In a recent statement that underscores his ongoing influence over economic policy, former President Donald Trump has clarified that he will not advocate for the removal of Federal Reserve Chair Jerome Powell. In an interview, Trump attributed parts of the current economic landscape to his own administration’s strategies, asserting that the positive aspects of the economy reflect his impact while simultaneously addressing concerns about inflation and monetary policy. This declaration comes as Trump continues to navigate the political arena, signaling a potential shift in his approach to economic governance as he eyes a renewed presidential bid. The interplay between Trump’s economic rhetoric and the Fed’s policies is set to shape discussions surrounding the nation’s financial stability in the months to come.

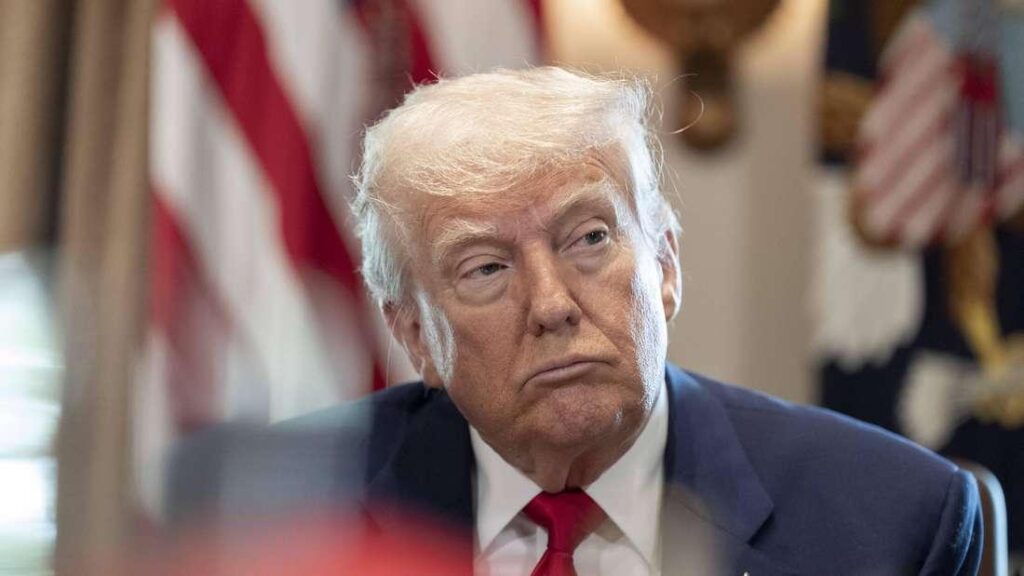

Trump Affirms Support for Fed Chair Powell Amid Economic Claims

Former President Donald Trump has publicly voiced his support for Federal Reserve Chair Jerome Powell, dismissing speculation that he would seek to remove him from office. In a recent statement, Trump acknowledged the positive impacts of Fed policies on the economy, asserting that certain aspects of the economic growth experienced during his presidency are intertwined with strategic decisions made by Powell and his team. This endorsement seems to suggest that Trump is more focused on the broader economic narrative than the individual decisions made by the Fed, underscoring his belief that the economy’s resilience reflects both his administration’s policies and the Fed’s actions.

While some critics suggest that the current economic climate reveals flaws in the Federal Reserve’s strategies, Trump pointed to several key indicators that he believes demonstrate economic success. These include:

- Low unemployment rates that continue to support consumer spending

- Robust stock market performance contributing to wealth creation

- Rising GDP growth supporting overall economic expansion

In his remarks, Trump emphasized that these achievements should not be overlooked in the broader conversation about economic policy, framing them as victories derived from both his leadership and the Fed’s management. The former president appears determined to highlight these successes as a central part of his narrative moving forward.

Analyzing the Administrations Impact on Economic Performance

The ongoing debate surrounding monetary policy and its influence on economic performance remains a focal point of the current administration’s narrative. President Trump’s recent declaration of support for Federal Reserve Chair Jerome Powell underscores a nuanced relationship between fiscal policy and economic outcomes. Trump’s assertion that several positive indicators—such as job growth and stock market performance—are a result of his administration’s policies challenges critics who attribute these successes primarily to Powell’s interest rate adjustments. Both perspectives underscore an intricate dance between the executive branch and the central bank, highlighting the complex interplay between government initiatives and economic stability.

Moreover, the contrasting viewpoints shed light on key economic indicators that demonstrate the administration’s impact. Factors such as unemployment rates, GDP growth, and consumer confidence reveal varying degrees of executive influence. The following table illustrates selected economic indicators during Trump’s presidency, capturing the essence of the rhetoric surrounding economic management:

| Indicator | 2017 | 2018 | 2019 | 2020 |

|---|---|---|---|---|

| Unemployment Rate (%) | 4.7 | 3.9 | 3.5 | 8.1 |

| GDP Growth (%) | 2.4 | 2.9 | 2.3 | -3.4 |

| Consumer Confidence Index | 122.5 | 131.4 | 126.3 | 88.6 |

This table not only highlights specific metrics but also reflects the broader narrative surrounding the administration’s economic policy. As Trump continues to assert that the successes are in part due to his leadership, it prompts questions regarding the future trajectory of these indicators, particularly as the administration moves forward in addressing economic challenges amid unprecedented times.

Expert Opinions on Future Federal Reserve Policies and Market Stability

As discussions circulate regarding the future of Federal Reserve policies, experts are weighing in on the implications of President Trump’s recent statements about Fed Chair Jerome Powell. Analysts highlight that Trump’s decision not to pursue Powell’s removal could signal a desire for continuity in monetary policy amidst ongoing economic fluctuations. This stability is seen as crucial as the Fed maneuvers through challenges such as inflation and labor market shifts. Economists speculate that a consistent leadership at the Fed may foster confidence among investors, aligning with broader efforts to maintain economic growth.

Market stability hinges on a delicate balance between interest rates and inflation control, and expert forecasts suggest that Powell’s tenure could play a pivotal role in achieving this. Observers note the following key points regarding future strategies:

- Interest Rates: Potential adjustments to interest rates will likely be incremental to avoid shocking the market.

- Inflation Targets: Adherence to inflation targets remains crucial for sustaining consumer confidence and spending.

- Unemployment Rates: Strategies to combat unemployment will be a primary focus, especially in light of the evolving job market.

In light of these factors, a recent survey among financial experts offers insights into anticipated economic conditions:

| Indicator | Current Status | 2024 Projection |

|---|---|---|

| Inflation Rate | 3.2% | 2.5% |

| Interest Rates | 5.0% | 4.5% |

| Unemployment Rate | 4.0% | 3.8% |

In Retrospect

President Trump’s recent remarks underscore his complex relationship with the Federal Reserve and its leadership, particularly Chair Jerome Powell. By asserting that he will not seek Powell’s removal, Trump appears to acknowledge the complexities of economic stewardship amid ongoing financial challenges. Furthermore, his claim that significant achievements in the economy can be attributed to his administration reflects his continued efforts to shape public perception ahead of the upcoming election. As the administration navigates these crucial economic conversations, the implications of Trump’s statements on both monetary policy and market confidence will be closely watched by analysts and voters alike. As always, the intersection of politics and economics remains a pivotal narrative as the nation approaches a decisive electoral season.