Jason Bednar was emphatic. Canacol Energy Ltd. would meet its debt payments this month and any suggestion to the contrary was “completely false,” the company’s chief financial officer said.

Author of the article:

Bloomberg News

Vinícius Andrade and Nicolle Yapur

Published May 17, 2024 • 2 minute read

(Bloomberg) — Jason Bednar was emphatic. Canacol Energy Ltd. would meet its debt payments this month and any suggestion to the contrary was “completely false,” the company’s chief financial officer said.

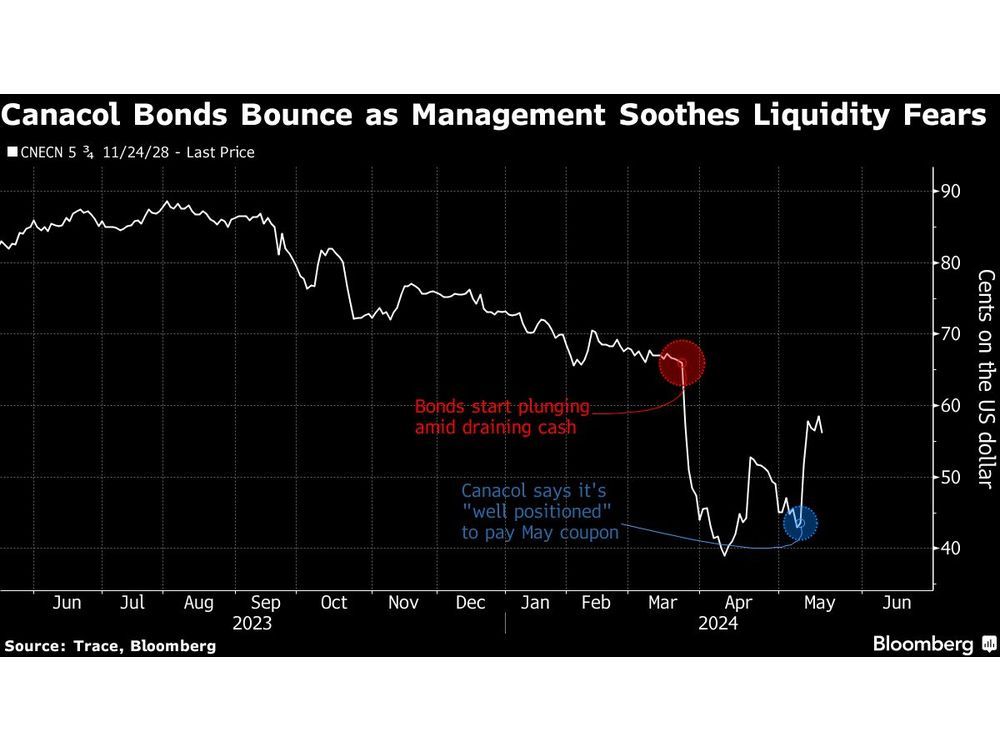

The comments, made during a conference call last week, fueled a rebound in the bonds of Colombia’s largest private gas producer. Dollar notes due in 2028 are now trading about 17 cents on the dollar above the all-time lows seen in April.

Advertisement 2

This advertisement has not loaded yet, but your article continues below.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

Exclusive articles from Barbara Shecter, Joe O’Connor, Gabriel Friedman, Victoria Wells and others.Daily content from Financial Times, the world’s leading global business publication.Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

Exclusive articles from Barbara Shecter, Joe O’Connor, Gabriel Friedman, Victoria Wells and others.Daily content from Financial Times, the world’s leading global business publication.Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

Access articles from across Canada with one account.Share your thoughts and join the conversation in the comments.Enjoy additional articles per month.Get email updates from your favourite authors.

Sign In or Create an Account

or

Article content

Article content

“We are well-positioned to meet all of our future financial obligations,” Bednar said. “We have not ever contemplated a restructuring.”

Analysts now see “minimal” odds that the Calgary-based company doesn’t make a $14 million coupon payment on May 24. The debt had fallen to as low as 39 cents on the dollar as cash drained away amid production problems and the termination of a key contract for a gas pipeline in the city of Medellin.

Canacol also faces cash taxes of about $36 million by the end of the second quarter, Fitch Ratings wrote in a note last week, downgrading its credit further into junk.

Bednar brushed off those concerns on the conference call, saying the company has effective cash reserves of $43 million.

“I’d like to respond to rumors in the markets,” he said. “I can unequivocally state Canacol has not hired a financial advisor, nor have we ever spoken to one at any time during 2024.”

The Well

Whether this bounce is short-lived will now depend on the gas driller addressing a fundamental, long-term problem: Pulling off a recovery in its production volumes and expanding reserves, while also cutting investment to free up cash for debt payments.

Advertisement 3

This advertisement has not loaded yet, but your article continues below.

Article content

After announcing some small gas discoveries in the past few months, investors are keeping an eye on the drilling of the Cardomomo 1 well, which is expected to start in mid-summer.

“The situation isn’t comfortable but they should be paying the May coupon,” said Ian McCall, a managing partner at First Geneva Capital Partners. “They’ve got some time now, but the question is: Can they use it productively?”

It won’t be easy.

Charle Gamba, Canacol’s chief executive officer, hinted at the output issue on the same call as he said the firm’s exploration program faced a “diminished pool” of low-risk drilling targets.

The company got a boost from higher prices in the first quarter as the El Nino phenomenon cut output at hydro-electric dams and drove demand from gas-fired power stations in Colombia. That pushed earnings before items including exploration expenses to $61 million, little changed from a year earlier.

Canacol has also sold its stake in Arrow Exploration Corp. for a little over $13 million, and delayed some of this year’s investment plans to free up cash.

“The key will be maintaining a high success rate on its exploratory wells,” said Francisco Schumacher, a strategist at BancTrust & Co. “The main vulnerability that they don’t have in their control is the evolution of gas spot (interruptible) prices. As the El Nino recedes, hydro generation steps up and thermal generation is less demanded.”

Article content

>>> Read full article>>>

Copyright for syndicated content belongs to the linked Source : Financial Post – https://financialpost.com/pmn/business-pmn/gas-driller-canacol-buys-time-to-tackle-main-issues-haunting-bond-investors