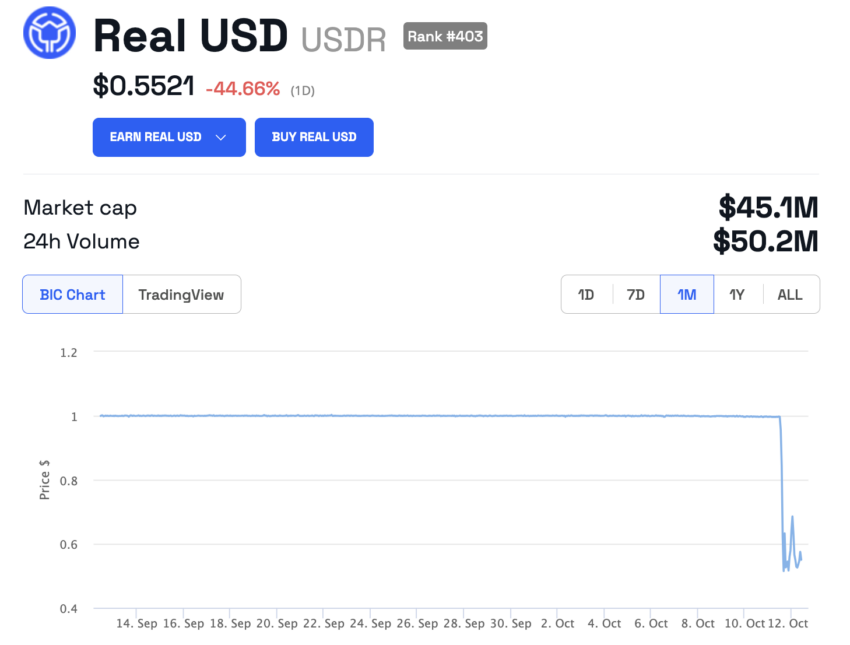

In the last 24 hours, mass redemptions of the Polygon-based stablecoin USDR used up the liquid DAI collateral in the treasury of its issuer TangibleDAO (Tangible). Panic selling ensued, causing the asset to fall from its $1 peg.

One user, fearing that Tangible would be unable to liquidate the real estate backing its coin, swapped $130,000 for $0.0001 USDC on Binance Smart Chain. A maximum extractable value (MEV) bot raked in $107,000 profit from the transaction.

Tangible Plan to Make USDR Users Whole After Depeg

Tangible said it would liquidate its insurance fund and mark its TNGBL token to zero to improve liquidity. TNGBL is a token anyone can lock up to receive a multiplier based on the period they lock up their tokens and receive a 3,3+ non-fungible token (NFT) representing their position.

In addition, the decentralized autonomous organization (DAO) will contribute $2.4 million of its own DAI, USDC, and USDT holdings.

USDR depeg | Source: BeInCrypto

USDR depeg | Source: BeInCrypto

On a slightly longer time frame, Tangible will mint its real-world tokenized assets into a yield-generating Basket token. Users will then have the option of earning yields from Basket tokens or selling them into Pearl, a decentralized exchange on Polygon, or farming them on the platform.

Tangible confirmed it is prepared to liquidate real-world property if there is no demand for Basket tokens.

Read more: Top 5 Yield Farms on Polygon

Challenges Facing RWA-Backed Stablecoins

Stablecoins backed by real-world assets (RWA) are a fairly novel concept. It harks back to the eighteenth century when the US government backed dollars with physical gold bars, a strategy that President Nixon ended in 1971.

Stablecoins, when they were introduced, were the first attempt to tokenize or represent the fiat-backed currencies on the blockchain. Issuers generally keep liquid assets they can convert to cash when holders want to bring funds from the blockchain back into the traditional financial system.

The notion of backing stablecoins with blockchain versions of real-world assets is fairly novel. Companies are still investigating ways these tokenized assets can be quickly exchanged for cash when users need it.

Read more: What is Tokenization on Blockchain?

Several hurdles exist, such as how to quickly and legally complete a real-world transfer of ownership effected on the blockchain. There is also the issue of how to transfer the ownership of an asset on one blockchain to the buyer whose address is on another blockchain.

Lawmakers also must establish rules on how digital asset custodians protect tokenized RWAs from theft and loss.

Do you have something to say about the Tangible plan to make users whole after the USDR depeg or anything else? Please write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

>>> Read full article>>>

Copyright for syndicated content belongs to the linked Source : BeingCrypto – https://beincrypto.com/tangibledao-plans-recovery-usdr-stablecoin-crashes/