Employers across the nation are bracing for the steepest rise in health benefit costs in 15 years, according to the latest report from Mercer. As healthcare expenses continue to surge, businesses face mounting pressure to balance employee coverage with financial sustainability. This significant increase signals potential challenges ahead for companies striving to provide competitive benefits amid escalating medical inflation and evolving industry dynamics.

Employers Face Steep Rise in Health Benefit Expenses Driven by Inflation and Utilization

Employers across industries are bracing for a significant surge in health benefit expenses, fueled by relentless inflation and increased utilization of services. Recent studies highlight that rising costs are not solely due to inflationary pressures on medical supplies and pharmaceuticals but are also driven by a pent-up demand for elective procedures, behavioral health services, and chronic condition management. These factors, combined with lingering impacts from the pandemic, are creating a perfect storm that is straining company budgets and challenging benefit strategies nationwide.

Key contributors to escalating health benefit costs include:

- Surge in outpatient and specialty care visits

- Higher prescription drug prices

- Increased mental health and wellness service utilization

- Greater complexity in chronic disease treatments

| Expense Driver | Estimated Annual Impact | Projected Increase 2024 |

|---|---|---|

| Prescription Drugs | $850M | 8% |

| Outpatient Care | $1.2B | 12% |

| Mental Health Services | $600M | 15% |

| Chronic Disease Management | $900M | 10% |

Strategies to Offset Costs Include Expanding Wellness Programs and Revising Plan Designs

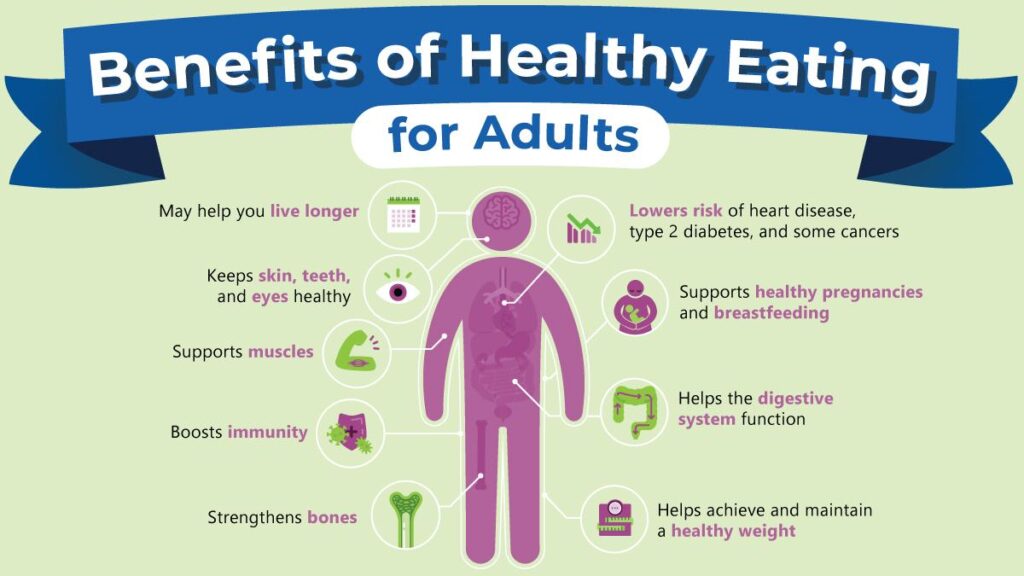

In response to the anticipated surge in health benefit expenses, many employers are turning to wellness programs as a proactive measure to manage costs sustainably. By promoting healthier lifestyles through initiatives like fitness challenges, mental health support, and nutrition counseling, organizations aim to reduce overall claims and absenteeism. Such programs not only foster employee engagement but also demonstrate a long-term investment in workforce well-being, ultimately softening the impact of rising premiums.

Alongside wellness initiatives, companies are actively revising plan designs to balance affordability with comprehensive coverage. Common adjustments include:

- Increasing deductibles and copayments to share costs with employees

- Incorporating value-based insurance designs to incentivize high-quality care

- Expanding telehealth options to reduce usage of costly emergency services

- Introducing tiered formularies for prescription drug coverage

These strategies contribute to a more sustainable health plan structure, enabling employers to control expenses without compromising access to essential medical services.

| Strategy | Expected Cost Impact | Employee Benefit |

|---|---|---|

| Wellness Programs | Moderate Savings | Improved Health & Engagement |

| Higher Deductibles | Immediate Cost Reduction | Potential Out-of-Pocket Increase |

| Telehealth Expansion | Lower ER Visits | Convenient Access to Care |

| Value-Based Design | Long-Term Cost Efficiency | Encourages Quality Care |

Expert Insights Recommend Enhancing Employee Engagement to Mitigate Impact of Benefit Increases

Industry leaders are emphasizing the critical role of employee engagement in managing the financial strain brought on by soaring health benefit costs. Experts advise that companies should pivot towards transparent communication and active involvement strategies to maintain workforce morale amid the rising expenses. Key recommendations include:

- Conducting regular surveys to gauge employee concerns and preferences

- Offering flexible benefit options tailored to diverse workforce needs

- Implementing wellness programs that encourage preventive care

- Enhancing education on cost-sharing and benefit utilization

Recent data suggests that engaged employees are more likely to adopt cost-conscious behaviors, directly mitigating excess healthcare spending. Companies investing in engagement see measurable benefits in both retention and reduced claims. Below is a snapshot comparison of engagement impact on benefit cost management:

| Engagement Level | Average Annual Benefit Cost Increase | Employee Retention Rate |

|---|---|---|

| High | 4.5% | 92% |

| Moderate | 8.2% | 81% |

| Low | 12.7% | 65% |

To Conclude

As employers brace for the steepest rise in health benefit costs in a decade and a half, businesses across sectors will need to evaluate their strategies carefully to manage expenses while maintaining quality coverage. Mercer’s latest findings underscore the growing challenges faced by employers in balancing cost containment with employee wellness-a dynamic that will continue to shape the landscape of workplace benefits in the coming years. Staying informed and proactive will be essential for organizations aiming to navigate this escalating financial pressure.