set out our strategy to achieve early production and cashflow on the path to financial self-sufficiency, we considered gas monetisation as a path to non-dilutive funding only one of several possibilities. However, the availability of our pipeline quality associated gas created the opportunity to bolster the Alaska LNG project, including the pipeline, LNG export facilities and gas conditioning facilities.”

As Pantheon considers the GSPA’s terms to be better than those of the previously announced vendor financing option, it believes the latter should be excluded from an overall funding strategy.

Hobbs remarked: “We are happy to be able to share the benefit, thereby enhancing both Pantheon’s and AGDC’s project economics and funding profiles. Our goal of demonstrating sustainable market recognition of $5-$10 per barrel of 1C/1P marketable liquids by end 2028 remains unchanged.”

Pondering pathways to bankroll LNG project

According to the UK firm, securing financing for Phase 1 of Alaska LNG could increase commercial alignment for the entire project and thus provide additional demand for Pantheon’s associated natural gas above the initial 500 mmcfd plateau.

As the GSPA could enable additional funding routes for the Alaska LNG project and the Ahpun field development activities, the UK player could avoid equity dilution following FID. In turn, this could enable the expansion of the Ahpun development scope and production increase to maximize the production capacity of both oil and gas by 2028 or 2029.

However, an environmental impact statement (EIS) may be required for the full scope of the Ahpun development due to its scope and size. This could take two to three years, bumping the FID for this field beyond the current end 2025 target. On the other hand, an EIS requirement was taken into account for the Kodiak field, with FID planned for 2028 and appraisal drilling scheduled for 2026 and 2027.

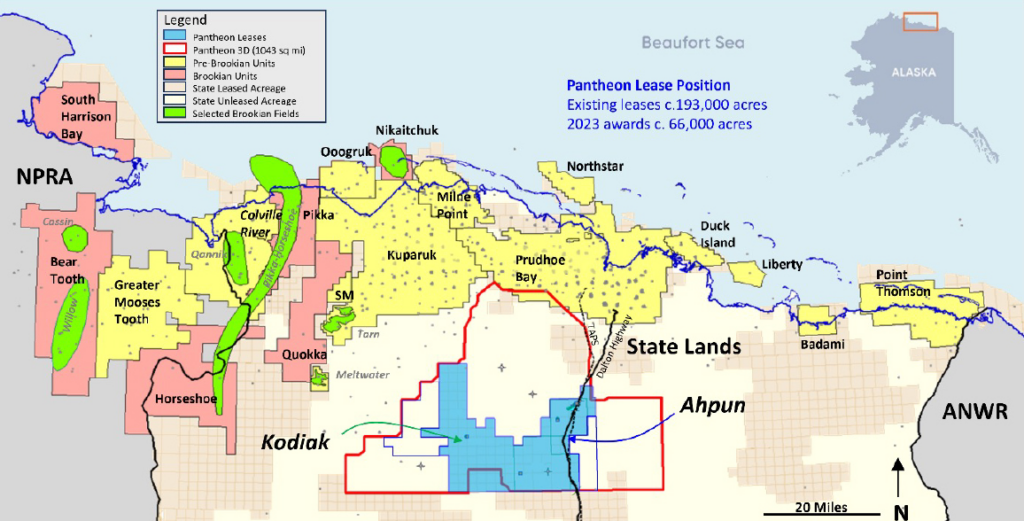

Based on Pantheon’s estimates, the two fields contain contingent recoverable resources of over 2 billion barrels of marketable liquids. The UK firm sees their location near the Trans Alaska Pipeline System (TAPS) main oil line and the Dalton Highway as a competitive advantage over other companies’ operations on the Alaskan North Slope (ANS).

Source: Pantheon Resources

Source: Pantheon Resources

As for the Alaska LNG, the project envisions building and operating a facility comprising three LNG trains, two 240,000 cubic meter storage tanks, and two loading berths that would produce up to 20 million tonnes of LNG per year and export it to non-free trade agreement (non-FTA) countries for 30 years.

Last year, a U.S. appeals court ruled in favor of moving forward with the project despite a petition submitted by environmental groups to review the federal approval for LNG exports.

Posted: about 1 year ago

>>> Read full article>>>

Copyright for syndicated content belongs to the linked Source : OffshoreEnergy – https://www.offshore-energy.biz/win-win-gas-supply-deal-paving-the-way-for-first-phase-of-alaskas-lng-project/