Despite a weekend dip in Bitcoin’s price, MicroStrategy’s holdings are still profitable.

Bitcoin tumbled over the weekend following a drone attack by Iran on Israel. Under the influence of Middle East tensions and the approaching halving, the price plunged from $68,000 to around $60,000 on Saturday, with $1.2 billion in long positions liquidated. Despite this sharp correction, Michael Saylor, co-founder of MicroStrategy, expressed a positive outlook, stating, “Chaos is good for Bitcoin.”

Chaos is good for #Bitcoin.

— Michael Saylor⚡️ (@saylor) April 13, 2024

His statement was shared on X after Bitcoin’s weekend downturn eroded over $1.5 billion from MicroStrategy’s holdings. Still, the company maintains a substantial profit exceeding $6 billion.

Saylor’s comments sparked diverse reactions within the crypto community. Some criticized his timing due to the ongoing international conflict, while others agreed with his view of Bitcoin as a “hedge against chaos.”

Historical data shows that Bitcoin often faces initial price declines during geopolitical instability but tends to recover as it is seen as a long-term haven.

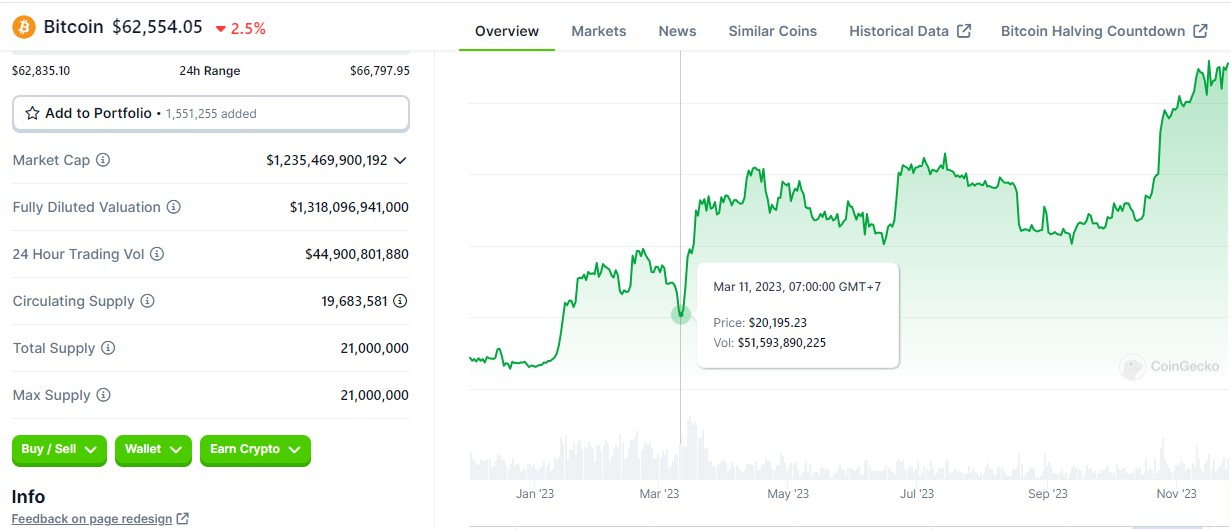

For instance, after the Russia-Ukraine conflict began in February 2022, Bitcoin’s price dropped to around $39,000 but rebounded to $44,000 within a week, according to data from CoinGecko. Similarly, following the Israel-Hamas conflict in October 2023, Bitcoin initially fell by 6% but rose to $35,000 within a month.

Banking distress last March also mirrors this pattern, though Saylor’s comment wasn’t necessarily related to economic chaos.

When Silicon Valley Bank faced bank runs on March 10, 2023, Bitcoin’s price briefly dipped below $20,500 but soon recovered, climbing to a nine-month high by the end of March. This recovery was further bolstered by BlackRock’s filing for a spot Bitcoin ETF.

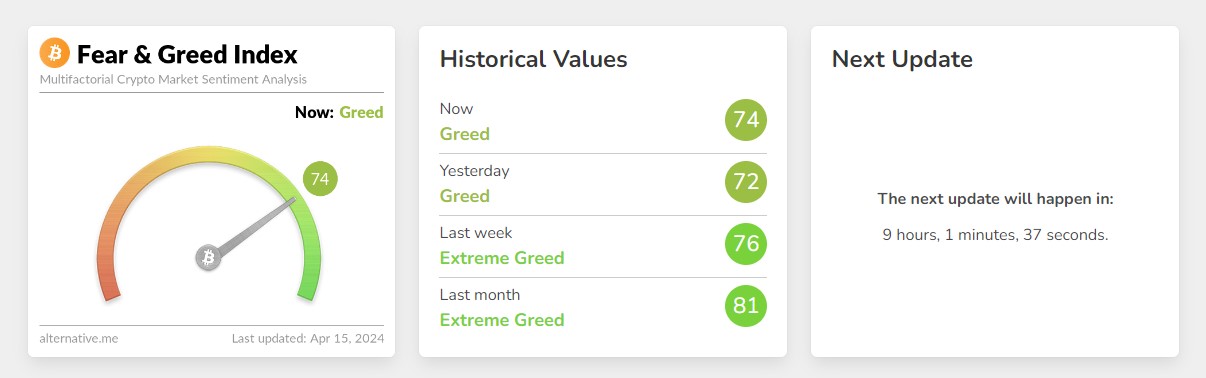

Despite recent war fears, Bitcoin market sentiment remains bullish. According to Alternative’s data, the Fear and Greed Index currently sits at 74, indicating “greed” – down from “extreme greed” but still reflecting strong investor confidence. This optimism is likely fueled by the approaching halving event, which historically has been followed by a price peak for Bitcoin several months later.

Bitcoin reclaimed the $66,000 earlier today after Hong Kong officially approved spot Bitcoin and Ethereum ETFs. At the time of writing, Bitcoin is trading at around $62,500, down 2.5% in the last 24 hours, per CoinGecko’s data.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

Crypto Briefing may augment articles with AI-generated content created by Crypto Briefing’s own proprietary AI platform. We use AI as a tool to deliver fast, valuable and actionable information without losing the insight – and oversight – of experienced crypto natives. All AI augmented content is carefully reviewed, including for factural accuracy, by our editors and writers, and always draws from multiple primary and secondary sources when available to create our stories and articles.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

See full terms and conditions.

>>> Read full article>>>

Copyright for syndicated content belongs to the linked Source : CryptoBriefing – https://cryptobriefing.com/bitcoin-market-resilience-analysis/