The Upward Trajectory of Silver Demand

Global silver demand is poised to rise to 1.2 billion ounces in 2024, potentially marking the second highest demand level on record, driven predominantly by industrial applications. The projected 4.0 percent rise in silver industrial fabrication this year will underpin the growth in demand, reaching a peak of 690 million ounces—a testament to the white metal’s enduring industrial importance.

However, forecasts of rising demand are driven mainly by the rapidly expanding electric vehicle (EV) market, and with it, silver’s utilization in electronic components and the burgeoning battery charging infrastructure that will be needed to support the increased use of electric vehicles.

Long term forecasts are also optimistic about silver’s role in green technologies, such as silver consumption from a surge in photovoltaic (PV) installations, with the incremental capacity anticipated to scale to new heights. Technological innovations like higher-efficiency N-type solar cells will further enhance silver’s prominence in the green energy sector.

Long term forecasts are also optimistic about silver’s role in green technologies, such as silver consumption from a surge in photovoltaic (PV) installations, with the incremental capacity anticipated to scale to new heights. Technological innovations like higher-efficiency N-type solar cells will further enhance silver’s prominence in the green energy sector.

The integration of AI into consumer electronics holds promise for silver usage, as tech companies prepare to launch new silver-intensive products into the market.

Additionally, a notable revival in the jewelry and silverware sectors is expected to inflate demand by 6.0 percent, with India playing a pivotal role in the market uplift. The jewelry sector, in particular, anticipates a resurgence in demand, based in the view that India’s economy presents a conducive environment for growth.

However, the U.S. and European jewelry markets might continue facing headwinds from cautious consumer spending, partially offset by retailers’ inventory rebuilding efforts.

In 2023, the U.S. silver mining industry thrived with production reaching approximately 1,000 tons. Alaska and Nevada lead the charge in silver output, demonstrating the continued relevance of silver in the national mining landscape.

Silver’s role in the U.S. stretches across many sectors—from investment bars and electrical components to coins and medals, demonstrating its versatility and durability as an industrial and investment asset.

The U.S. continues to engage actively in the international trade of silver, boasting consumption patterns that reflect its robust industrial landscape and investment strategies.

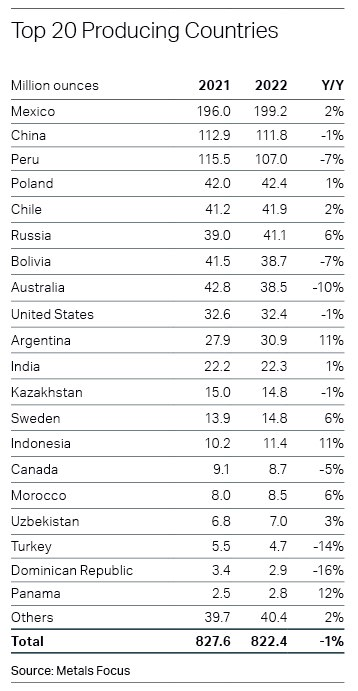

Prospects for 2024 indicate a 4.0 percent increase in global silver mine production, reaching 843 million ounces—the highest since 2018—contingent on uninterrupted operations in major mines across Mexico, Russia, Chile, and the United States.

Prospects for 2024 indicate a 4.0 percent increase in global silver mine production, reaching 843 million ounces—the highest since 2018—contingent on uninterrupted operations in major mines across Mexico, Russia, Chile, and the United States.

However, silver recycling is expected to drop to by 3.0 percent. This retracement is largely due to diminishing returns from jewelry and silverware scrap, coupled with a sustained decline in photographic scrap supply.

Silver supply may face obstacles, particularly from the by-product production from base metal mines, which is expected to decrease in the wake of mine closures stemming from societal and governmental disputes, particularly in South America.

As 2024 unfolds, financial markets are readjusting their expectations regarding U.S. interest rate cuts, and how this might influence the price of silver. Although an initial rise in U.S. rates seems unlikely, expected adjustments in the latter half of the year suggest potential for silver investment recovery.

Investment dynamics as in relation to silver are intricately linked to global economic policies. With the U.S. Federal Reserve poised to start rate cuts by mid-year, silver could be bolstered as inflation abates, real yields fall, and the dollar faces pressure.

