Increased effective tax rate on capital gains for Canadian companies and some individuals

Author of the article:

Bloomberg News

Erik Hertzberg

Published Jul 22, 2024 • Last updated 23 minutes ago • 4 minute read

Prime Minister Justin Trudeau’s government has turned to raising taxes on businesses to help fund Canada’s budget, adding headwinds to an economy that’s already struggling to attract investment.

The landscape is a contrast with the United States, which is in the midst of a supply renaissance and a factory building boom. Economists warn that Canada’s higher taxes will send the wrong signal to firms thinking about expanding production — risking longer-term damage to an economy that has relied on high levels of immigration and consumption to fuel growth.

Advertisement 2

This advertisement has not loaded yet, but your article continues below.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

Exclusive articles from Barbara Shecter, Joe O’Connor, Gabriel Friedman, Victoria Wells and others.Daily content from Financial Times, the world’s leading global business publication.Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

Exclusive articles from Barbara Shecter, Joe O’Connor, Gabriel Friedman, Victoria Wells and others.Daily content from Financial Times, the world’s leading global business publication.Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

Access articles from across Canada with one account.Share your thoughts and join the conversation in the comments.Enjoy additional articles per month.Get email updates from your favourite authors.

Sign In or Create an Account

or

Article content

In its most recent survey of businesses, the Bank of Canada flagged a sharp increase in firms’ anxiety about the tax burden: 42 per cent listed taxes and regulation among their top three concerns, from 27 per cent previously. Business confidence is lower than it was a year ago, and planned business investment is weak.

“Capital has to feel like it’s welcome, whether that’s how it’s treated in terms of taxation or regulation,” Doug Porter, chief economist at Bank of Montreal, said in an interview. “And I’m not sure capital does feel entirely welcome in Canada.”

Rising concerns by business owners follow the introduction of a new budget that increased the effective tax rate on capital gains for Canadian companies and some individuals.

Phase out tax breaks

The government is also phasing out some tax breaks on new business investment, a reversal of measures introduced in 2018 that were meant to help firms compete with the U.S. by allowing quicker write-offs of certain assets against their incomes.

The tax hikes are part of Trudeau’s political playbook as he seeks to win back young voters frustrated by the rising cost of living. The government says the changes are about “fairness” and asking the country’s most successful to contribute more, and is allocating more to priorities such as boosting the supply of housing.

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Advertisement 3

This advertisement has not loaded yet, but your article continues below.

Article content

In a recent interview, Finance Minister Chrystia Freeland downplayed criticisms that the capital-gains increase was sending the wrong message to business. She pointed to a recent report from the International Monetary Fund that said it wouldn’t significantly harm investment or productivity growth. Government spending on housing is necessary, and new measures such as investment tax credits for clean energy are “a really big deal” that should help draw investment, she said.

“Which other G7 country you think is both investing aggressively in our own economy and in our own people, and doing it in a fiscally responsible way?” Freeland said. “I don’t see anybody else doing both.”

Still, a regime of higher taxes risks deepening a dire productivity crisis, according to some economists.

