Advances in electric vehicles, solar and semiconductors are helping the nation navigate its property slump

Author of the article:

Bloomberg News

Bloomberg News

Published Jul 15, 2024 • 9 minute read

6ak5o0ihfwdzdn5pqrf7q2ig_media_dl_1.png Bloomberg

6ak5o0ihfwdzdn5pqrf7q2ig_media_dl_1.png Bloomberg

(Bloomberg) — China’s twin-track economy is generating doom-and-gloom headlines about domestic woes one moment and growing fears around the world about the dominance of its manufacturers the next.

Those conflicting signals on Monday showed ongoing strength in industrial production more than offset by tepid consumption as the property slump continues, leading to the slowest quarterly growth pace in five quarters. But through the fog a silver lining is becoming clear: Xi Jinping’s long quest for technology-driven “high-quality growth” is actually starting to pay off.

Advertisement 2

This advertisement has not loaded yet, but your article continues below.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

Exclusive articles from Barbara Shecter, Joe O’Connor, Gabriel Friedman, Victoria Wells and others.Daily content from Financial Times, the world’s leading global business publication.Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

Exclusive articles from Barbara Shecter, Joe O’Connor, Gabriel Friedman, Victoria Wells and others.Daily content from Financial Times, the world’s leading global business publication.Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

Access articles from across Canada with one account.Share your thoughts and join the conversation in the comments.Enjoy additional articles per month.Get email updates from your favourite authors.

Sign In or Create an Account

or

Article content

While Japan and America both suffered deep economic setbacks when their housing markets hit the skids, China’s tech advances and resulting export boom have helped to keep economic growth within reach of its targeted pace of around 5%.

And the nation’s leaders are determined to keep it that way. Xi and his top Communist cadres are gathered in Beijing this week for the Third Plenum — a once-in-five-year meeting to chart long-term economic plans.

Yet a major hurdle stands in their way. Chinese consumers haven’t yet bought into the hype, with confidence in the economy far behind pre-Covid levels — as shown by June’s weak retail sales numbers.

What’s more, the flood of cheap electric vehicles and solar panels onto global markets — a key reason the economy has been so resilient — has sparked a protectionist response from governments in the US and Europe who worry about a whole new wave of job losses at the hands of China’s industrial might.

Things could get even tougher if Donald Trump wins reelection in November — an outcome that political analysts say now looks more likely after the weekend’s near-miss assassination attempt and his bloodied, fist-pumping departure from the stage in Butler, Pennsylvania. Trump has threatened to impose 60% tariffs on Chinese goods.

Advertisement 3

This advertisement has not loaded yet, but your article continues below.

Article content

For Xi, those protectionist salvos only reinforce his resolve to build self sufficiency in strategic areas such as advanced computer chips to ensure China can’t be hobbled by any worsening in trade — or military— tensions.

If Beijing can keep batting away US-led containment efforts, exclusive analysis from Bloomberg Economics forecasts the hi-tech sector will account for 19% of gross domestic product by 2026, up from 11% in 2018. Combining what Beijing has dubbed the “new three” — EVs, batteries and solar panels — the proportion of GDP swells to 23% of GDP by 2026, more than enough to fill the void from the ailing real estate sector, which is set to shrink from 24% to 16%.

“Pessimism on China’s prospects is understandable but also overdone,” say Chang Shu and Eric Zhu, economists with Bloomberg Economics. “The government might just be about to pull off a great rebalancing.”

Xuzhou, a city of 9 million people about halfway between Beijing and Shanghai, is grappling with the transition Xi’s policies are spurring.

Until about a decade ago, Xuzhou relied on heavy industries like coal, steel and cement to drive its economy. Property also played an important role — the city like many others across China in 2015 started to tear down shantytown homes and build new apartments, fueling a five-year boom in property investment, prices and spending on furnishings and other goods.

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Advertisement 4

This advertisement has not loaded yet, but your article continues below.

