Liquid Staking Tokens (LSTs) and Liquid Restaking Tokens (LRTs) are some of the most exciting DeFi developments you should know about.

LSTs, like stETH from Lido, allow you to stake your Ethereum and earn staking rewards while retaining liquidity.

This means you can use your staked assets in various DeFi activities, such as lending, trading, or providing liquidity, all while still earning staking rewards. This dual functionality has kept many folks’ hands full, boosting the capital efficiency and appeal of staking.

Liquid Re-Staking Tokens, LRTs, take this a step further by enabling restaking, which means you can re-stake your already staked tokens to earn additional rewards.

Platforms like EigenLayer allow stakers to participate in securing new blockchain projects or DeFi services, earning yields from the base Ethereum staking, liquid staking activities, as well as staking activities.

Liquid Staking into Liquid Re-Staking: A Brief History

As of writing, there are 1,023,467 validators actively securing the Ethereum blockchain, with a staggering 32,709,951 $ETH staked– about $115 billion in normal people terms.

Of that lump sum, $47 billion is done through liquid staking, a testament to the explosion of interest and investment in Liquid Staking Derivatives (LSDs).

The spark was The Ethereum Shanghai Upgrade in April 2023, which revolutionized staking by enabling stakers, who had locked up their ether since December 2020, to withdraw both their principal and their rewards.

This newfound flexibility turned heads and opened wallets, driving a surge in LSDs. But let’s rewind.

The real game-changer was the Merge in September 2022; Ethereum shifted from its energy-hungry Proof-of-Work (PoW) model to the sleek and efficient Proof-of-Stake (PoS) system.

Validators became the gatekeepers of the Ethereum network, and are rewarded handsomely with an annual return of around 4-5% on their staked ETH. This has transformed Ethereum from a few mining whales to a bustling hub of over a million validators.

Unlike miners who need vast resources to solve complex puzzles, validators simply need to stake 32 ETH to gain the privilege of adding blocks to the blockchain; folks with less than 32 ETH could delegate their holdings to a validator and earn yield as well.

This democratization of block creation meant lower costs and higher participation.

So, each validator earns roughly 1.25 to 1.6 $ETH per year– about $4,300 to $5,600, in addition to any token appreciation, forming a relatively conservative economy around relatively passive income.

The journey from the Merge to the Shanghai Upgrade set the stage for the DeFi momentum from which Liquid Staking Derivatives emerged.

With traditional staking, you lock up your cryptocurrency to help validate transactions and maintain the network’s integrity.

With liquid staking, you’d still lock up your cryptocurrency ($ETH) and earn yield, but in return, you’d get a liquid staking token, stETH (Staked ETH), which you can use for various other DeFi purposes.

For example, you stake 10 ETH on a platform like Lido and receive 5 stETH in return. These tokens can be utilized in various DeFi activities, such as crypto swaps, providing liquidity, lending, and using them as collateral.

Typically, Ethereum staking yields about 3-5%. Depending on your specific activities, you can enhance your returns further by engaging in DeFi with your stETH (3-5% + x%). Note that, prior to the re-staking infrastructure we’ll describe below, staking your LSTs wasn’t possible.

Lido is the most successful liquid staking protocol, capturing the bulk of the Ethereum DeFi Liquid Staking Derivatives (LSD) market.

Note on TVL: TVL calculations are often contentious, involving double-counting of tokens. For example, if a user deposits ETH into Lido, it is counted in Lido’s TVL. If the resulting stETH is then deposited into EigenLayer, it is counted again in EigenLayer’s TVL, leading to inflated and potentially misleading representations of value. This double-counting results in TVL figures that are considered unreliable, distorting the DeFi landscape.

From Liquid Staking to Re-Staking

Liquid restaking, pioneered and launched by EigenLayer in June 2023, introduced the ability for liquid staking tokens (LSTs) to be further tokenized into liquid restaking tokens (LRTs).