The contrasting economic landscapes of the U.S. and China will play a pivotal role in silver investment trends. A robust U.S economy might suppress investment in silver, while a lagging recovery in China could similarly act as a deterrent.

While initial forecasts for 2024 remain cautious about the outlook for investment in precious metals, particularly silver, a turnaround is anticipated when the Federal Reserve triggers rate cuts. Investment trends in silver for the latter part of the year are expected to pivot, enhancing the metal’s attractiveness as a hedge against volatility, particularly if economic signals point towards monetary easing and inflation targeting.

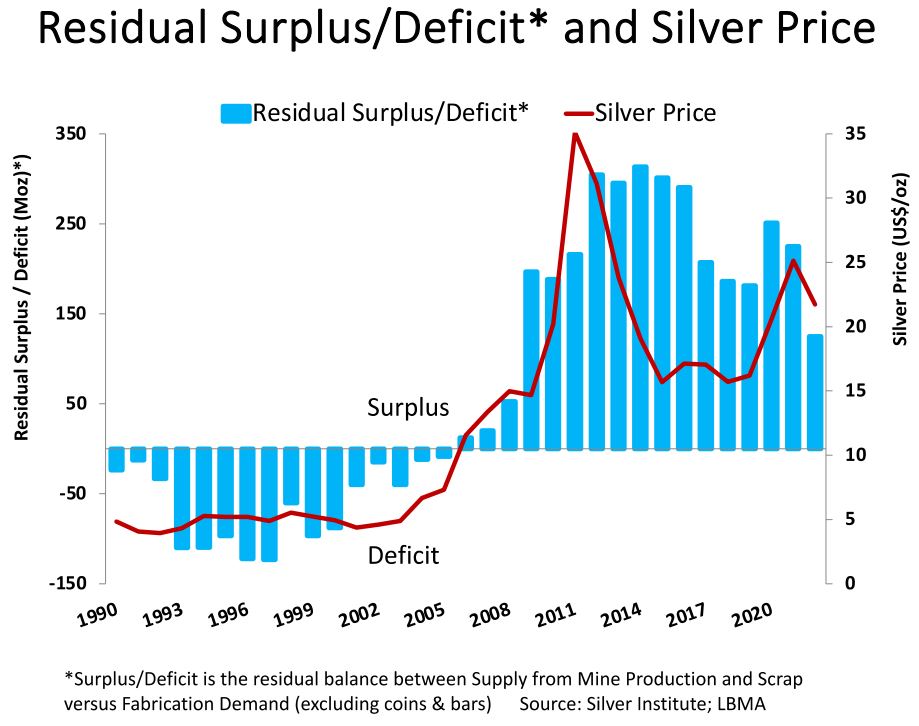

A projected easing of inflation and real yields could stimulate investment in silver as investors seek assets that perform well amidst such economic shifts. The silver market is anticipated to experience its fourth consecutive year of deficits, with a minor decrease expected to reach 176 million ounces. Various factors, including production and industrial offtake, will influence the deficit forecast, potentially maintaining high deficits by historical standards.

Persistent deficits in the silver market underscore the enduring demand for the metal and may impact long-term price stabilization and investment strategies. Investors face a myriad of economic uncertainties in early 2024. This may influence the investment appeal of silver in the immediate term.

The Federal Reserve’s long-term monetary policy decisions are poised to shape the landscape for precious metal investments, including silver.

While global economic shifts are inscribing complex, multifaceted impacts on silver’s stature as a dual asset, with industrial thrusts, technology advancements, and fluctuating investment climates presaging a dynamic path ahead, it is also pertinent to note the specific milestones and developments from junior silver companies such as Equity Metals Corp. [EQTY-TSXV; EQMEF-OTCQB; EGSD-FSE], Discovery Silver Corp. [DSV-TSX; DSVSF– OTCQX] and Southern Silver Exploration Corp. [SSV-TSXV; SSVFF-OTCQB; SEG1-FSE; SSVCL-Santiago. Their exploration activities and potential mine developments may subtly but surely influence the broader market.

Discovery Silver aims to become the mining sector’s next major silver producer as it works to develop its 100%-owned Cordero project in Chihuahua State, Mexico.

Discovery Silver aims to become the mining sector’s next major silver producer as it works to develop its 100%-owned Cordero project in Chihuahua State, Mexico.

