AUD/USD surges 0.66%, eyes 0.6700 as US inflation shows signs of slowing, softening the US dollar.

Despite weaker Chinese data and lower CPI, AUD finds support from diminished expectations of aggressive Fed hikes.

Aussie’s surge and the US Dollar Index’s 0.48% drop reflect a reassessment of the Fed’s future tightening stance.

AUD/USD climbs sharply and eyes a test of the 0.6700 figure after economic data from the United States (US) showed that inflation is cooling, weakening the US Dollar (USD) despite solid data revealed on Thursday. Hence, the Australian Dollar (AUD) gets a respite, and the AUD/USD pair exchanges hands at 0.6658, gaining 0.66% after hitting a daily low of 0.6603.

Cooling inflation in the US softens the greenback and boosts the Aussie, despite weaker Chinese data, subdued RBA expectations

The US economic docket showed plentiful data as the week, month, and quarter-end approaches. The US Department of Commerce delivered the US Federal Reserve (Fed) preferred gauge for inflation, the Core Personal Consumption Expenditures (PCE), which rose by 0.3% MoM, in line with estimates, below April’s 0.4%. Yearly data pointed lower to 4.6%, from 4.7% in the previous month, showing that inflation is becoming entrenched and not slowing at the pace projected by the Fed. Headline data showed that inflation edged much lower than monthly figures.

In other data, the Chicago National Activity Index PMI rose by 41.5, exceeding May’s 40.4 print, a slight improvement but shy of getting to expansionary territory. At the same time, the University of Michigan (UoM) Consumer sentiment survey rose by 64.4, above estimates and the preliminary reading of 63.9.

On the Australian front, the Aussie (AUD) remains pressured by weaker Chinese data, as factory data dented market sentiment during the Asian session. Expectations for additional tightening by the Reserve Bank of Australia (RBA) sank after the latest CPI report showed inflation dipping to a 13-month low. Hence, money market futures show six basis points of tightening by July, but investors expect rates to peak at around 4.50% by December 2023.

Following the release of the US data, the AUD/USD soared from around 0.6620 to 0.6650. That reflects traders expect the Fed to hike rates, but not as aggressively as expected, following upbeat Thursday’s data. Consequently, US Treasury bond yields are falling, while the US Dollar Index, a measure of the buck’s performance against a basket of six currencies, edged lower by 0.48%, exchanging hands at 102.925.

Regarding monetary policy by the Fed, odds for a 25-bps hike are still up at 87%, as shown by the CME FedWatch Tool, with traders still expecting another rate increase towards November 2023.

AUD/USD Price Analysis: Technical outlook

After diving to a weekly low of 0.6595, the AUD/USD bounced off the lows and rose above 0.6650, a psychological level. It should be said that for a bullish continuation, the AUD/USD must crack June’s 23 daily low of 0.6662 turned resistance to open the way to a confluence of daily EMAs, with the 20, 50, and 100 hoovering around the 0.6700 figure. Otherwise, the AUD/USD pair will be exposed to further selling pressure, with sellers eyeing the 0.6600 figure, the weekly low of 0.6590s, and the May 30 daily high turned support at 0.6559.

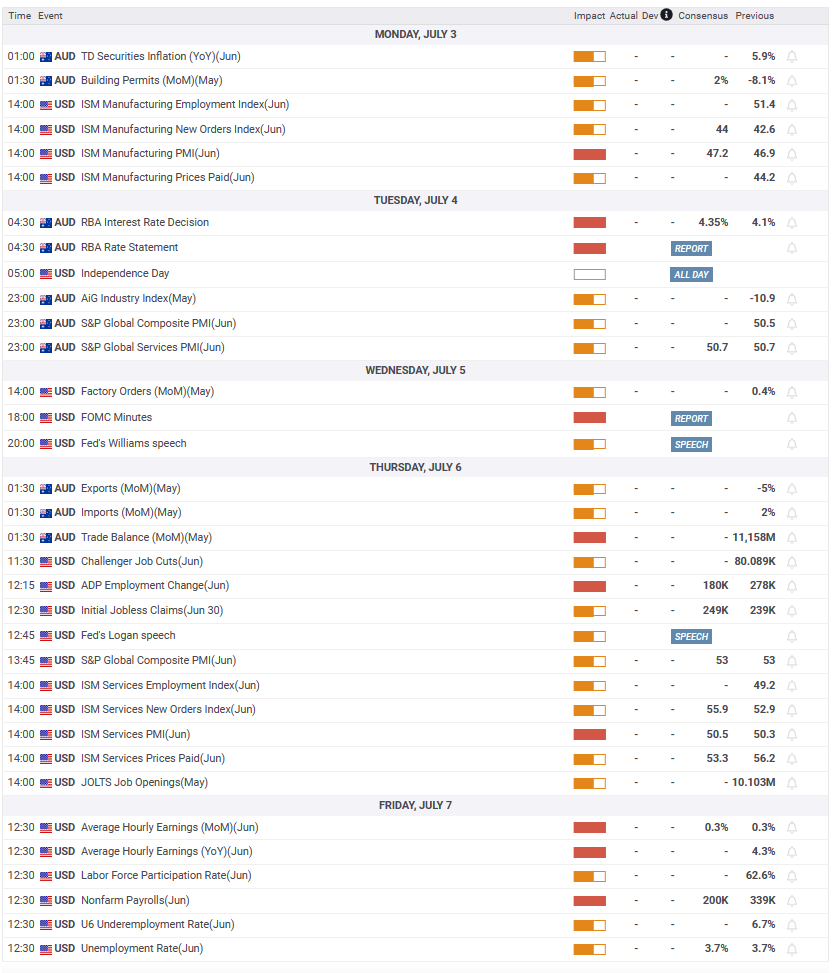

Upcoming events

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

>>> Read full article>>>

Copyright for syndicated content belongs to the linked Source : FXStreet – https://www.fxstreet.com/news/aud-usd-rises-amid-easing-us-inflation-stays-firm-around-06650s-202306301602