Article content

Worried about rapidly rising debt levels, authorities then applied the brakes. In Xuzhou, like other so-called second-tier cities, the fallout has been severe with home prices in some areas down by more than half since 2021. With its natural resources depleted, the city has also been shutting down coal mines and steel factories, turning instead to three sectors: New energy, machinery construction and new materials.

Enter GCL Technology, the world’s second-largest maker of polysilicon — a key material to make solar panels. A technological breakthrough saw it become the world’s only commercial maker of granular silicon, a pebble-like gray mineral that requires about 80% less electricity to produce compared with larger chunks used in more established techniques developed by German companies known as the Siemens process.

That helped it reduce carbon emissions, lower costs, ramp up production and boost market share. The company says it has created over 5,000 jobs and fostered more than 450 suppliers in Xuzhou in the past five years, becoming a key driver of the local green industry.

Advertisement 5

This advertisement has not loaded yet, but your article continues below.

Article content

“We went from a following to a leading position in the industry,” said Xu Zhenyu, assistant vice president of GCL’s polysilicon business division. “Technological innovation has been critical in this process.”

It’s the sort of transformation President Xi called for back in October 2017, when he used the twice-a-decade Communist Party congress to unveil plans to shift from high-speed to “high-quality growth.”

“Since the 1960s, only a dozen of the more than 100 middle-income economies have successfully become high-income ones,” Xi said at a key economic meeting in December 2017. “Countries that succeeded all went through a shift from quantity to quality in term of economic growth after a period of fast expansion. Those that stagnated or even regressed failed to achieve that fundamental shift.”

Through boom-and-bust property cycles, on-and-off Covid lockdowns and a manufacturing surge as the world reopened, Xi’s push endured, spurring newer catchphrases like the quest to develop “new productive forces.”

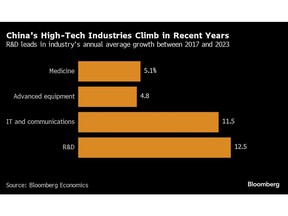

GDP related to high-tech industries — including medicine, advanced equipment, information technology and communications equipment and services, and research and development — expanded 12% on average between 2018 and 2023, significantly faster than the nominal GDP growth of 7%. Bloomberg Economics’s projections are based on the assumption that the industries can largely keep their current growth pace.

Advertisement 6

This advertisement has not loaded yet, but your article continues below.

Article content

The focus on technological advancement is set to be prioritized for at least another decade, Liu Lei, a researcher at the National Institution for Finance and Development, a state think tank advising government agencies, said ahead of the Plenum.

“China right now is going from imitating to surpassing others, and that requires the government’s help,” he said. “The help needs to last until there’s a relatively mature market environment and until China is in a leading position in critical industries.”

The flip side of the tech focus is that other industries related to the old drivers — including property — are de-prioritized.

Back in Xuzhou, the economy’s transition is proving difficult for those who aren’t employed by the new industries. Gao, a 43-year-old woman who declined to give her first name, says her furniture shop selling children’s beds has seen sales halve this year.

“Sales fell off a cliff after the Lunar New Year,” she said while folding the sheets of a display bed. “It feels like everyone is suffering, even in other industries. I’ve never been so worried.”

Advertisement 7

This advertisement has not loaded yet, but your article continues below.

Article content

Across China, weakness in the property market has undermined consumer sentiment, youth unemployment is worryingly high and raging price wars in sectors like automobiles are weighing on company revenues. Yet the government and central bank have held back from switching to stimulus mode as the overall growth rate remains underpinned by surging exports.

Economists say there’s room for more stimulus if the 5% growth target appears out of reach. But Chinese leaders remain firmly wedded to supply-side policies rather than demand-side “welfarism” — something Xi has in the past criticized as a trap that leads to “lazy people.”

That means rebalancing the economy to be more led by consumption — as prescribed by institutions like the World Bank and International Monetary Fund — is taking a back seat for now. Government advisors believe that increasing supply of higher-end products will stimulate consumers’ desire to own them, while the higher salaries paid to make those products will provide workers the means to buy them.

