Bitcoin’s (BTC) recent rally has revived concerns about a market peculiarity that puts traders of futures and futures-based exchange-traded funds (ETFs) at a disadvantage relative to coin holders.

The cryptocurrency topped $31,000 late last month, reaching the highest in a year. With the rally, the spread between prices for the Chicago-Mercantile Exchange (CME)-listed July futures contract and the now-expired (the-then front-month) June futures contract exploded to nearly $500, the highest gap since the bull market days of late 2021, according to data from charting platform TradingView.

The sharp widening of the spread, or the so-called steepening of the contango, has grabbed eyeballs in the crypto market. The spread raises the cost of pre-expiry futures rollover, or shifting of bullish long positions from front-month to next-month contracts, and affects the performance of the futures-based products offered by ProShares, VanEck and others. Observers, therefore, said the prevailing excitement about a potential launch of a spot-based ETF is justified.

Futures have an expiry date, which mandates the rollover of positions ahead of the settlement. When the spread between the front-month and the next-month contract widens, rollovers are characterized by traders selling the expiring contract at a low price and entering the new one at a high price (the exact opposite of buy low and sell high), inadvertently bleeding money.

“We were not surprised to see the level of contango in the bitcoin futures market expand over the past week. The CME Bitcoin Futures Market has historically traded in relatively sharp contango during bull market periods, particularly when people are excited about future events (like an eventual spot bitcoin ETF approval). This level of contango will certainly impact [futures-based ETF] investors,” Matthew Hougan, chief investment officer at crypto index fund and ETF provider Bitwise Asset Management, said in an email.

“This generally points to why a spot bitcoin ETF would be superior for most investors vs. a futures-based ETF. People just want to own bitcoin, safely, with no ifs, ands, or buts. A spot-based ETF would achieve that goal,” Hougan added.

The U.S.-based futures ETFs invest in CME-listed bitcoin futures.

Last month, bigwigs from traditional finance like BlackRock (BLK), Invesco (IVZ), Fidelity, and others filed spot-based bitcoin ETF applications with the U.S. Securities and Exchange Commission (SEC). Bitcoin rallied nearly 12% in June.

A spot-based ETF, if approved, will be like SPDR Gold Trust ETF, which owns gold bars. The product will allow investors to hold their positions indefinitely while eliminating the rollover cost associated with futures ETFs and bypassing complexities involved with storing the cryptocurrency in a wallet. Besides, the spot-based ETF will track bitcoin’s spot price more closely than futures-based ETFs.

In other words, the spot-based ETF will be a better investment avenue than futures-based products like ProShares’ Bitcoin Strategy ETF, which have underperformed the cryptocurrency this year. ProShares’ futures-based ETF, which debuted in October 2021, is the world’s largest and most actively-traded futures-based ETF.

Per Yahoo Finance, shares in ProShares’ ETF, trading on NYSE under the ticker BITO, have risen 79% this year. Meanwhile, bitcoin has rallied 88%. That’s notable a loss of upside for BITO investors. BITO bled more than bitcoin during the 2022 bear market.

“We might expect underperformance vs. holding spot BTC. The cost of carry emphasizes that futures-based ETFs incorporate the effects of either contango, where holders experience lagging performance or backwardation, where holders experience outperformance. This emphasizes that there is a cost to investors to restricting them to just a derivatives-based ETF,” Ryan Kim, Head of Derivatives at institutional crypto derivatives platform FalconX, said.

“The dynamic does contribute to the excitement over spot-based ETFs,” Kim added.

The situation is unlikely to improve if bitcoin continues to rally, brining more buyers to the derivatives market and keeping futures premiums elevated across the different expiries.

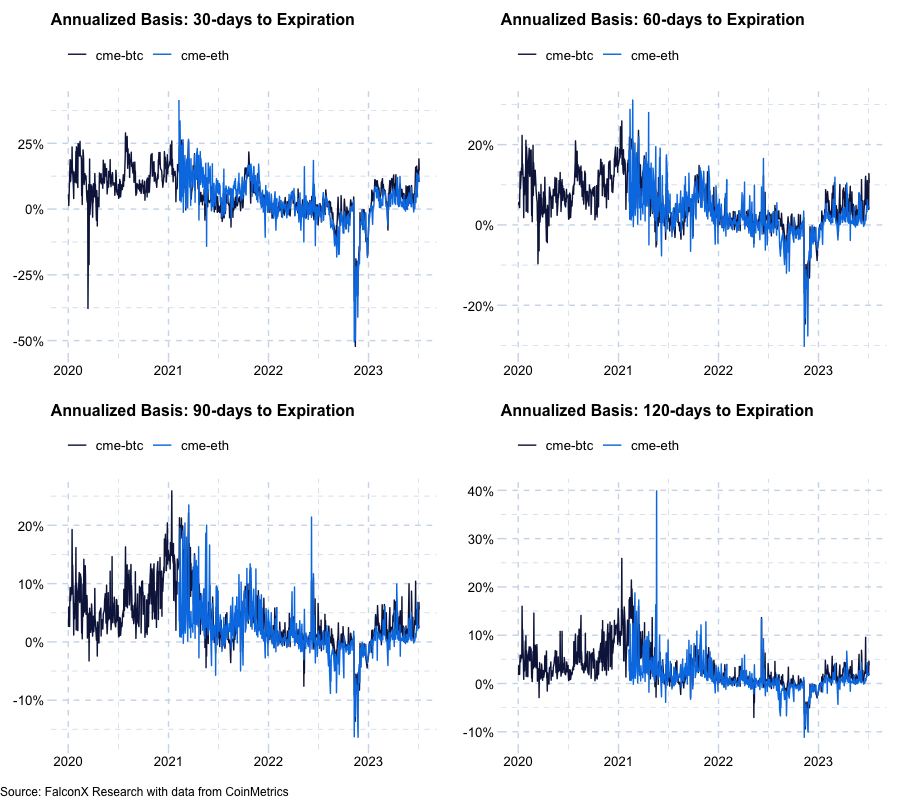

Annualized basis in futures contracts with 30, 60, 90, and 120 days to expiration. (FalconX) (FalconX)

Annualized basis in futures contracts with 30, 60, 90, and 120 days to expiration. (FalconX) (FalconX)

As of Wednesday, the basis in bitcoin and ether CME futures or the difference between futures and spot prices was notably higher at the front end (30-day and 60-day) of the futures curve.

“For context, the 30-day annualized BTC basis just hit 19%, which is the highest value since October 2021, when BTC was trading at above $60,000,” Kim said. “The 30- and 60-day futures are the preferred vehicles for many investors, and more so for bitcoin than for ether.”

Ravi Doshi, co-head of trading at Genesis Global Trading, expressed a similar opinion, saying, “the bullish market sentiment has driven up the front-end CME futures basis.”

Per Doshi, the situation was exacerbated last week as the futures ETFs were required to roll their long exposure from the expiring June contract to July and “the illiquidity in the spread led to a temporary 23% annualized basis in the July contract costing futures ETF holders dearly.”

3:52 UTC: BITO’s year-to-date gain is 79%. The previous version wrongly mentioned the figure at 56%.

Edited by Parikshit Mishra.

>>> Read full article>>>

Copyright for syndicated content belongs to the linked Source : CoinDesk – https://www.coindesk.com/markets/2023/07/06/bitcoin-rally-puts-focus-on-futures-market-quirk-that-underscores-need-for-spot-based-etfs/?utm_medium=referral&utm_source=rss&utm_campaign=headlines