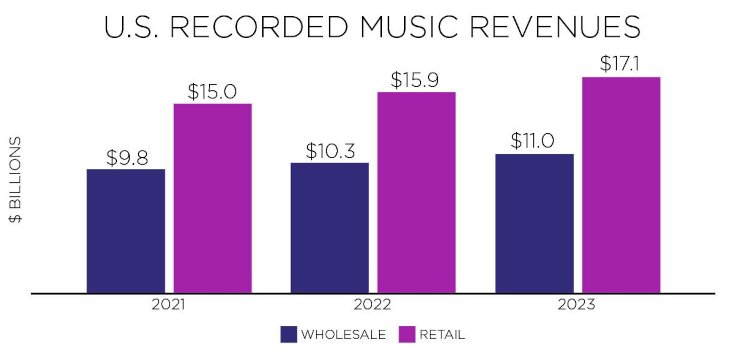

A breakdown of U.S. recorded music industry revenue by year, 2021-23. Photo Credit: RIAA

Late last month, the RIAA pointed to $17.1 billion in U.S. recorded music revenue for 2023, with the total representing “the highest topline number the annual report has reported.” But how does the figure stack up against prior years’ revenue when adjusted for inflation?

In the same annual report, the Recording Industry Association of America (RIAA) disclosed ongoing vinyl growth (to the tune of 17 consecutive years) and made clear the continued contributions of streaming, which accounted for 84 percent of U.S. recorded revenue on the year.

Furthermore, the trade organization noted that the $17.1 billion sum – up from $15.9 billion in 2022, with both based on estimated retail value – had also ushered in the eighth consecutive year of domestic growth.

Nevertheless, industry revenue, despite streaming expansions and vinyl’s evidently controversial resurgence, remains well beneath its historical high. Running with that point, the RIAA’s database of inflation-adjusted recording revenue, now updated to reflect 2023’s commercial performance, paints an interesting picture of precisely where the stateside industry stands at present.

U.S. Recorded Music Industry Annual Revenue, Selected Years Between 1988 and 2023

1988 – $16.1 billion

1993 – $21.2 billion

1998 – $25.6 billion

2003 – $19.6 billion

2008 – $12.4 billion

2013 – $9.2 billion

2018 – $11.8 billion

2023 – $17.1 billion

All sums are adjusted for inflation in 2023 dollars and reflect the RIAA’s estimated retail value calculations. Source: RIAA

Perhaps more interesting than the sizable revenue gap between the 2023 total and those attributable to the 1990s is how particular formats and segments are faring. Needless to say, streaming was a non-factor throughout the 80s and 90s, when CDs accounted for the lion’s share of revenue. That dominance continued well into the 2000s, but CDs made up just 3.1 percent of U.S. recorded revenue during 2023, per the RIAA.

U.S. recorded music industry revenue from CDs, 1990-2023. Percentages show the format’s share of total domestic revenue in the relevant year. The inflation-adjusted sums derived from the RIAA’s sales database and represent estimated retail value. Photo Credit: Digital Music News

Of course, these figures pertain solely to the U.S. recorded market, and similarly noteworthy insight is presumably available from inflation-adjusted analyses of different music spheres.

On this front, we’ve also covered 2023 data behind the global market as well as Australia (which turned in double-digit growth), Italy (revenue spiked 18.8 percent from 2022), the U.K. (where vinyl growth neared 19 percent), Germany (a 12 percent streaming-volume hike as cumulative on-demand streams surpassed one trillion), and France (revenue was up 6.2 percent, for seven consecutive years of growth), to name a few.

>>> Read full article>>>

Copyright for syndicated content belongs to the linked Source : DigitalMusicNews – https://www.digitalmusicnews.com/2024/04/03/recorded-music-industry-revenue-inflation-adjustment-2023/