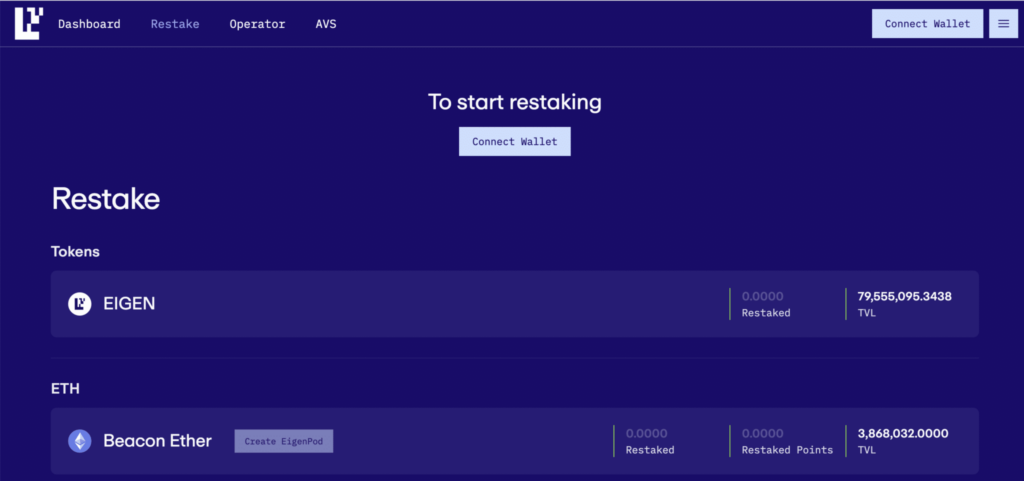

EigenLayer’s home page.

Very meta, indeed.

LRTs offer stakers new ways to maximize their assets through a broader range of activities beyond simply increasing yield. Specifically, it supports Actively Validated Services, or AVS, including layer-2 networks, data layers, dApps, cross-chain bridges, and more.

The pitch for AVSs is that by integrating with Ethereum’s consensus mechanism, AVSs no longer need to develop their own costly consensus systems.

Security + cost savings=win/win for AVSs

In this system, LSTs can be restaked (supporting the AVSs) and converted into LRTs, which can then be used to participate in various DeFi activities.

So, stakers earn rewards from the primary staking network and the additional AVS applications they support.

Re-Staking Behind the Scenes

Node operators register with EigenLayer, allowing stakers to delegate their tokens to them. Operators then validate AVS tasks and secure transactions by restaking their ETH, acting similarly to Ethereum validators.

AVSs gain network security, and restakers earn supplemental rewards.

The ability to earn staking rewards from both the native network and the new protocol, alongside additional AVS rewards, has made liquid restaking a pretty attractive option for experienced yield seekers.

EigenLayer’s first Actively Validated Service, EigenDA, launched in Q2 2024, with more services expected to follow.

DeFi Categories (Source: Defi Llama)

Re-Staking (and Liquid Staking) Risks

For starters, liquid staking introduces a few distinct risks.

Staking through a liquid staking protocol outsources the responsibility of maintaining a validator node. In proof-of-stake networks, staked assets can be slashed due to malicious or negligent behavior from validators.

Being slashed means you lose a portion of the assets you’ve staked.

While liquid staking derivatives aim to reduce these risks, they cannot completely eliminate them, leaving stakers vulnerable to potential losses if validators are penalized.

LST value is influenced by market dynamics, including supply and demand, liquidity constraints, and price volatility. Theoretically, these tokens could “depeg” significantly from the underlying staked cryptocurrencies, leading to a substantial deviation from the native token’s value.

Such a de-pegging event can trigger a cascade of liquidations, compounding the financial impact on users.

For example, if stETH is worth significantly less than ETH for some reason, people would likely sell stETH to move into the safer base layer asset (or completely exit the ETH ecosystem.)

The custodial risk associated with the potential for malicious actions by liquid staking protocols can result in the loss of staked assets.

