Tuesday 02 July 2024 2:33 pm

The Treasury is having to shoulder heavy losses from QE, which is attracting a lot of political attention given the parlous state of the public finances.

The Treasury is having to shoulder heavy losses from QE, which is attracting a lot of political attention given the parlous state of the public finances.

The Bank of England should structure its balance sheet more like the US Federal Reserve to help stem losses from the unwinding of quantitative easing (QE), analysts at Barclays have argued.

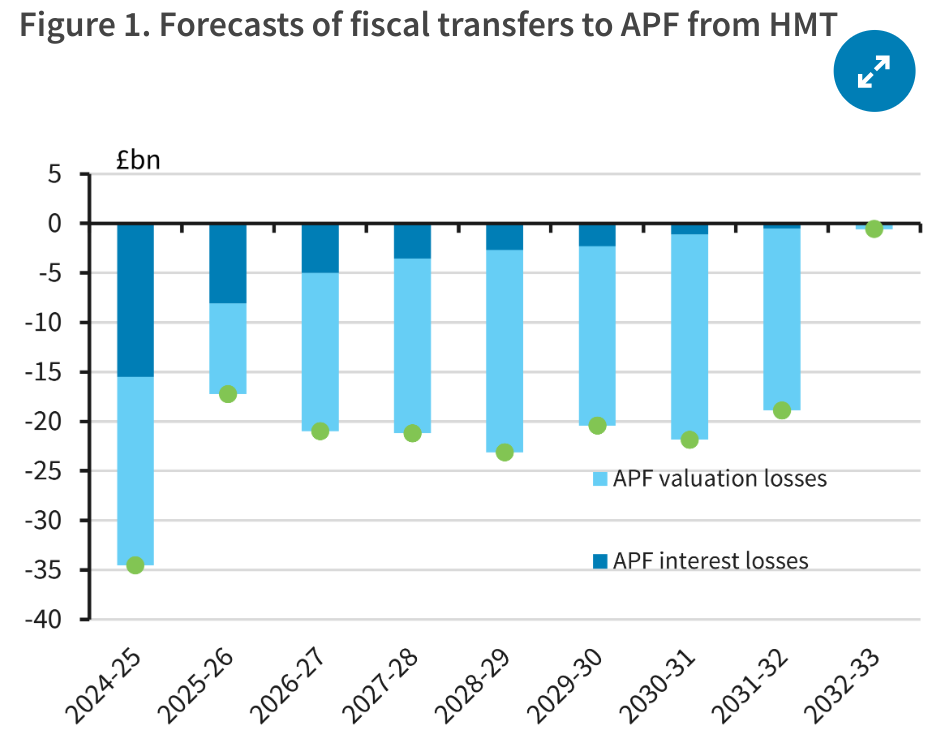

The Treasury is having to shoulder heavy losses from QE, which is attracting a lot of political attention given the parlous state of the public finances. Taxpayers are expected to transfer around £35bn to the Bank of England this year to cover losses resulting from QE.

However, analysts at Barclays suggested these losses could be dramatically reduced by restructuring the Bank’s accounting system.

Through QE, the Bank bought government bonds from financial institutions in exchange for commercial bank deposits. The hope was this would drive down borrowing costs, stimulating economic activity.

However, as interest rates have increased, the Bank now has to pay out more on those newly created deposits than it receives from its bond portfolio.

The value of the bonds has also fallen as interest rates have increased, with the Bank crystallising losses as it is actively selling bonds back into the market.

Source: OBR and Barclays

Source: OBR and Barclays

Official estimates suggest losses will fall to £15bn next year but stay around £20bn for the rest of the decade, largely due to valuation losses. Economists at Barclays noted that the annual mental health budget was slightly less than £17bn.

A number of suggestions have been put forward to try and reduce the losses, most prominently introducing a system of tiered reserves in which a portion of bank deposits would not receive interest payments.

However, shadow chancellor Rachel Reeves has ruled this out and many economists warn that this could have unforeseen consequences on the operation of monetary policy. It would also not deal with losses from actively selling bonds back into the market.

Analysts at Barclays suggested a three-step process to help reduce QE’s costs.

First, the assets bought through QE should be transferred to the Bank’s own balance sheet rather than be held in the Asset Purchase Facility (APF). The APF is a vehicle created in 2009 to buy bonds.

Legislation should then be introduced, allowing the Bank to retain seigniorage income, which is currently transferred to the Treasury. Seigniorage is the profit made by a government for issuing currency, reflecting the difference between the value of money and the costs to produce it.

Finally, losses from the gilt portfolio should be framed as a ‘deferred asset’, similar to what the Fed does.

“This would mean that the Bank of England could continue to operate without the need for an immediate capital injection from HMT as it could earmark future seigniorage income to cover the losses, spreading them over a much longer period than just the moment in which they are realised,” the analysts wrote.

Although the Treasury would no longer receive seiniorage, the savings from the scheme would easily outweigh the costs, they wrote.

“The saving implied by this plan could more than cover the real-terms cuts to unprotected government budgets implied by current spending plans across both the Conservatives and Labour,” the analysts argued.

>>> Read full article>>>

Copyright for syndicated content belongs to the linked Source : CityAM – https://www.cityam.com/bank-of-england-should-become-more-like-the-fed-to-stem-bond-losses-barclays-says/