Projection of royalty collection changes following Spotify’s 1,000-stream minimum payment transition (Digital Music News)

In our recent DMN Pro Weekly report, guest author Jeff Price — founder and former CEO of TuneCore and Audiam and current founder and CEO of Word Collections — takes an in-depth look at Spotify’s updated royalty payout structure and the financial impact it could have on labels, artists, and DIY distributors like CD Baby, Distrokid, and Tunecore in 2024. It’s an eye-opening calculation, to say the least.

For a comprehensive breakdown of what Spotify’s new payout model means for major and indie labels, music distributors, artists, and the broader music industry, check out our recent DMN Pro Weekly report. The exhaustive breakdown explores the ins and outs of the streaming platform’s 2024 compensation changes. That includes a detailed look at the legal and contractual frameworks involved, which parties will benefit the most, and the potential long-term impact on the music ecosystem.

Throughout 2023 – including well before the late-November arrival of an official announcement – Spotify’s retooled payment model spurred no shortage of discussion. While the chatter was certainly noisy, a detailed and numbers-driven focus on the shift’s likely impact on labels, DIY distributors, and artists was largely absent.

In one of our latest DMN Pro Weekly Reports, guest author Jeff Price covered the subject at length, giving the industry its first complete view of the complex matter. The analysis includes detailed projections of who stands to win and who stands to lose in revenue terms.

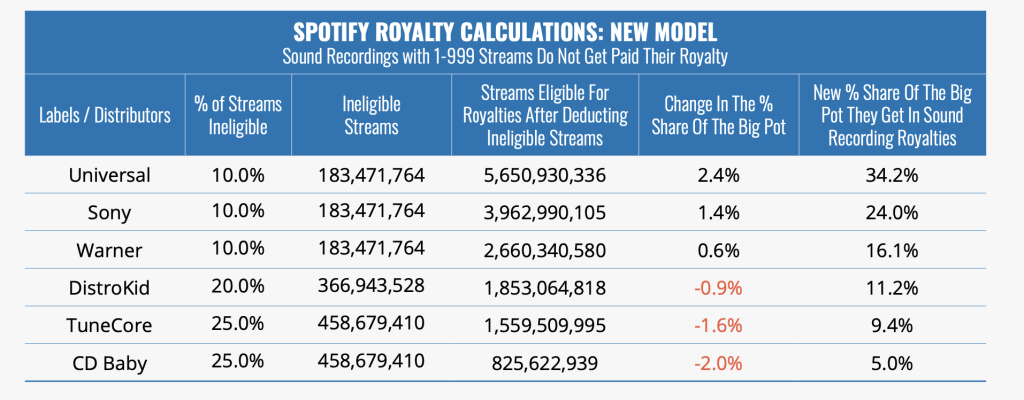

Expectedly, the data shows that Spotify’s new system will leave DIY distributors with far more “ineligible streams” than majors Universal Music Group, Warner Music Group, and Sony Music Entertainment. The reason is simple: developing and emerging artists are streamed less than major label acts, with many non-major artists struggling to break Spotify’s 1,000-stream annual threshold.

Specifically, the entities that work for the DIY, developing, and independent artists (i.e., Distrokid, Tunecore, CD Baby, Ditto, and many others) represent a higher percentage of the sound recordings that are streamed less than 1,000 times over the prior twelve months. That is Spotify’s new ‘bright line’ for royalty payments: stream more than 1,000 in one year, and you get paid. Stream less than 1,000, and you get nothing.

A top-level transfer quickly emerges. Quite simply, royalties previously earned from the streams of sub-1,000 recordings will be taken from smaller artists and shifted to the artists and labels that break the 1,000-stream threshold. More prominent artists are often signed to major labels, which gives bigger labels an expected revenue bump.

But how much of a bump? One projection suggests that one-fifth of Distrokid’s total streams will not get paid royalties under the new plan. CD Baby and Distrokid, the second and third largest distributors of DIY and indie artists, are projected to grapple with an even higher ineligibility rate as 25 percent or more of their total streams become ineligible for payment.

Over time, the amount of money being taken from developing artists and handed to major music companies could be significant.

To illustrate, in December of 2022, Tunecore announced that it had collected and paid over $3 billion to its artists. Under the new Spotify model, assuming that 20% of Tunecore’s royalties were earned by recordings streamed less than 1,000 times on Spotify, as much as $600 million dollars would disappear from the pockets of Tunecore artists.

There are certainly other streaming platforms, and this assumes a simplified model involving Spotify only. It’s also important to note that Spotify’s changes only affect recordings, not publishing, and Tunecore’s figure is cumulative over many years. However, the rough math demonstrates that the changes could significantly erode developing artists’ royalties and market share.

But what will actually happen in 2024 and beyond, thanks to Spotify’s changes? Though the broader analysis dives into various adjacent figures that provide insight, the brass-tacks takeaway is that the three mentioned distributors are projected to receive a cumulative 4.5 percent less than they earned in 2023.

The inverse of this is the major labels, chief among them the main advocate of streaming-compensation changes, Universal Music Group (UMG). UMG and the majors are positioned to grow their revenue share by roughly the same percentage by taking the money that used to go to the DIY artists affiliated with Distrokid, Tunecore, and CD Baby.

As laid out in the report, UMG is poised to enjoy a 2.4 percent revenue-share increase each month, against 1.4 percent for Sony Music Entertainment (SME) and 0.6 percent for Warner Music Group (WMG). That amounts to a shift of approximately $4 million per month, as detailed in the report’s analysis.

At close to $50 million annually, this revenue transfer could prove significant out of the gate, with the potential for a substantial change in the streaming landscape.

From the major label perspective, one question is whether Spotify’s new policy and recent price raises will offset any decline in revenue caused by a slowdown in Spotify subscription growth — depending on what slowdown (if any) materializes in 2024 and beyond.

In that light, the majors may have also cleverly offset pressures from a streaming subscriber plateau or decline ahead. Other headwinds, including inflation and potentially softening consumer demand, might be mitigated by Spotify’s royalty changes and recent price increases.

With UMG and others driving similarly advantageous pivots on different platforms, the numbers indicate that 2024 could represent the beginning of a broader revenue transfer away from developing artists, smaller labels, and DIY distributors. In effect, under Spotify’s new royalty structure, the market share and revenue gains of the DIY sector are now facing significant erosion, with the majors slowing down any market share losses ahead.

>>> Read full article>>>

Copyright for syndicated content belongs to the linked Source : DigitalMusicNews – https://www.digitalmusicnews.com/2024/01/06/spotify-royalty-model-ramifications/