Symbiotic’s diverse ERC-20 token restaking model challenges the status quo.

The launch of restaking protocol Symbiotic brought another evolving step to the restaking landscape, according to IntoTheBlock’s “On-Chain Insights” newsletter. Symbiotic reached its cap for liquid staking tokens in less than 48 hours, and its popularity is bolstered by a $5.8 million investment from Paradigm and cyber.Fund.

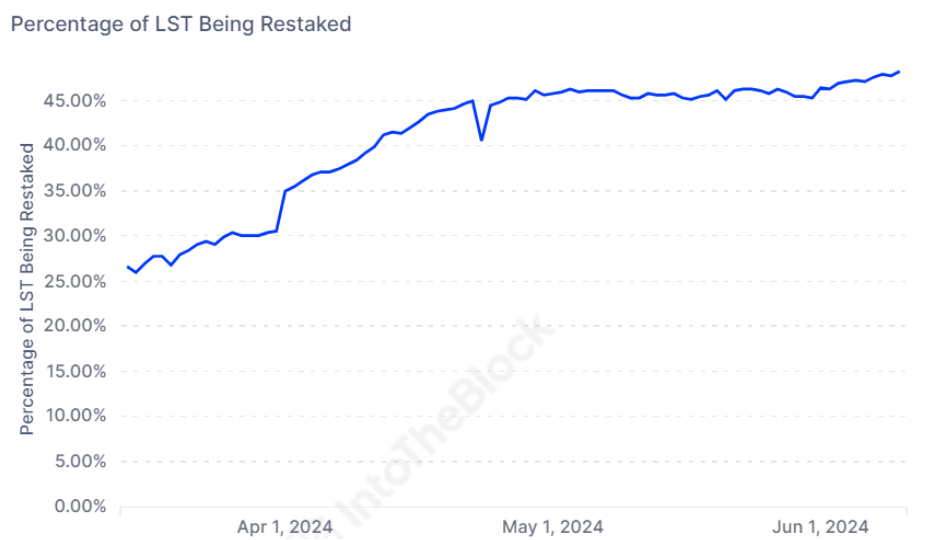

EigenLayer has seen 48% of all Liquid Staking Tokens (LST) being restaked within its protocol, the highest proportion to date. It has also placed limits on the deposit of Lido’s stETH, which has prompted some users to transfer their LST from Lido to EigenLayer in search of higher yields.

Restaking was popularized in the Ethereum (ETH) ecosystem by EigenLayer, consisting of a layer that uses staked ETH to provide dedicated security for decentralized applications. Consequently, projects don’t have to focus on creating their own set of validators, as they can tap into restaking layers.

However, Symbiotic sets itself apart by accepting a variety of ERC-20 tokens for restaking, not just ETH or certain derivatives, mirroring Karak’s open restaking model. The project’s unveiling aligns with the start of its bootstrapping phase and the integration of restaked collateral.

Moreover, Mellow, Symbiotic’s first liquid restaking platform, launched simultaneously with the protocol itself. Lido’s endorsement of Mellow suggests a potential shift of wstETH deposits from EigenLayer to Symbiotic.

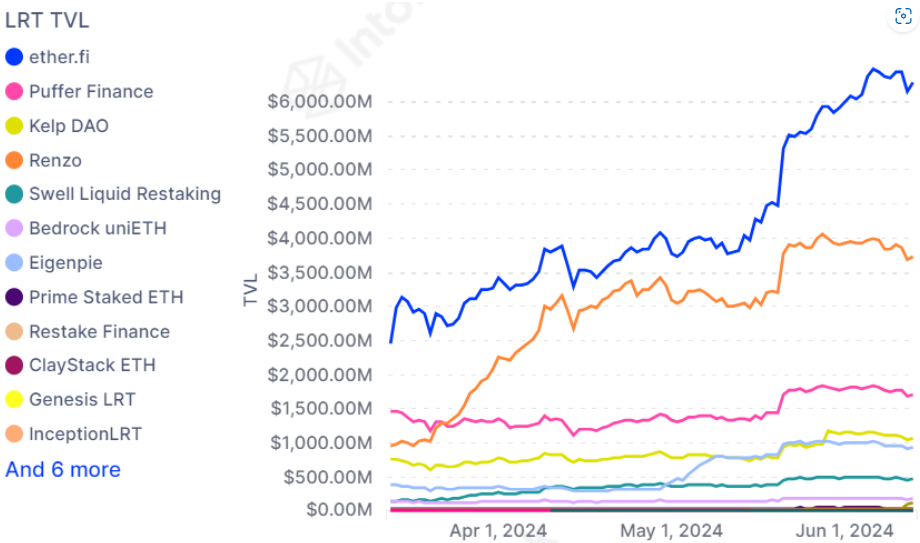

Additionally, the ongoing points distribution phase for both Mellow and Symbiotic, prior to their token launches, may attract airdrop farmers. Established LRT protocols such as Etherfi or Renzo might soon begin collaborations with Symbiotic.

IntoTheBlock’s analysts assess that the liquid restaking protocol landscape is in a state of flux, with Symbiotic’s entry introducing new capabilities that challenge the status quo, signifying a shift towards a more diverse and competitive environment.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

Crypto Briefing may augment articles with AI-generated content created by Crypto Briefing’s own proprietary AI platform. We use AI as a tool to deliver fast, valuable and actionable information without losing the insight – and oversight – of experienced crypto natives. All AI augmented content is carefully reviewed, including for factural accuracy, by our editors and writers, and always draws from multiple primary and secondary sources when available to create our stories and articles.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

See full terms and conditions.

>>> Read full article>>>

Copyright for syndicated content belongs to the linked Source : CryptoBriefing – https://cryptobriefing.com/symbiotic-restaking-innovation/