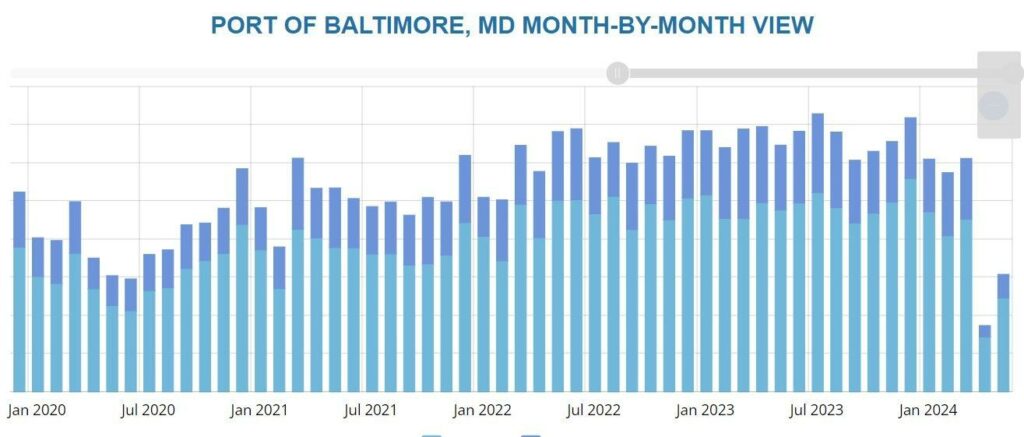

While the Port of Baltimore’s imports recovered a great deal of ground in May from April, as shown … [+] on the right side of the chart, what is also apparent is just how bad April was: The April total was even lower than the totals from the worst months of the Covid-19 pandemic, the short bars on the left side of the graphic.

ustradenumbers.com

The Port of Baltimore’s imports increased 70.89% in May, one month after the Francis Scott Key Bridge collapsed when it was struck by the container skip Dali, according to my analysis of the latest U.S. Census Bureau data.

What makes the 70.89% gain in May particularly impressive is that the channel did not completely open for cargo traffic until early June.

The total for April was $1.44 billion. The total for May was $2.47 billion, an increase of $1.02 billion.

As you would expect, the picture is less rosy when looking at year-to-date data. April took a big bite.

Through May, the Port of Baltimore’s imports are off 28.09%, down $6.74 billion to $17.27 billion. I expect even stronger numbers a month from now, when the figures for June are released. The channel will have been open almost the entire month.

The challenge, of course, is for the port to regain all traffic diverted to other seaports while the channel wasn’t open, about which I wrote previously.

Exports, while a smaller share of the seaport’s trade, have been slower to recover so far, down 42.08% year to date. Exports through May totaled $5.55 billion, less than a third of the total for imports.

The Maryland seaport, one of the most important on the Eastern Seaboard, was the nation’s leading importer and exporter for a number of commodities prior to the bridge collapse.

For the month of May, the port’s balance of trade became more imbalanced, with exports accounting … [+] for only 20% of the total.

ustradenumbers.com

But, like so many U.S. seaports, its trade isn’t particularly balanced. While the U.S. average for all airports, seaports and border crossings is generally about 40% of total trade being an export, the Port of Baltimore has been below 30% for close to a decade. It was 20% in May.

That’s why I am focusing here, and in a previous column, on imports first.

The most valuable of the port’s imports, before and after the bridge collapse, is passenger vehicles. The gain in passenger vehicles from April to May was four times that of any other import, increasing $441.53 million.

A 37.38% increase from April, the May total is only a decrease of 17.05% from the March total, before the bridge collapse, and a 1.08% decrease from the same month one year ago.

Year-to-date it is even a better story. The $8.16 billion total is the second highest on record through May and only 0.43% lower than the same five months of 2023, a record pace.

The news is a little less positive for the second-, third- and fourth-ranked imports year-to-date — all vehicles — bulldozers and other self-propelled construction machinery, vans and other commercial vehicles, and tractors, including those that pull trailers.

Looking at year-to-date data, the bulldozers category is down 40.60% ($608.13 million), commercial vehicles off 31.45% ($258.61 million) and tractors down 48.40% ($507.41 million).

On a monthly basis, compared to the dismal April, all three gained, up $99.92 million (193.40%), $61.40 million (240.95%) and $79.16 million (1,051.71%), respectively.

On a related import, forklifts and vehicles with a forklift increased $28.76 million over April, a gain of 122.77%, and the category was only 14.25% below March and 20.14% below last May.

Also among the Port of Baltimore’s most valuable imports historically, and certainly most important by tonnage, have been iron and steel, tin, aluminum and nickel. Not through April and May.

In April, there were no imports of either nickel, tin or the category that includes iron and steel. In May, there were no imports of aluminum or tin.

In May, iron and steel imports were off 99.96% from March and 99.97% from last May. Nickel is a similar story. The value of nickel imports was still 99.41% below March of this year and 99.81% below May of 2023.

There were no imports of tin in May, a 100% decline from both March of this year and May of the previous year.

While there were limited aluminum imports in April, there were none in May, a 100% decline from March and May of last year.

Furniture imports remain depressed, down 81.27% from April, 99.32% from March and 99.39% from last May.

>>> Read full article>>>

Copyright for syndicated content belongs to the linked Source : Forbes – https://www.forbes.com/sites/kenroberts/2024/07/10/port-of-baltimore-imports-increased-71-in-month-after-bridge-struck