As we step into August 2025, global economies are navigating a complex landscape marked by shifting trade dynamics, inflationary pressures, and evolving monetary policies. This month’s economic outlook from Seeking Alpha offers a comprehensive analysis of the key factors shaping growth prospects across major markets, highlighting emerging trends and potential risks. Investors and policymakers alike are closely monitoring indicators that could influence the trajectory of recovery and stability in the months ahead.

Global Growth Forecasts and Emerging Market Trends

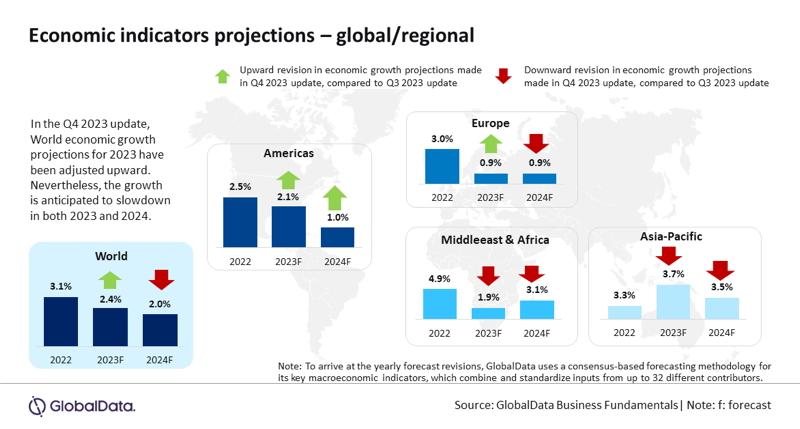

Despite ongoing geopolitical tensions and supply chain disruptions, global growth is expected to maintain a steady but modest pace throughout 2025, driven largely by resilient consumer demand and expansive fiscal policies in key economies. Advanced economies, particularly the U.S. and parts of Europe, are projected to grow at approximately 2.1% and 1.8% respectively, while Asian powerhouses like China and India continue to outperform the global average, buoyed by structural reforms and technological innovation.

Emerging markets are capturing renewed investor interest due to several transformative trends shaping their trajectories:

- Digitalization acceleration enhancing financial inclusion and e-commerce adoption.

- Green energy investments driving sustainable growth in renewable-rich regions.

- Urbanization waves fueling infrastructure demand across Latin America and Africa.

- Improved governance reforms that stabilize market conditions and boost investor confidence.

| Region | 2025 GDP Growth Estimate | Key Emerging Sector | ||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Southeast Asia | 4.5% | Digital Payments | ||||||||||||||||||||||||||||||||||

| Sub-Saharan Africa | 3.8% | Renewable Energy | ||||||||||||||||||||||||||||||||||

| Latin America |

Global Economic Growth Outlook for 2025:

Emerging Market Trends:

2025 GDP Growth Estimates and Key Emerging Sectors by Region: | Region | 2025 GDP Growth Estimate | Key Emerging Sector | If you provide the rest of the table or want me to generate the missing data based on typical estimates, please let me know! Inflation Pressures and Central Bank StrategiesGlobal inflation rates have remained stubbornly above target, driven by persistent supply chain disruptions, robust consumer demand, and escalating energy costs. Central banks worldwide are responding with a mix of aggressive interest rate hikes and strategic forward guidance to temper price rises without derailing growth. While the Federal Reserve and European Central Bank have prioritized a cautious pace, emerging market authorities face the added challenge of balancing inflation control with currency stabilization and capital flow volatility. Key strategies currently in play include:

Investment Opportunities Amid Geopolitical UncertaintyIn the midst of rising geopolitical tensions, investors are seeking safer havens while also exploring growth sectors fueled by global challenges. Traditional assets such as gold and government bonds continue to garner attention for their defensive qualities, offering protection against market volatility. Simultaneously, sectors like renewable energy, cybersecurity, and infrastructure development are emerging as strategic areas with long-term upside due to shifting political priorities and increased government spending worldwide. Key sectors showing resilience include:

To ConcludeAs the global economy navigates the complexities of mid-2025, uncertainties remain amid shifting geopolitical dynamics, fluctuating commodity prices, and evolving monetary policies. Investors and policymakers alike will need to stay vigilant as new data unfolds in the coming months, shaping the trajectory of growth and inflation. Staying informed on these developments will be crucial for making strategic decisions in an increasingly interconnected market environment. |