The bid to secure permits for Cordero is headed by CEO Tony Makuch, a highly experienced mining executive who previously led the transformation of Kirkland Lake Gold Ltd., a company that merged with Agnico Eagle Mines Ltd (AEM-TSX, AEM-NYSE) in a $13.5 billion deal in February 2022.

When Discovery released the results of a feasibility study in February 2024, Makuch outlined the value proposition that Cordero represents, not only for investors and local communities in Mexico, but also for the global effort to reduce greenhouse gas emissions.

With expected annual production averaging 37 million silver-equivalent (AgEq) ounces in the first 12 years, he said Cordero can play a key role in closing market deficits and supplying silver for high-growth sectors such as electric vehicles and solar energy. Makuch said the project will deliver valuable benefits to Mexico by creating high-quality, high-paying jobs, investing in infrastructure as well as goods and services and generating tax revenue.

But more importantly, Cordero can be an example of how a large-scale mining project that is profitable, contributes to greater prosperity and meets the highest environmental standards, can be part of the solution when it comes to addressing ESG issues and achieving sustainable objectives in a world that increasingly needs metals and minerals.

The Cordero project is located in northern Mexico, in the state of Chihuahua, about 600 kilometres from the border with the U.S. and 35 kilometres by road from Chihuahua City. It is a region with a long history of mining, dating all the way back to the 1600s.

The Cordero project is located in northern Mexico, in the state of Chihuahua, about 600 kilometres from the border with the U.S. and 35 kilometres by road from Chihuahua City. It is a region with a long history of mining, dating all the way back to the 1600s.

Cordero will be an open pit mine with an expected lifespan of 19 years and is expected to be one of the most significant employers in the Chihuahua region, creating over 2,500 jobs during the construction and over 1,000 direct jobs during operation. In addition, the project will purchase $4 billion in goods and services over the mine life, leading to significant indirect job creation, and make estimated tax contributions of over $1.4 billion within Mexico.

According to the feasibility study, it will rank as one of the largest primary silver mines globally, with average production of 33 million ounces of AgEq annually at all-in-sustaining cost averaging US$13.50 an ounce AgEq over the life of the mine. On April 12, 2024, spot silver was trading at US$28.01 an ounce.

The feasibility study is based on resource estimate that was recently updated to include an additional 33,400 metres of drilling (total drilling of 310,900 metres in 793 drill holes). Discovery has said the overall expansion of the resource was driven largely by exploration success at depth and in the northeast part of the deposit.

Measured and indicated resources stand at 1.2 billion ounces AgEq at an average grade of 52 g/t AgEq (719 million tonnes grading 21 g/t silver, 0.06 g/t gold, 0.31% lead, and 0.60% zinc).

On top of that is an inferred resource of 155 million ounces of AgEq at an average grade of 32 g/t AgEq (149 million tonnes of 14 g/t silver, 0.03 g/t gold, 0.18% lead, and 0.35% zinc).

In a bid to maximize capital efficiency, development will occur in phases with phase 1 estimated at $606 million to be incurred over a two-year period. This capital estimate includes Phase 1 of the process plant, with nameplate capacity of 9.6 million tonnes annually (26,000 tonnes per day).

Phase 2 will be funded from project cash flow and involve the processing facility to be expanded to a nameplate capacity of 19.2 million tonnes annually (51,000 tonnes per day) at an estimated cost of $291 million. An expansion of the flotation circuit is planned for Year 7 at a cost of $17 million to accommodate an increase in zinc grades.

On May 7, 2024, Discovery Silver shares were trading at 92 cents in a 52-week range of $1.22 and 52 cents, leaving the company with a market cap of $364.3 million based on 396 million shares outstanding.

Southern Silver Exploration Corp. [SSV-TSXV, SSVFF-OTCQX, SSVCL-SSEV] is another exploration and development company with a specific emphasis on the 100%-owned Cerro Las Minitas silver-lead-zinc project in Mexico.

Southern Silver Exploration Corp. [SSV-TSXV, SSVFF-OTCQX, SSVCL-SSEV] is another exploration and development company with a specific emphasis on the 100%-owned Cerro Las Minitas silver-lead-zinc project in Mexico.

