Canada’s biggest banks are more than twice as exposed to the fossil-fuel business as their European and US counterparts, according to a report from climate change think tank InfluenceMap.

Author of the article:

Bloomberg News

Christine Dobby

Published Mar 06, 2024 • 2 minute read

2t2x4oo}ds1}t0ta6c1z([cd_media_dl_1.png Source: InfluenceMap

2t2x4oo}ds1}t0ta6c1z([cd_media_dl_1.png Source: InfluenceMap

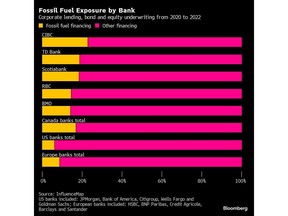

(Bloomberg) — Canada’s biggest banks are more than twice as exposed to the fossil-fuel business as their European and US counterparts, according to a report from climate change think tank InfluenceMap.

The country’s largest lenders — Royal Bank of Canada, Toronto-Dominion Bank, Bank of Nova Scotia, Bank of Montreal and Canadian Imperial Bank of Commerce — committed 18.4% of their combined corporate lending and bond and equity underwriting to the sector in 2022, says the report, published Wednesday.

Advertisement 2

This advertisement has not loaded yet, but your article continues below.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

Exclusive articles from Barbara Shecter, Joe O’Connor, Gabriel Friedman, Victoria Wells and others.Daily content from Financial Times, the world’s leading global business publication.Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

Exclusive articles from Barbara Shecter, Joe O’Connor, Gabriel Friedman, Victoria Wells and others.Daily content from Financial Times, the world’s leading global business publication.Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

Access articles from across Canada with one account.Share your thoughts and join the conversation in the comments.Enjoy additional articles per month.Get email updates from your favourite authors.

Sign In or Create an Account

or

Article content

Article content

In contrast, fossil-fuel entities accounted for 7.2% of overall financing among the largest banks in Europe and 6% at the biggest US lenders, said Daan Van Acker, program manager at FinanceMap, a research program run by the London-based organization.

The five Canadian banks committed most of the financing to domestic oil and gas companies, the report found, with pipeline operators Enbridge Inc. and TC Energy Corp. and oil producer Cenovus Energy Inc. receiving a combined $61.9 billion in financing via the Big Five banks between 2020 and 2022.

The report was critical of the lenders for not setting policies to exclude new oil and gas investments or to phase out the financing of thermal coal, which is used for power generation. “Given Canada’s position as one of the largest producers of oil and natural gas, Canadian banks have an integral role to play in supporting the transition away from fossil fuels,” the report said.

Canada was the world’s fourth-largest producer of crude and other petroleum liquids in 2022, ranking just ahead of Iraq, according to the US Energy Information Administration. The oil and gas extraction sector averages about 5% of Canada’s gross domestic product, according to Statistics Canada estimates, a proportion that has remained relatively stable since 2000.

Advertisement 3

This advertisement has not loaded yet, but your article continues below.

Article content

Read More: Texas Pension Divests From Overseas Banks Labeled Oil Boycotters

Canada’s lenders “understand the important role that the financial sector can play in facilitating an orderly transition to a low-carbon future,” the Canadian Bankers Association said in an emailed statement.

The banks are implementing climate action plans with specific targets, Mathieu Labreche, a spokesperson for the industry lobby group, said in the email. “This includes working with clients across industries to help them decarbonize and pursue energy transition opportunities, and financing new and existing green projects.”

Labreche said the InfluenceMap report, which is based only on data up until the end of 2022, doesn’t capture the banks’ recent progress on climate goals. “Upcoming disclosures will provide additional insight into ESG initiatives and climate efforts.”

Read More: Wall Street Makes Zero Progress in Energy Finance Transition

Out of the five largest lenders, CIBC had the most exposure to fossil-fuel financing at 23% of its lending and underwriting over the three-year period covered in the report. Bank of Montreal had the least, with 14%. The five banks on average committed 17% of their corporate financing to the sector, the report said.

Bank of Montreal didn’t comment on the report, while RBC, CIBC, Scotiabank and Toronto-Dominion referred Bloomberg to the CBA’s statement.

InfluenceMap said its report uses data from Bloomberg league tables to calculate the banks’ loans, bonds and equity deals.

—With assistance from Erik Hertzberg.

Article content

>>> Read full article>>>

Copyright for syndicated content belongs to the linked Source : Financial Post – https://financialpost.com/pmn/business-pmn/canadian-banks-fossil-fuel-exposure-outpaces-us-european-peers