Australian Dollar rises on stronger Chinese Yuan and higher ASX 200 on Monday.

Australia’s government has committed to backing a minimum wage increase aligned with inflation in 2024.

CNY experienced a significant upward movement due to FX intervention, with Chinese major state banks observed selling USD/CNY.

Fed Atlanta President Raphael Bostic revised his earlier forecast of two interest rate cuts this year, now expecting only one.

The Australian Dollar (AUD) starts the week by recovering its recent losses registered in the previous session. The AUD/USD pair trades higher on Monday despite a slight decrease in the US Dollar (USD) amid higher US Treasury yields. Investors are expected to closely monitor the Australian monthly Consumer Price Index (CPI) data for February and the US Gross Domestic Product (GDP) for the fourth quarter of 2023.

The Australian Dollar receives upward momentum as the ASX 200 Index extends its winning streak, led by gains in the mining and energy sectors. Additionally, the Aussie Dollar is bolstered by a stronger Chinese Yuan (CNY), with the People’s Bank of China (PBoC) setting the mid-rate for the onshore yuan significantly higher than expected.

The US Dollar Index (DXY) undergoes a correction after hitting a five-week high of 104.49 in the previous session. The US Dollar (USD) might face downward pressure as ongoing United States (US) data shapes expectations for the start of the Federal Reserve (Fed) easing cycle, anticipated to commence in June. The Federal Reserve (Fed) has downplayed higher inflation readings, with Chairman Jerome Powell reassuring markets that the central bank will not hastily react to two consecutive months of increased inflation figures.

Daily Digest Market Movers: Australian Dollar appreciates on stronger CNY, ASX 200

Australian Employment Change for February surged to 116.5K, surpassing expectations of 40.0K and the previous figure of 15.3K.

Australia’s Unemployment Rate came in at 3.7%, lower than the anticipated 4.0% and the previous 4.1%.

Australia’s government has pledged to support a minimum wage increase aligned with inflation this year, recognizing the ongoing challenges faced by low-income families amid rising living costs.

China’s Premier Li Qiang stated on Sunday that the nation’s low inflation rate and low central government debt ratio provide significant leeway for macroeconomic policy adjustments.

Federal Reserve Bank of Atlanta President Raphael Bostic revised his earlier forecast of two interest rate cuts this year, now expecting only one, citing persistent inflation and stronger-than-expected economic data.

During the press conference, Fed Chair Jerome Powell stated that an unexpected rise in unemployment could lead the Federal Reserve to consider lowering interest rates.

S&P Global Services PMI showed a slight decrease in March, dropping to 51.7 from 52.3. The expected reading was 52.0. Manufacturing PMI rose to 52.5 against the expected 51.7 and 52.2 prior. Composite PMI showed a slight dip to 52.2 from 52.5 prior.

Initial Jobless Claims for the week ending on March 15 came in at 210K, below the 215K expected and 212K prior.

