In the midst of a politically charged landscape, the latest Economist/YouGov Poll conducted between April 13-15, 2025, illuminates the intricate relationship between President Trump’s job approval ratings and key economic indicators, including the stock market, tariffs, taxes, and the federal budget. As the nation grapples with inflationary pressures and fluctuating market dynamics, the poll captures public sentiment on the administration’s economic policies and their perceived effectiveness. With a spotlight on how these issues resonate with voters, the findings not only reflect current attitudes but also set the stage for crucial discussions as the country approaches an election year. In a divided electorate, understanding the nuances of Trump’s standing amidst ongoing economic challenges is essential for both policymakers and citizens alike.

Trumps Job Approval and Public Sentiment Amid Economic Concerns

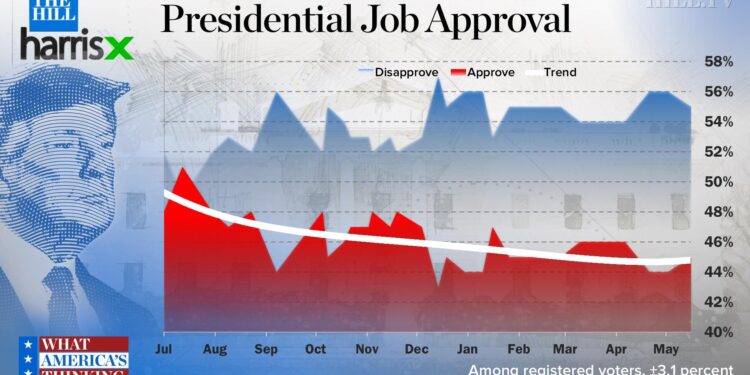

The recent Economist/YouGov poll, conducted between April 13-15, 2025, reveals a complex landscape in Trump’s job approval ratings, particularly as economic issues take center stage in public discourse. As the nation grapples with inflation, rising interest rates, and fluctuating stock markets, sentiments towards Trump’s handling of the economy remain divided. Key findings from the poll indicate that 38% of respondents approve of Trump’s economic management, while 54% express disapproval. This discord reflects growing frustrations among constituents who feel the pinch of tightening budgets and increased costs of living. Public anxiety is further exacerbated by discussions surrounding proposed tariffs and tax adjustments that many fear could worsen their financial situations.

| Key Issues | Public Sentiment (%) |

|---|---|

| Approval of Trump’s Economic Policies | 38 |

| Disapproval of Trump’s Economic Policies | 54 |

| Concern Over Inflation | 65 |

| Support for Increased Tariffs | 30 |

Public opinion reveals a mixed bag regarding Trump’s economic agenda. While some Americans express optimism about the potential benefits of proposed tax cuts aimed at stimulating growth, skepticism persists amidst fears of widening income inequality and rising living costs. The poll underscores a critical tension: as Trump continues to advocate for his fiscal policies, many voters are increasingly preoccupied with their day-to-day economic realities. the respondents indicate a distorted belief in the robustness of the economy, showcasing a tendency to hold the President accountable for broader economic failures, pointing not just to political leadership but also to global market dynamics that remain beyond his control.

Assessing the Impact of Tariffs and Taxes on Market Confidence

The recent Economist/YouGov poll highlights a significant divide in public sentiment regarding the ongoing tariffs and taxes instituted under the Trump administration. Economic analysts have observed that these policies have created both winners and losers in the marketplace, leading to a complicated relationship between government actions and consumer confidence. The imposition of tariffs on imported goods has sparked concerns about rising prices, which could deter consumer spending and, consequently, slow economic growth. Conversely, proponents argue that these measures bolster domestic industries, potentially leading to job creation in the long term.

Moreover, the impact of taxes on market confidence cannot be overlooked. A variety of stakeholders, including small business owners and large multinational corporations, have expressed mixed feelings about the current tax structure. On one hand, lower corporate tax rates have been marketed as incentives for investment. On the other hand, increasing taxes on certain sectors may lead to hesitation among investors. The poll results reflect this duality, showing that uncertainty surrounding fiscal policy may contribute to a lack of confidence in the market. Stakeholders are keenly watching for any shifts that could either bolster or diminish this fragile equilibrium, as the implications for future economic performance are significant.

| Aspect | Public Sentiment |

|---|---|

| Impact of Tariffs | Mixed – concern over prices vs. support for domestic jobs |

| Tax Structure | Divided – tax cuts vs. targeted increases |

| Market Confidence | Tentative due to policy uncertainty |

Budgetary Challenges Ahead: Recommendations for Sustainable Growth

The recent Economist/YouGov Poll indicates growing concerns over the nation’s fiscal health, as respondents cite budgetary challenges stemming from a combination of trade policies, tax reforms, and an economy teetering on the brink of uncertainty. Key recommendations to support sustainable growth include:

- Implementing strategic spending cuts in non-essential areas to focus resources on infrastructure and education, which can drive long-term economic gains.

- Rethinking tariff strategies to avoid escalation of trade wars that could undermine the competitiveness of American industries and drive up consumer prices.

- Revisiting tax reforms to ensure a more equitable system that encourages domestic investment while easing the burden on middle-class families.

In addition to these recommendations, fostering dialogue between government officials and economic experts is vital for planning a balanced budget that addresses both immediate fiscal pressures and future growth opportunities. To understand the implications more clearly, here is a concise overview of recent trends:

| Trend | Impact |

|---|---|

| Stock Market Volatility | Increased investor uncertainty, affecting consumer confidence. |

| Rising Tariffs | Potentially higher prices for imports leading to inflation. |

| Public Approval Ratings | Falling confidence in economic policy may hinder legislative support. |

In Retrospect

the findings from the April 13-15, 2025 Economist/YouGov poll illuminate the intricate web of public sentiment surrounding former President Donald Trump’s job approval and its correlation with key economic indicators. As Americans grapple with the complexities of tariffs, taxes, and budgetary concerns, the poll underscores the evolving landscape that shapes voter perceptions. The ongoing fluctuations in the stock market further complicate the narrative, reflecting both optimism and uncertainty in the economic outlook. As the political landscape continues to shift, these insights will be crucial for understanding how economic factors influence public opinion and, ultimately, electoral outcomes. As we move forward, the interplay between Trump’s policies and the American economy will remain a focal point for both analysts and voters alike.