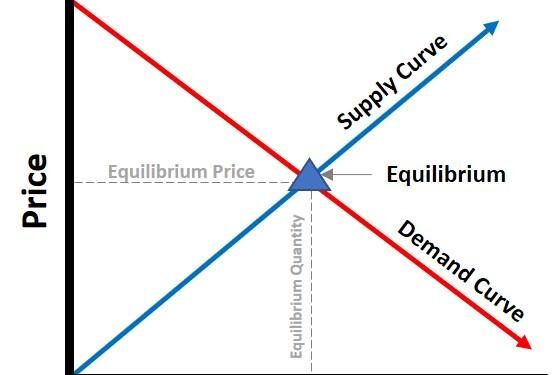

The delicate balance between supply and demand is sending mixed signals about the state of the economy, leaving analysts and policymakers grappling with uncertainty. While some indicators point to robust consumer spending and tight supply chains, others reveal slowing growth and weakening demand in key sectors. This complex interplay, described as a “supply and demand seesaw,” underscores the challenges of interpreting economic data in a post-pandemic world marked by inflationary pressures, shifting consumption patterns, and ongoing geopolitical tensions. As markets respond to these contradictory signals, the outlook for economic stability remains anything but clear.

Supply and Demand Fluctuations Create Uncertainty in Market Trends

Market analysts are struggling to decode the erratic behavior stemming from ongoing shifts in supply and demand. While certain sectors show signs of robust consumption, others are grappling with overstocked inventories, hinting at a fragmented economic landscape. These contradictions make it difficult to predict whether current trends signal recovery or a looming slowdown. Key factors contributing to this uncertainty include:

- Supply Chain Bottlenecks: Disruptions persist globally, causing uneven product availability across industries.

- Consumer Spending Variability: Varying preferences and cautious purchasing patterns influence demand unpredictably.

- Geopolitical Instabilities: Ongoing tensions amplify risk, affecting shipping routes and trade agreements.

To better visualize the volatility, consider the following snapshot of month-over-month changes in key market indicators:

| Indicator | Change (%) | Comment |

|---|---|---|

| Manufacturing Output | -2.4 | Decline due to raw material shortage |

| Retail Sales | 3.7 | Boost from seasonal promotions |

| Shipping Volumes | -1.8 | Logistical delays impacting supply |

The seesaw effect in these metrics underscores the challenge for businesses and policymakers alike, who must navigate an economy where signals are mixed and timing remains uncertain.

Analyzing Economic Indicators Amid Conflicting Signals from Supply Chains

The latest economic data reflects a pronounced tension between supply chain disruptions and consumer demand patterns, producing a mosaic of contrasting signals for analysts and policymakers. On one side, persistent bottlenecks in key manufacturing hubs continue to restrict the flow of goods, driving up prices and stoking inflation concerns. Meanwhile, demand indicators reveal a mixed picture: while certain sectors report robust consumption spikes fueled by pent-up savings, others face waning interest due to rising costs and tightening credit conditions. This imbalance is complicating forecasts, as traditional metrics no longer move in unison, challenging established economic models.

Key factors fueling this dynamic include:

- Inventory fluctuations: Businesses are hesitant to overstock amidst uncertain lead times.

- Labor market shifts: Staffing shortages hinder production recovery despite surging service demand.

- Consumer behavior changes: A shift toward durable goods contrasts with softness in discretionary spending.

| Indicator | Trend | Impact |

|---|---|---|

| Manufacturing Output | Plateau | Supply chain strain remains high |

| Retail Sales | Moderate Growth | Demand varies by sector |

| Inventory Levels | Declining | Businesses cautious on restocking |

| Labor Market | Mixed Signals | Hiring challenges persist |

Strategic Recommendations for Navigating Volatile Supply and Demand Dynamics

Businesses must adopt a multifaceted approach to stabilize operations amid unpredictable market shifts. Prioritizing flexibility in supply chain management, such as diversifying suppliers and integrating real-time demand forecasting tools, can help mitigate risks. Equally important is maintaining an adaptive inventory strategy that balances lean practices with buffer stock to cushion against sudden demand fluctuations without incurring excessive holding costs.

Additionally, decision-makers should focus on enhanced data analytics and scenario planning to anticipate potential disruptions. Investing in technology for rapid market insight enables quicker response times, empowering firms to pivot strategies swiftly. Below is a concise framework to guide tactical moves in these uncertain conditions:

| Strategic Focus | Recommended Action |

|---|---|

| Supply Chain Resilience | Build supplier diversity & local sourcing |

| Demand Forecasting | Utilize AI-driven predictive analytics |

| Inventory Management | Adopt hybrid just-in-time and buffer stock |

| Market Agility | Implement flexible pricing models and promotions |

- Regularly revisit contracts to ensure terms reflect current market realities.

- Engage cross-functional teams for integrated problem-solving approaches.

- Leverage customer feedback to tune offerings dynamically amid demand volatility.

To Wrap It Up

As the supply and demand seesaw continues to sway unpredictably, economists and market watchers remain vigilant for clearer signals about the economy’s direction. While some indicators point toward recovery, others suggest caution, underscoring the complexity of current market dynamics. In this uncertain landscape, businesses and policymakers alike face the challenge of navigating mixed messages as they plan for what lies ahead.