Southern Silver is hoping that by improving the economics at Cerro Las Minitas, it will attract a joint venture partner or a major mining company who is willing to buy the project outright and take it to production.

It is a strategy led by a highly experienced management team, including company President Lawrence Page, who has been involved in the development of a number of major mining projects, including Eskay Creek (British Columbia), Hemlo (Ontario) and Penasquito (Mexico).

It is worth noting that the company’s portfolio includes two properties in southern New Mexico: the Oro porphyry/CRD copper-gold project and the early-stage Hermanas gold-silver epithermal vein project.

The flagship Cerro Las Minitas project already ranks as one of the largest and high- grade undeveloped silver projects in the world. It is located in a well-established silver mining district, about 79 kilometres to the northeast of the city of Durango. Consisting of 25 concessions covering 34,450 hectares, it lies within the heart of the Faja de Plata (Belt of Silver) of north central Mexico.

The belt is one of the most significant silver producing regions in the world, with current reserves/resources and historic production in excess of 3.0 billion ounces of silver. Major mining operations in the region include Newmont Corp.’s [NGT-TSX, NEM-NYSE] Penasquito mine.

According to the latest estimate, Cerro Las Minitas hosts an indicated resource of 12.5 million tonnes of average grade 106 g/t silver, 0.07 g/t gold, 0.2% copper, 1.3% lead and 3.3% zinc, an amount that equates to 140 million ounces of silver equivalent (AgEq).

According to the latest estimate, Cerro Las Minitas hosts an indicated resource of 12.5 million tonnes of average grade 106 g/t silver, 0.07 g/t gold, 0.2% copper, 1.3% lead and 3.3% zinc, an amount that equates to 140 million ounces of silver equivalent (AgEq).

On top of that is an inferred resource of 21.0 million tonnes of 118 g/t silver, 0.1 g/t gold, 0.2% copper, 1.2% lead and 2.2% zinc, 210 million ounces of AgEq.

To date, Southern Silver has identified six high-grade silver-polymetallic deposits, which have been partially delineated, as well as several other high priority targets throughout the property.

In a recent interview, Southern Silver Exploration Vice-President Rob MacDonald said the company hopes to increase the indicated and inferred resource from the current 33.5 million tonnes to around 40 million tonnes.

According to a preliminary economic assessment (PEA) dated August, 2022, the project can support a large-scale underground mining operation with a 15-year mine life, with an average annual plant feed of 14.2 million ounces of silver equivalent (AgEq) (including 5.8 million ounces of silver) at an all-in-sustaining cost of US$13.27 per ounce of AgEq sold.

The PEA envisages base case gross revenue of US$3.7 billion with silver accounting for 42% of the revenue, and zinc accounting for 39%. The project has an initial capital expenditure of US$341 million.

However, the company is confident that it can improve on those numbers in a updated PEA that is expected to be announced in the very near future.

However, the company is confident that it can improve on those numbers in a updated PEA that is expected to be announced in the very near future.

Future work at Cerro Las Minitas will focus on adding value to the project early in the production timeline for maximum economic benefit. This will include further engineering upgrades to the project design, a detailed review of capital expenditures, the addition of gold payables to the cash-flow model and pre-concentration to improve the project economics.

The company is also working to enhance the value of its other projects. It is looking at the potential for rare earth elements (REEs) by-product revenue at its wholly-owned Oro property located in a porphyry copper belt in southwestern New Mexico, U.S.A.

It is also aiming to secure permits to drill its Hermana gold silver project in New Mexico.

On May 7, 2023, Southern Silver shares were trading at 23 cents in a 52-week range of 25.5 cents and 11 cents, leaving the company with a market cap of $67 million based on 292.3 million shares outstanding.

Equity Metals Corp. [EQTY-TSXV, EQMEF-OTCQB, EGSD-FSE] is working to develop a high-grade resource that is open for expansion at its flagship Silver Queen project in British Columbia.

Equity Metals Corp. [EQTY-TSXV, EQMEF-OTCQB, EGSD-FSE] is working to develop a high-grade resource that is open for expansion at its flagship Silver Queen project in British Columbia.

