Whales were selling Bitcoin throughout the last week.

Most market indicators suggested that investors might witness a few slow-moving days.

After a tough week, Bitcoin [BTC] started to stabilize as its value stayed above a crucial support level. This latest development could result in a price uptick in the coming days, allowing BTC to reclaim $64k.

Is Bitcoin back on track?

According to CoinMarketCap, BTC’s price has dropped by more than 3% in the last seven days. However, the last 24 hours were better, as the coin’s price moved up marginally.

At the time of writing, BTC was trading at $61,011.10 with a market capitalization of over $1.2 trillion. BTC’s fear and greed index continued to remain in the “greed” zone, as at press time it had a value of 56.

Source: Alternative.me

Crypto Tony, a popular crypto analyst, recently posted a tweet revealing BTC’s price was near its support at $60k. The tweet also mentioned that there were chances of BTC reclaiming $64k.

Considering the last 24 hours’ performance, the target of $64k in the near term seemed achievable.

Therefore, AMBCrypto analyzed BTC’s metrics to find whether they support the possibility of a price uptick. AMBCrypto’s analysis of CryptoQuant’s data revealed that selling pressure on BTC was high.

The coin’s net deposit on exchanges was high compared to the last seven-day average.

Additionally, both its Coinbase Premium and Korea Premium were red, meaning that selling sentiment was dominant among US and Korean investors.

Source: CryptoQuant

Apart from retail investors, whales were also on a selling spree.

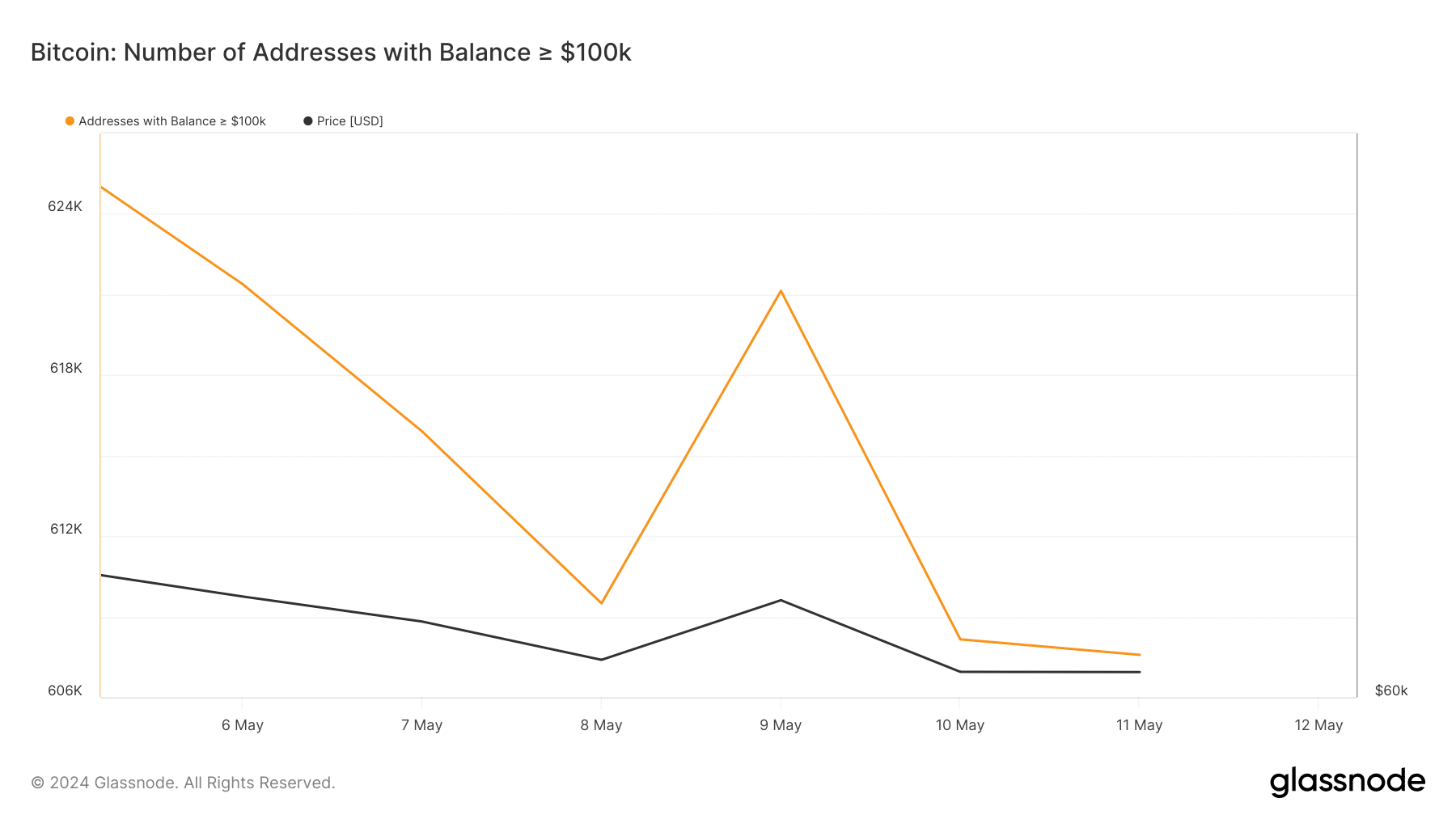

AMBCrypto’s look at Glassnode’s data pointed out that BTC’s number of addresses with balances greater than $100k has dropped sharply over the last seven days.

