The American Gaming Association (AGA) outlined slowed but “more sustainable” growth in the US gambling industry for Q1.

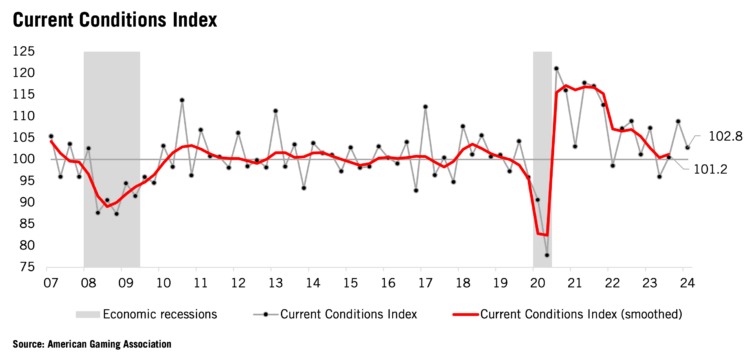

The AGA Gaming Industry Outlook stated the Current Conditions Index for Q1 2024 was 102.8. The AGA stated this was consistent with real annualised growth of 2.8%. The Current Conditions Index analysed economic activity in the US casino gaming industry, such as gaming revenue and employee wages.

The AGA’s Future Conditions Index also measured 102.2 in Q1, with economic activity in US gaming predicted to increase by an annualised rate of 2.2% over the next six months. The Future Conditions Index measures the expected direction of conditions of the US casino gaming industry, analysing the economic environment, consumer intentions and the aggregate sentiment of the AGA’s gaming executive panel, which includes senior-level AGA members chosen to represent the industry.

The AGA received 32 survey responses from executives at US gaming companies for its Gaming Industry Outlook. The executives’ general views on existing conditions were moderated, although the future outlook was a marginal improvement. The Future Conditions Index also accounted for a more resilient economy than first expected, although that is expected to slow over the rest of 2024.

Growth slower compared to previous years

The AGA’s Current Conditions Index found that real economic activity was slower in 2023 than in 2021 and 2022.

However, the index remained positive at 102.8, indicating “solid industry growth” despite high inflation that somewhat tempered its findings. This follows a reading of 108.8 in Q4 2023, which is consistent with an 8.8% rate of annualised growth.

Gaming CEOs’ growth expectations were around the same as six months ago. Positive responses outweighed negative responses by 6.3%, down from 6.4% in Q3 2023.

The next three to six months are predicted to be an improvement according to 32% of executives. Meanwhile, 58% expect gaming activity to remain around the same. The finding of nine in 10 expecting the sector to improve or stay the same is also up from the eight in 10 reported in autumn. In total, 44% characterised the ongoing situation to be good, while 50% stated it was satisfactory.

Additionally, 42% of executives were more positive that overall balance sheet health will improve. However, 13% expected revenue growth to stagnate, while 22% predicted new hiring will slow.

AGA expects growth to slow further with “restrictive” financial conditions

As per current expectations of the US economy growth slowing over 2024, the AGA also predicts that higher interest rates will continue to hold back the gaming industry.

However, the AGA expects the strong labour market to boost disposable income. Therefore, the AGA predicts a more positive outlook than reported six months ago.

On outlook, 19% of executives characterised access to credit as tight, down from 26% in the previous CEO survey. Just over a quarter – 28% – also reported concerns over interest rates limiting operations as a limiting factor, while 34% pointed to geo-political risks. Additionally, 34% pointed to uncertainty over the economic environment as a limiting factor.

In concluding, the AGA stated its Future Conditions Index reading of 102.2, when allowing for underlying inflation, reflects increasing economic activity in the gaming sector.

>>> Read full article>>>

Copyright for syndicated content belongs to the linked Source : IGamingBusiness – https://igamingbusiness.com/gaming/aga-survey-highlights-slowed-sustainable-q1-growth-us/