Understanding the Recent Economic Contraction in the U.S.: A 0.3% Decline in Q1

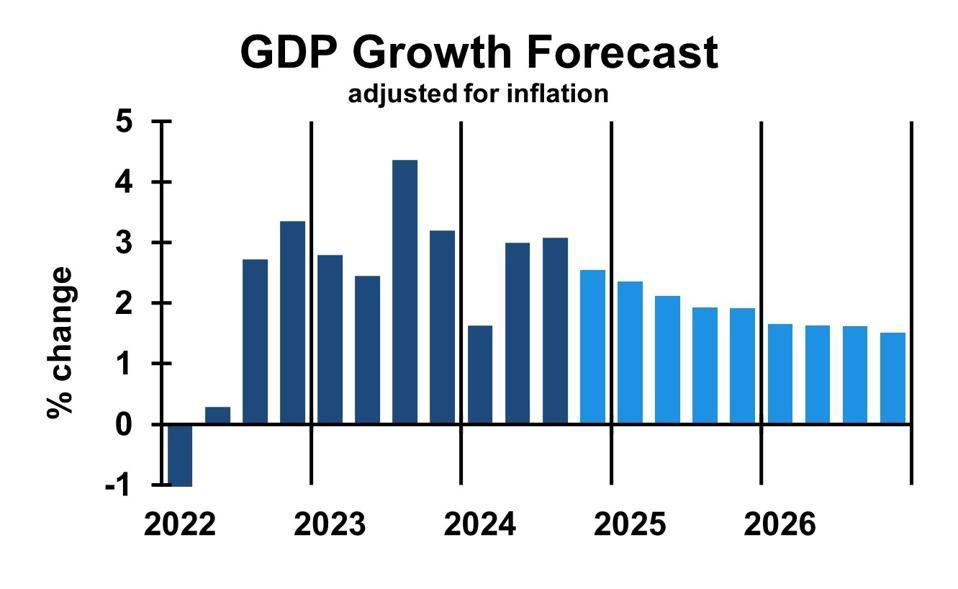

The latest economic data from the United States indicates a concerning contraction of 0.3% during the first quarter of this year, prompting alarm among economists and government officials. This unexpected downturn deviates sharply from previous growth patterns and is primarily linked to ongoing tariff impacts that have affected multiple industries. As companies face heightened expenses and consumers encounter escalating prices, experts caution that the economic environment may be shifting, raising essential questions about the durability of current recovery trends. This article examines the underlying causes of this economic slowdown and its potential future ramifications.

Examining Factors Behind the 0.3% Economic Contraction

The recent decline in U.S. economic performance by 0.3% has triggered significant concern among financial analysts and policymakers alike. Several factors have contributed to this downturn, with tariffs imposed during trade conflicts being a major culprit. These tariffs have not only driven up consumer prices but also disrupted supply chains, compelling businesses to scale back on investments and expenditures.

A notable factor exacerbating this situation is diminished consumer confidence, which has been further impacted by rising inflation rates alongside persistent job security concerns.

The role of monetary policy set by the Federal Reserve cannot be overlooked either; as interest rates rise to combat inflationary pressures, borrowing costs increase significantly—this discourages both consumer spending and business investment activities. The tightening monetary policy has led to a marked decrease in manufacturing output, as firms adapt to an increasingly challenging financial landscape.

Additionally, external influences such as geopolitical tensions and interruptions in global trade are complicating recovery efforts further, casting doubt over positive economic forecasts for the remainder of 2023.

Effects of Increasing Tariffs on Consumer Expenditure and Business Investment Trends

The rise in tariffs has resulted in a discernible drop in consumer expenditure across various sectors within the economy. As import prices surge due to these additional tariffs, consumers are feeling financial strain which leads them towards more cautious spending behaviors—particularly affecting discretionary purchases where individuals now prioritize essentials over luxury items.

A recent survey revealed that approximately 58% of consumers are reevaluating their spending habits due to inflated prices; many are postponing significant purchases like vehicles or home appliances as they adjust their budgets accordingly.

Consequently, industries dependent on consumer goods brace for potential declines since these tariff-induced changes suppress demand while forcing businesses into reassessing inventory levels along with pricing strategies.

On a corporate level:

- Reduced Expansion Initiatives: Companies are delaying new projects or expansions due to unpredictable costs associated with imported materials.

- Stagnation in Job Growth: Many sectors report hiring freezes as organizations navigate increased operational expenses.

- Shift Towards Local Production:

A recent study indicated that around65% This growing anxiety regarding these economic pressures continues shaping conditions for both consumers and businesses alike while adaptation becomes crucial amidst increasing volatility.

Strategic Actions To Address Economic Slowdown And Encourage Recovery

Tackling current economic challenges requires policymakers’ focus on implementing effective fiscal measures alongside monetary interventions aimed at fostering recovery pathways.

The following strategies should be prioritized:

- Targeted Financial Assistance Programs:

- Infrastructure Investments:

- Support Mechanisms For Small Enterprises:

Moreover fostering international trade relations remains vital while carefully assessing tariff implications moving forward:

| Action | Potential Benefits |

|---|---|

| Reevaluate Tariff Structures | Encouraging competitive markets leading towards lower pricing models for consumers . |