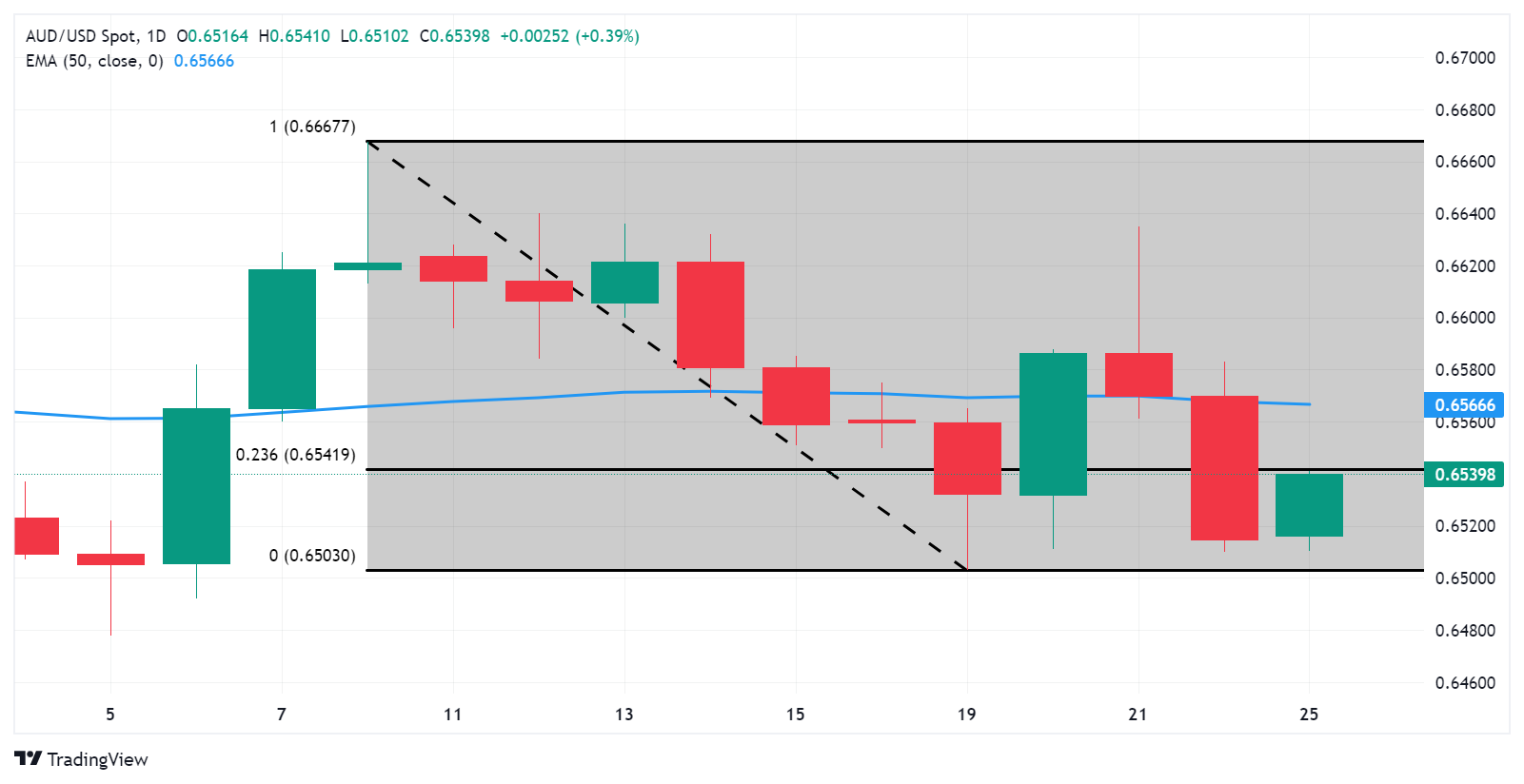

Technical Analysis: Australian Dollar hovers below 0.6540 followed by the 23.6% Fibonacci

The Australian Dollar trades near 0.6540 on Monday. The immediate resistance appears at the 23.6% Fibonacci retracement level of 0.6541, followed by the major barrier of 0.6550 level. A breakthrough above the latter could lead the AUD/USD pair to navigate the area around the 50-day Exponential Moving Average (EMA) at 0.6566, following the psychological barrier of 0.6600. On the downside, the key support appears at the psychological level of 0.6500. followed by March’s low at 0.6477.

AUD/USD: Daily Chart

Australian Dollar price today

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the US Dollar.

USD

EUR

GBP

CAD

AUD

JPY

NZD

CHF

USD

-0.09%

-0.11%

-0.08%

-0.16%

-0.02%

-0.12%

-0.02%

EUR

0.10%

-0.02%

0.01%

-0.05%

0.08%

0.03%

0.06%

GBP

0.10%

0.02%

0.03%

-0.02%

0.08%

0.04%

0.08%

CAD

0.07%

-0.01%

-0.03%

-0.07%

0.05%

0.00%

0.05%

AUD

0.16%

0.06%

0.04%

0.07%

0.10%

0.03%

0.12%

JPY

0.02%

-0.06%

0.02%

-0.03%

-0.11%

-0.07%

0.01%

NZD

0.07%

0.02%

0.01%

0.03%

-0.05%

0.08%

0.10%

CHF

0.04%

-0.06%

-0.07%

-0.03%

-0.12%

0.02%

-0.05%

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Inflation FAQs

Inflation measures the rise in the price of a representative basket of goods and services. Headline inflation is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core inflation excludes more volatile elements such as food and fuel which can fluctuate because of geopolitical and seasonal factors. Core inflation is the figure economists focus on and is the level targeted by central banks, which are mandated to keep inflation at a manageable level, usually around 2%.

The Consumer Price Index (CPI) measures the change in prices of a basket of goods and services over some time. It is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core CPI is the figure targeted by central banks as it excludes volatile food and fuel inputs. When Core CPI rises above 2% it usually results in higher interest rates and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually results in a stronger currency. The opposite is true when inflation falls.

Although it may seem counter-intuitive, high inflation in a country pushes up the value of its currency and vice versa for lower inflation. This is because the central bank will normally raise interest rates to combat the higher inflation, which attracts more global capital inflows from investors looking for a lucrative place to park their money.

Formerly, Gold was the asset investors turned to in times of high inflation because it preserved its value, and whilst investors will often still buy Gold for its safe-haven properties in times of extreme market turmoil, this is not the case most of the time. This is because when inflation is high, central banks will put up interest rates to combat it. Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold vis-a-vis an interest-bearing asset or placing the money in a cash deposit account. On the flipside, lower inflation tends to be positive for Gold as it brings interest rates down, making the bright metal a more viable investment alternative.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

>>> Read full article>>>

Copyright for syndicated content belongs to the linked Source : FXStreet – https://www.fxstreet.com/news/australian-dollar-recovers-recent-losses-amid-stronger-cny-weaker-us-dollar-202403250241