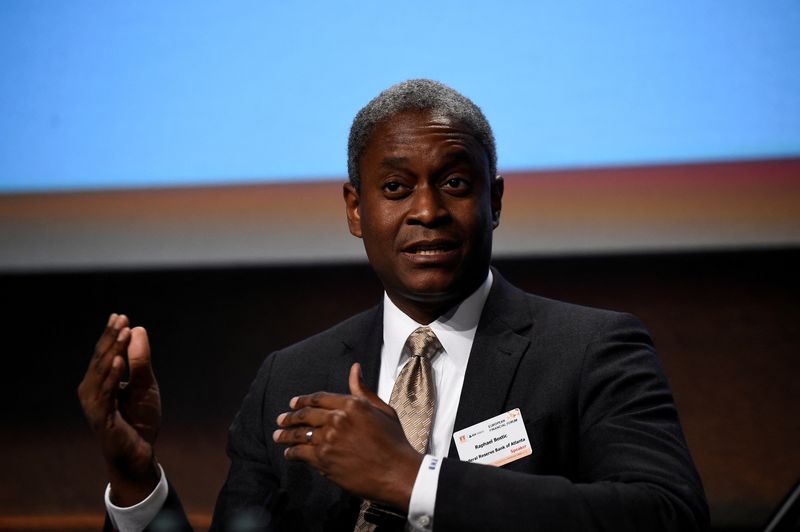

(Reuters) – The Federal Reserve should not cut its benchmark interest rate until the end of this year, Atlanta Fed President Raphael Bostic said on Wednesday, as he maintained his view that the U.S. central bank should reduce borrowing costs only once over the course of 2024.

“We’ve seen inflation kind of become much more bumpy,” Bostic said in an interview with broadcaster CNBC. “If the economy evolves as I expect and that’s going to be seeing continued robustness in GDP and employment, and a slow decline in inflation over the course of the year, I think it will be appropriate for us to start moving down at the end of this year, the fourth quarter.”

The Fed held rates steady in the 5.25% to 5.5% range last month, with most policymakers still expecting at least three rate cuts this year, but its new projections reflected slower progress on inflation and continued robust economic growth and employment.

Two other Fed policymakers in separate appearances yesterday maintained their forecasts for three rate cuts. Fed Chair Jerome Powell is set to speak later on Wednesday.

Bostic said that any weakening in the economy was incremental and once again highlighted his concerns that some secondary measures in the inflation numbers are much higher than they were before.

“I’ve got to make sure those are not hiding some extra upward pricing pressure before I’m going to want to move our policy rate,” Bostic noted. He now expects inflation to drop incrementally through 2024 and 2025 with the 2% target rate reached “sometime in early 2026.”

Inflation by the Fed’s targeted measure was 2.5% in February, far below its mid-2022 peak of around 7% but still above the 2% goal, with progress slower so far this year than for much of last year.

“If that trajectory slows down, in terms of inflation, then we are going to have to be more patient than I think many had expected,” Bostic said.

>>> Read full article>>>

Copyright for syndicated content belongs to the linked Source : Investing.com – https://www.investing.com/news/economy/feds-bostic-says-first-rate-cut-should-come-in-q4-of-this-year-3364008