Silver Queen Project is a premier gold-silver property with over 100 years of historic exploration and development and is located in the Skeena Arch porphyry copper region of B.C., adjacent to power, roads, and rail with significant mining infrastructure that was developed under previous operators Bradina JV (Bralorne Mines) and Houston Metals Corp. (a Hunt Brothers company). The property covers 18,852 hectares with no underlying royalties and contains two historic declines into the No 3 Vein, camp infrastructure and a maintained tailings facility.

Mineralization is hosted by high-grade precious and base metal veins related to a buried porphyry system which has only been partially delineated.

In December 2022, the company announced an updated indicated and inferred resource of 85 million silver equivalent (AgEq) ounces. The estimate was based on 78 holes or 25,659 metres of drilling in six successive exploration phases starting in late 2020.

Five separate target areas were tested in part and thick intervals of high-grade gold, silver and base metal mineralization have been identified in each of the Camp Vein, The Sveinson Target, No. 3 Vein and NG-3 Vein system.

Five separate target areas were tested in part and thick intervals of high-grade gold, silver and base metal mineralization have been identified in each of the Camp Vein, The Sveinson Target, No. 3 Vein and NG-3 Vein system.

Hopes that the existing resource can be expanded are based on exceptional assay results, which demonstrate exploration upside across several of the more than 20 different veins which have been identified on the property so far.

Equity Metals President Joe Kizis said the resource remains open for additional delineation west of the Camp Target and within the Sveinson Target. “In addition, there are several targets that have only been tested by a few drill holes and remain very attractive areas for new discoveries and a MRE (mineral resource estimate) increase,” he said.

Overall, in 2023, 26 core holes were completed for a total of 9,989 metres and 1,437 soil sediment samples were collected. That program successfully demonstrated lateral and down-dip extensions of the known Camp and Sveinson deposits.

Looking ahead to drilling in 2024, the company said it will focus on the systematic resource expansion of the Camp and Sveinson deposits and the further delineation of mineralization at both the Cole Lake and George Lake targets which were not included in the 2022 mineral resource update.

Several additional new targets will be tested in 2024, including the newly identified soil anomaly north of the Camp Deposit. An initial program 6,000 metres of drilling is planned and is currently funded to begin testing these targets.

In a January 15, 2024, press release, Equity Metals reported assays from the final six holes on the Cole Lake target and a single hole from the Camp Target, which were completed as part of the company’s Autumn 2023 core drilling program.

In a January 15, 2024, press release, Equity Metals reported assays from the final six holes on the Cole Lake target and a single hole from the Camp Target, which were completed as part of the company’s Autumn 2023 core drilling program.

“The initial drill results from the Cole Lake target confirm both the historical grade and tenor of the Cole Vein and its prospectivity as a viable follow-up target for resource delineation,’’ said Rob Macdonald, Vice-President, Exploration at Equity Metals.

Macdonald is a key part of a highly experienced geological exploration team with a proven track record of success. Kizis, has 40 years of experience in exploring for gold, silver, copper, molybdenum, lead and zinc in British Columbia and abroad.

On May 7, 2024, Equity Metals shares closed at 20 cents and are currently trading in a 52-week range of 25.5 cents and $0.075, leaving the company with a market cap of $31.6 million based on 158 million shares outstanding. The company recently had $2.7 million cash in its treasury.

Aside from its 100% interest in Silver Queen, the company also has interests in two highly prospective diamond properties in the Lac de Gras area northeast of Yellowknife in the Northwest Territories. Lac de Gras ranks as one of Canada’s most prolific diamond producing areas.

Resource World Magazine Inc. has prepared this editorial for general information purposes only and should not be considered a solicitation to buy or sell securities in the companies discussed herein. The information provided has been derived from sources believed to be reliable but cannot be guaranteed. This editorial does not take into account the readers investment criteria, investment expertise, financial condition, or financial goals of individual recipients and other concerns such as jurisdictional and/or legal restrictions that may exist for certain persons. Recipients should rely on their own due diligence and seek their own professional advice before investing.

Continue Reading

>>> Read full article>>>

Copyright for syndicated content belongs to the linked Source : ResourceWorld – https://resourceworld.com/global-economic-shifts-and-their-impact-on-silver-as-a-dual-asset/?utm_source=rss&utm_medium=rss&utm_campaign=global-economic-shifts-and-their-impact-on-silver-as-a-dual-asset