In Xuzhou, GCL is among firms offering those high-paying jobs, along with companies including excavator makers Xuzhou Construction Machinery Group and Caterpillar Inc. And more quality jobs are on the way: The world’s top EV maker BYD Co. is investing in two plants in the city.

Advertisement 8

This advertisement has not loaded yet, but your article continues below.

Article content

David Li Daokui, one of China’s most prominent economists and a government adviser, worries that the technology drive will see more money in the hands of companies and less in the wallets of consumers. That could worsen income inequality, as seen in many developed economies. He’s working on a proposal to the government to restrict the use of AI in certain professions to prevent the potential for massive job losses.

Technology is “literally replacing people in fields like news, accounting, legal and advertising,” Li said. “There’s a tension and dilemma there.”

While Xi’s high-tech manufacturing push is clear, it’s not the only aspect of his ambition to remodel China — a diagram from the country’s top economic planning agency explaining “high-quality growth” shows some 29 interlinked text bubbles replete with jargon.

So at the same time China Inc. is being encouraged to adopt Xi’s vision for a high-tech future, ill-designed government efforts targeted at promoting income equality have turned into crushing crackdowns on industries such as private tutoring, costing thousands of jobs and turning entrepreneurs cautious.

Advertisement 9

This advertisement has not loaded yet, but your article continues below.

Article content

The breadth and vagueness of the “high-quality growth” concept has spurred a race among local governments to determine exactly how to measure it and whether they’re hitting all the right marks. Some have identified nearly 50 metrics ranging from energy consumption per unit of GDP to the number of public toilets accessible to every 10,000 people.

Indeed, “high-quality growth” has become the central guiding principle for virtually all aspects of economic work at both the provincial and central government level. At press briefings and during high-profile events, ministers rush to explain what they’re doing to achieve it. The central bank is on board, unleashing a slew of targeted policy tools funneling funds into sectors like green energy and tech. The Ministry of Finance too — it’s spending more cash on research and development.

Xi himself uttered the phrase “high-quality growth” on at least 128 occasions in 2023, nearly double the mentions in 2022, according to a Bloomberg analysis of his public speeches. He was up to 66 mentions this year as of Monday.

For China’s leaders, it’s not just about economics. Beijing is fearful of a scenario where a conflict breaks out with the US when China remains dependent on America and its allies for critical technology.

Advertisement 10

This advertisement has not loaded yet, but your article continues below.

Article content

Chinese leaders have set an ambitious goal of becoming a “medium-developed country” by 2035 — a goal that would require it to lift per-capita GDP from the current $12,600 level to over $20,000 and maintain growth rates of around 5% a year. Policy advisers point to countries like South Korea, which managed to move up the value chain and avoid getting stuck in the middle-income trap.

To repeat Korea’s success, China needs to lift its productivity through innovation, which would lead to an increase in economic output even when the quantity of inputs like labor and capital stays the same or even contracts. That’s important because China’s aging society means the labor force has been decreasing for a decade, while the return of credit-driven investment from things like bridges and roads is in decline.

China’s total factor productivity — a measure of how efficiently resources are used to generate output — has been stuck at around 40% of that of the US since 2008, according to Wang Yiming, a long-time state adviser. Korea and Japan reached 60% and 80% of US productivity, respectively, before their economic rise relative to the US began to stall. It will be an “uphill battle” for China to push for faster productivity gains, Wang said.

Larry Hu, head of China economics at Macquarie Group Ltd., also compares Xi’s push to Korea’s transition toward tech from an earlier focus on heavy industry after the Asian Financial Crisis of the late 1990s. Only this time, China is facing a much more hostile environment.

“Key to China’s ability to attain its tech goals will be the pace of change in the technologies themselves. The faster things like AI and advanced chipmaking progress, the harder it will be for China to keep pace,” he said.

—With assistance from Davy Zhu and Gabrielle Coppola.

Article content

>>> Read full article>>>

Copyright for syndicated content belongs to the linked Source : Financial Post – https://financialpost.com/pmn/business-pmn/xi-jinpings-great-economic-rewiring-is-cushioning-chinas-slowdown