Further, liquid staking derivatives rely heavily on smart contracts to manage staked assets and issue derivative tokens. Smart contracts can have bugs and vulnerabilities or be exploited, leading to significant financial losses for users.

Similarly, restakers place this trust in the platforms they use for staking.

While Liquid Restaking Tokens (LRTs) offer higher profit potential compared to native tokens or Liquid Staking Tokens (LSTs), they also come with a higher risk of substantial loss.

A recent incident with Renzo Protocol illustrates these risks: users holding Renzo Protocol’s liquid restaking token, ezETH, experienced significant losses when the token depegged during a controversial airdrop of the REZ native token, leading to a $60 million liquidation cascade.

As of June 2024, Renzo Protocol is still operational and has continued to grow and evolve. The protocol has been actively expanding its ecosystem and is now integrated with multiple platforms, including Morpho Blue, Balancer, Curve, and Pendle. Renzo has also been added to Binance’s Launchpool as its 53rd project, highlighting its prominence in the DeFi space.

Despite these inherent risks, the appeal of liquid staking derivatives still draws many validators, and ETH (and stETH) holders.

Further Re-staking Considerations

On one hand, “restaking” has the vibes of hypothecation, the culprit behind the demise of Luna and Celsius. This line of thought would point to this as the next black swan event in the crypto space if something goes wrong.

Users should rightfully be skeptical about any DeFi innovation if only for the sake of poking holes through weak designs that could collapse and cost people their shirts.

On the other hand, a closer examination suggests that the fear may be exaggerated, likely influenced by past traumatic events like the Luna collapse.

Eigen’s docs essentially claim that “rehypothecation” isn’t possible because the layer doesn’t have financial activities– remember, rehypothecation has to do with the domino effects of lending borrowed funds.

EigenLayer’s primary function is to pass economic security to new projects implementing proof-of-stake mechanisms rather than engaging in financial activities that could create a domino effect.

However, the biggest, often overlooked, risk is its inherent centralization.

Involving multiple off-chain networks complicates the verification of honest behavior. A significant slashing event on EigenLayer relies on manual triggers, raising concerns about the system’s transparency and reliability. While advanced cryptography might address these issues in the future, it hasn’t yet provided a solution.

For U.S. investors, there’s an added layer of risk. EigenLayer could potentially meet the criteria of the Howey Test, classifying it as a security under SEC regulations. This is particularly relevant since EigenLayer accepts deposits from non-validators for yield, similar to staking on a centralized exchange. This arrangement essentially places investors in a securities contract, relying on the entities to manage their investments correctly.

Making the process permissionless could introduce further complications. Malicious entities could potentially manipulate the system by overwhelming it with votes to cause slashing events. If collateral is required to vote, then this collateral might be classified as a

Liquid Staking TVL Rakings (Source: DefiLlama)

security, creating a complex legal and operational situation. This predicament may prevent EigenLayer from achieving full decentralization, limiting its potential growth and stability.

Overall, while restaking presents opportunities for enhanced yields and security, these potential risks and regulatory challenges should be carefully considered by investors and developers alike.

Final Thoughts: Liquid Restaking and the DeFi Evolution

Liquid staking and restaking are new, albeit experimental, fixtures of DeFi that combine enhanced yield opportunities with liquidity.

The Shanghai Upgrade and the Merge facilitated this growth and made Ethereum staking more accessible and profitable. This has drawn significant attention from crypto OGs, technologically advanced DeFi crowds, and more institutional investors’ interest.

By proxy, an ETH ETF would stimulate and accelerate innovation (and breaking points) for both liquid staking protocols like Lido and staking protocols like Eigen Layer.

Looking ahead, the success of liquid staking and restaking will hinge on addressing the risks and considerations noted above.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.

>>> Read full article>>>

Copyright for syndicated content belongs to the linked Source : CoinCentral – https://coincentral.com/liquid-restaking-tokens-liquid-staking-tokens/?utm_source=rss&utm_medium=rss&utm_campaign=liquid-restaking-tokens-liquid-staking-tokens