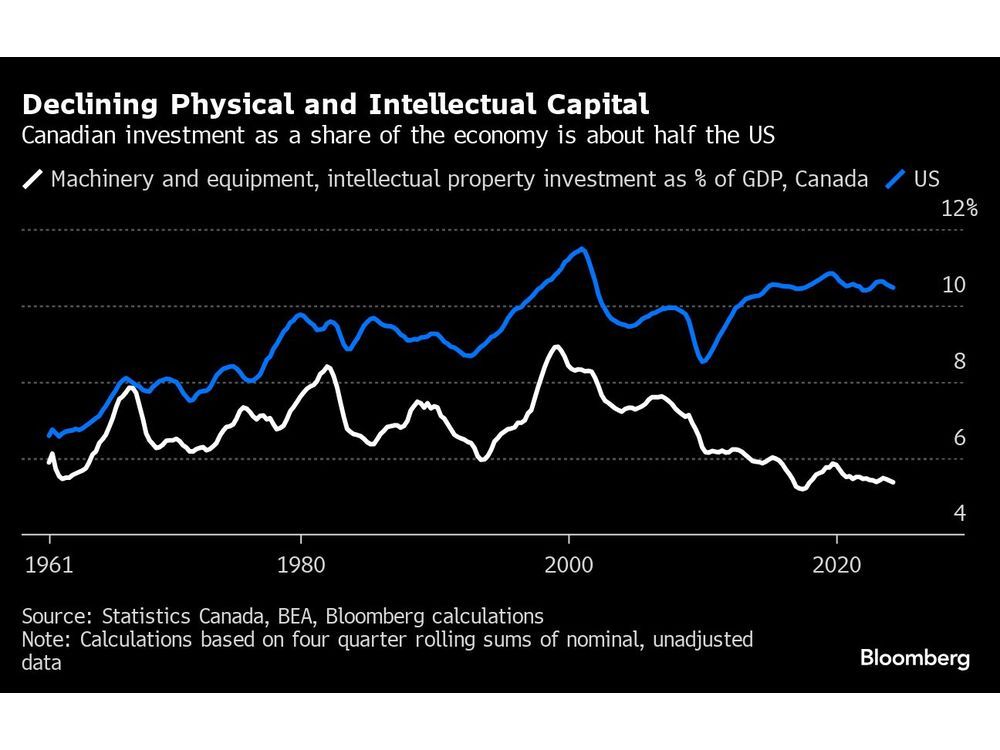

Canada’s capital stock of machinery and equipment has shrunk 2.8 per cent since peaking in 2014 at just over $1 trillion in real terms. The value of those assets — some of the more productive drivers of output — declined in seven of the eight last years, the only stretch of depreciation in data going back to 1961.

Advertisement 4

This advertisement has not loaded yet, but your article continues below.

Article content

Part of that decline can be explained by the collapse of oil prices in 2014 and 2015, Porter said, which led to a structural change in how much capital was added in Canada. A number of foreign energy companies divested from the Alberta oilsands, while some domestic firms focused on repaying debt or boosting payments to shareholders rather than plowing money into new projects.

Oil and gas investment

Since then, no industry has been able to fill the vacuum left by the oil and gas sector, either in terms of productivity or as a recipient of foreign direct investment. That means fewer resources for a growing labour force. In 2022, there was $46,883 in machinery and equipment capital for every Canadian working or seeking work, 11 per cent less than in 2014 in real terms.

The Bank of Canada’s business outlook survey shows investment intentions were well below historic averages in the second quarter. Firms are focusing on “repairing and replacing existing capital equipment rather than investing in new capacity or products to improve productivity,” the bank said.

The picture in the U.S. looks very different. The Inflation Reduction and CHIPS Acts have channelled trillions into productive capacity. In response, Canada has announced billions of its own subsidies and tax credits for select industries, courting companies like Volkswagen AG and Stellantis NV to build battery plants for electric vehicles.

Advertisement 5

This advertisement has not loaded yet, but your article continues below.

Article content

In 2023, Canadian workers likely received 40 cents of new machinery and equipment capital for every dollar received by their counterparts in the U.S., according to William Robson, chief executive at the C.D. Howe Institute.

“We are really losing the race to equip our workers,” Robson said.

Recommended from Editorial

Economic uncertainty pushes Canadians to save at rising rate

More older Canadians fear losing job as labour market slows

Bank of Canada expected to cut interest rates on Wednesday

The government points to Canada’s marginal effective tax advantage relative to the Organisation for Economic Co-operation and Development and other advanced economies, but it risks losing the upper hand. The tax rate on new business investment is set to rise to 16.8 per cent in 2028 from 14.5 per cent currently. That’s compared with a projected 24.9 per cent in the U.S. in 2028 — but Donald Trump has pledged to slash corporate taxes if he wins power.

Bloomberg.com

Article content

>>> Read full article>>>

Copyright for syndicated content belongs to the linked Source : Financial Post – https://financialpost.com/pmn/business-pmn/trudeaus-tax-hikes-risk-worsening-canadas-struggle-for-capital