This clearly indicated that the top players in the crypto market were selling BTC, which could make it problematic for the coin to touch $64k in the short term.

Source: Glassnode

Which way is Bitcoin headed?

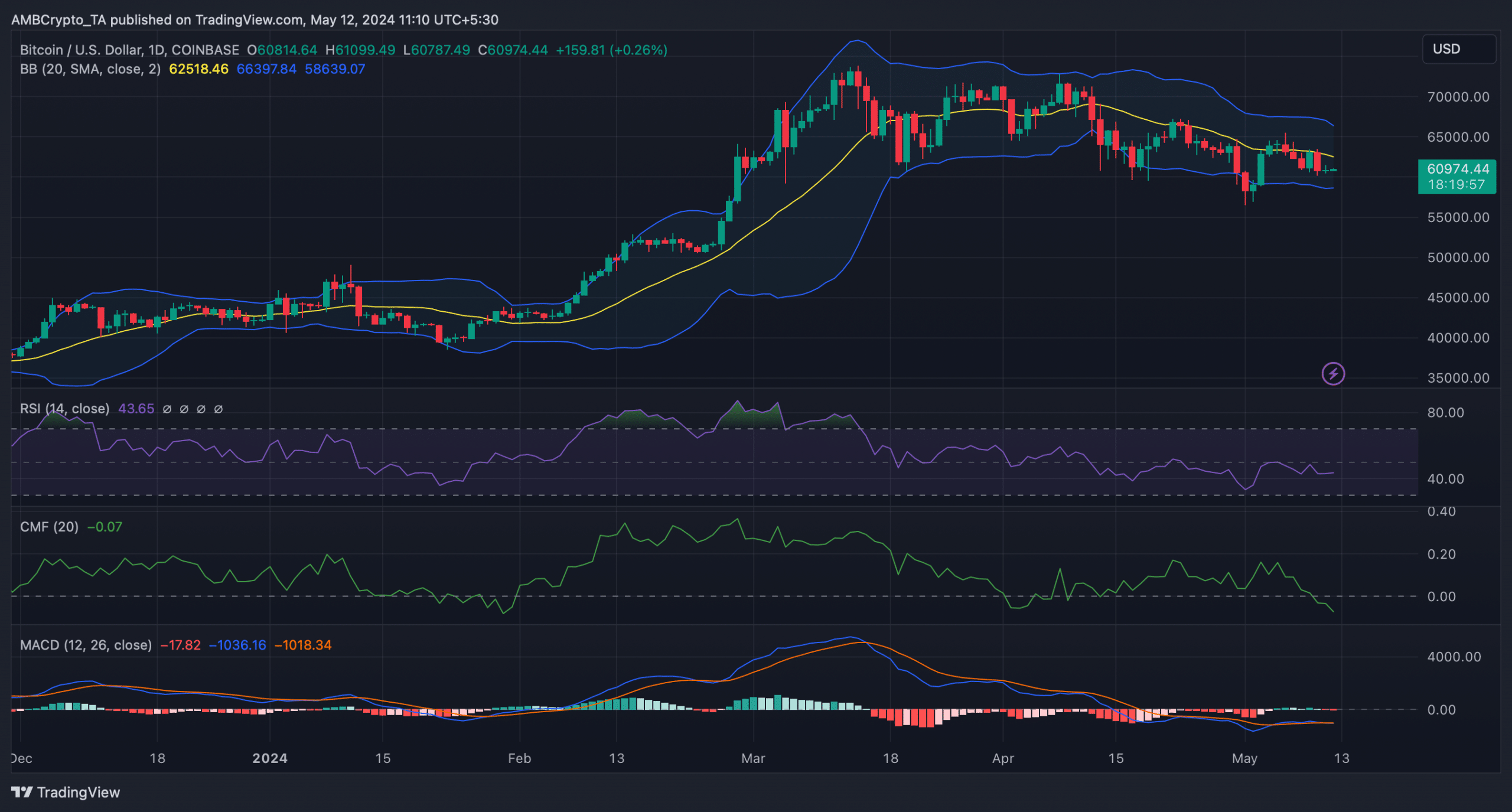

To see whether the recent sell-offs will have an immediate impact on BTC’s price action, AMBCrypto then analyzed its daily chart.

As per our analysis, BTC might take some more time to turn volatile in the northward direction. The coin’s Chaikin Money Flow (CMF) registered a sharp downtick.

Its Relative Strength Index (RSI) also moved sideways under the neutral mark.

Read Bitcoin’s [BTC] Price Prediction 2024-25

The MACD displayed that the bulls and bears were competing against each other to gain an advantage in the market. All these indicators hinted at slow-moving days ahead.

In order for BTC to turn volatile, it must first go above its 20-day Simple Moving Average (SMA), as at press time, BTC’s price was resting under that level.

Source: TradingView

>>> Read full article>>>

Copyright for syndicated content belongs to the linked Source : AMBCrypto – https://ambcrypto.com/bitcoin-analyzing-the-odds-of-btc-reaching-64k-in-may/