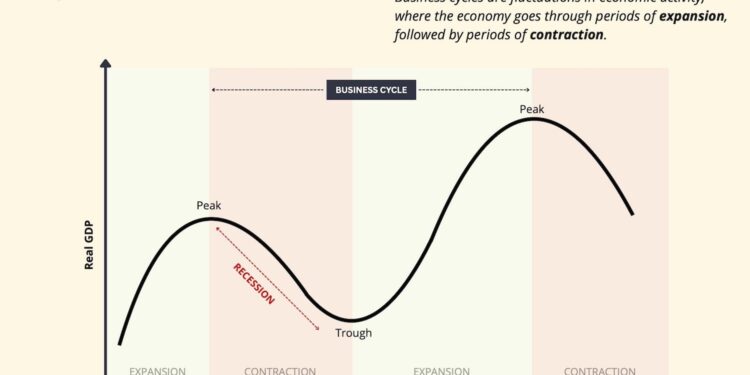

Economic forecasts suggest that a recession remains unlikely in the near term, offering a measure of relief to businesses and consumers alike. However, despite this optimistic outlook, underlying challenges persist within the U.S. economy, signaling that stability is not guaranteed. This article delves into the complexities behind the current economic landscape, examining the factors contributing to growth alongside the risks that could unsettle markets in the months ahead.

Recession Risks Remain Low Amid Steady Economic Growth

Economic indicators continue to paint a resilient picture, with consumer spending holding steady and labor markets maintaining strong momentum. Wage growth remains moderate but consistent, supporting household incomes and boosting confidence. As a result, inflation pressures are showing signs of easing, allowing central banks to adopt a more cautious approach in their monetary policies. Despite these positive trends, challenges such as supply chain disruptions and geopolitical uncertainties linger, preventing a fully untroubled outlook.

Several key factors contribute to the stability observed in the current economic environment:

- Robust employment figures with historically low unemployment rates.

- Steady consumer demand fueled by pent-up savings and cautious optimism.

- Gradual easing of inflation supporting more moderate interest rate increases.

| Economic Indicator | Current Status | Impact |

|---|---|---|

| Unemployment Rate | 3.8% | Supports spending capacity |

| Inflation Rate | 4.2% | Easing pressure on prices |

| GDP Growth | 2.5% Annualized | Indicates steady expansion |

Lingering Challenges in the Labor Market and Inflation Pressure

The labor market, while resilient, continues to wrestle with several persistent issues that keep economic experts vigilant. Wage growth remains uneven across industries, and job openings outnumber available skilled workers, creating bottlenecks in critical sectors such as manufacturing and technology. Additionally, employee turnover rates are still elevated, signaling underlying dissatisfaction despite steady employment figures. These dynamics complicate employers’ ability to stabilize their workforce, which in turn puts upward pressure on wages and operational costs.

Meanwhile, inflationary pressures refuse to relent, fueled by ongoing supply chain disruptions and fluctuating energy prices. Consumer prices for essentials like food and housing are rising faster than average incomes, squeezing household budgets. The Federal Reserve’s balancing act-raising interest rates to tame inflation without stifling growth-remains a delicate and highly scrutinized endeavor.

- Labor market tightness: High job vacancies and skill shortages

- Inflation persistence: Prices outpacing wage gains

- Supply chain strains: Continued disruptions impacting costs

| Indicator | Current Level | 6-Month Change |

|---|---|---|

| Job Openings (millions) | 10.1 | +0.3 |

| Consumer Price Index (CPI) Annual % | 4.7% | -0.5% |

| Average Hourly Earnings Growth | 3.9% | +0.2% |

Strategic Moves for Investors Navigating Uncertain Economic Terrain

Investors are currently walking a tightrope, balancing the optimistic signals against an array of economic uncertainties. While widespread recession still appears unlikely in the near term, several key indicators suggest caution is warranted. Market volatility, fluctuating inflation rates, and geopolitical tensions continue to influence financial landscapes, making it essential for investors to adopt a proactive and diversified strategy. Focusing on resilience, rather than chasing short-term gains, can provide a buffer against sudden market shifts.

Prudent investors should consider the following approaches to safeguard their portfolios amid this unpredictable environment:

- Prioritize sectors with strong fundamentals and defensive characteristics, such as healthcare and consumer staples.

- Incorporate alternative assets that may hedge against inflation and currency fluctuations, including real estate and commodities.

- Maintain liquidity for flexibility to capitalize on emerging opportunities or weather potential downturns.

- Review and adjust asset allocations regularly in response to economic data and market trends.

| Investment Approach | Key Benefit | Consideration |

|---|---|---|

| Defensive Stocks | Stability during volatility | Lower growth potential |

| Alternative Assets | Inflation protection | Higher complexity |

| Increased Liquidity | Flexibility | Opportunity cost |

Closing Remarks

While a recession may not be looming on the immediate horizon, the economy’s path remains anything but smooth. Persistent challenges-from supply chain disruptions to inflationary pressures-continue to test resilience across sectors. As policymakers and market participants navigate these complexities, vigilance will be essential to sustaining growth and avoiding potential pitfalls ahead.