Bond investors are starting to bet the worst ever rout in US Treasuries may soon be over.

Author of the article:

Bloomberg News

Ruth Carson and Garfield Reynolds

Published Oct 09, 2023 • Last updated 1 hour ago • 3 minute read

39i13jbahiph3(2ty4aot9z(_media_dl_1.png Bloomberg RSS

39i13jbahiph3(2ty4aot9z(_media_dl_1.png Bloomberg RSS

(Bloomberg) — Bond investors are starting to bet the worst ever rout in US Treasuries may soon be over.

US 10-year yields slid the most since March in early Asian trade after dovish comments from Federal Reserve officials fueled speculation the US tightening cycle is about done, while jitters over the Israel-Hamas war added haven demand. The move was more pronounced than normal as trading of cash Treasuries had been shut worldwide Monday for a US holiday.

Advertisement 2

This advertisement has not loaded yet, but your article continues below.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

Exclusive articles by Kevin Carmichael, Victoria Wells, Jake Edmiston, Gabriel Friedman and others.Daily content from Financial Times, the world’s leading global business publication.Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

Exclusive articles by Kevin Carmichael, Victoria Wells, Jake Edmiston, Gabriel Friedman and others.Daily content from Financial Times, the world’s leading global business publication.Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.Daily puzzles, including the New York Times Crossword.

REGISTER TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

Access articles from across Canada with one account.Share your thoughts and join the conversation in the comments.Enjoy additional articles per month.Get email updates from your favourite authors.

Article content

Article content

Two Fed officials speaking Monday expressed the idea that the recent surge in US yields may have done some of the job of tightening financial conditions for them.

The Fed speakers “seemed very much on the same page in noting higher bond yields and tighter financial conditions will impact their thinking on the Fed funds rate,” said Andrew Ticehurst, a rates strategist at Nomura Inc. in Sydney. “Market pricing suggests the Fed likely won’t hike this year,” he said, adding there may still be a risk of a final “insurance” increase.

Fed Vice Chair Philip Jefferson said he’s watching the increase in Treasury yields as a potential further restraint on the economy even though the rate of inflation remains too high. Fellow policymaker Lorie Logan said the recent increase in long-term yields may indicate less need for the central bank to raise rates again.

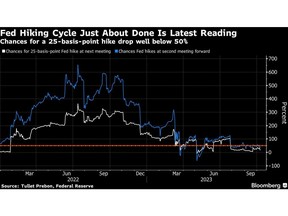

Fed-meeting-dated swaps now show about a 65% chance the central bank will stay on hold in December, compared with 60% odds on another hike by then, just a week ago. They are even more confident policymakers won’t raise rates at any of the other gatherings through to mid-2024.

Advertisement 3

This advertisement has not loaded yet, but your article continues below.

Article content

US 10-year yields fell as much as 18 basis points to 4.62%, the biggest one-day decline since March 22. Two-year yields slipped as much as 16 basis points to 4.92%.

Bonds in other markets rallied along with Treasuries. Australian 10-year yields slid nine basis points, while those on similar-maturity New Zealand notes slipped seven basis points. The drop in Treasury yields also caused the dollar to weaken against most of its Group-of-10 peers, while boosting Asian stocks.

“With events quickly escalating in the Middle East and the recent bond selloff pushing long-term yields to new multi-decade highs, policymakers will be reluctant to hike,” Althea Spinozzi, senior fixed-income strategist at Saxo Bank A/S, wrote in a research note.

Bond investors have had their hopes for an end to rate hikes dashed before. A rally after the banking crisis that sent 10-year yields as low as 3.25% in April was followed by waves of selling as the Fed kept on tightening policy.

Treasury yields have surged in in recent months amid concern stubborn inflation will convince the Fed to keep borrowing costs higher for longer. An index of US government debt has dropped 2.6% this year, heading for a third year of losses.

The recent run up in yields “might give the Fed extra reason for pause in the short run, but it’s too early to call this justification for the end of the cycle,” said Robert Thompson, macro rates strategist at Royal Bank of Canada in Sydney.

The Fed’s rate increases have so far failed to bring inflation back down to the central bank’s 2% target, and the US economy still appears to be resilient. Yields have also risen this year on concern about increased Treasury issuance, which is needed to fund widening government deficits.

Article content

>>> Read full article>>>

Copyright for syndicated content belongs to the linked Source : Financial Post – https://financialpost.com/pmn/business-pmn/treasuries-jump-on-dovish-fed-comments-middle-east-conflict