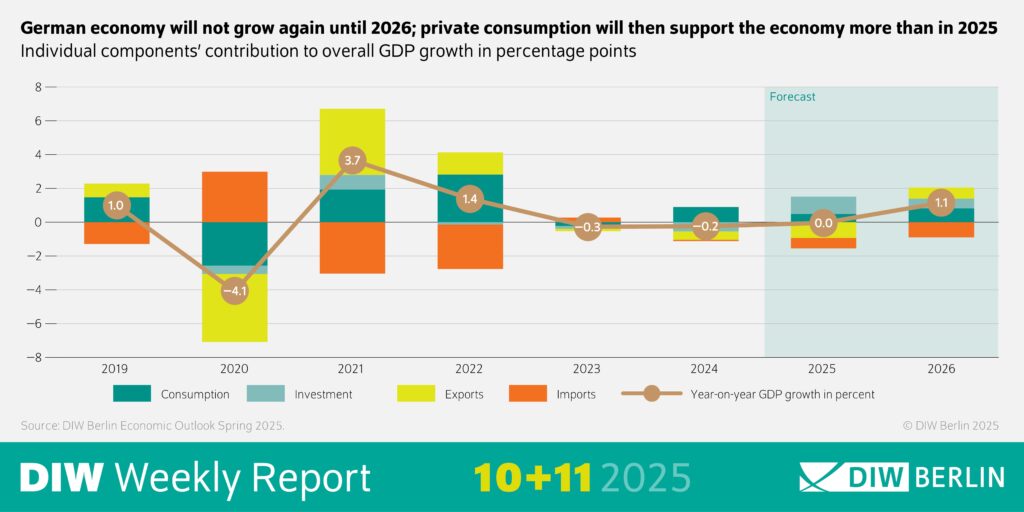

The German economy is set to experience modest growth in 2025, according to a revised forecast from the German Institute for Economic Research (DIW Berlin). The institute has raised its projection, now expecting the country’s GDP to expand by 0.3% next year. This adjustment reflects a cautiously optimistic outlook amid ongoing global economic uncertainties and domestic challenges. The updated forecast provides important insights for investors and policymakers as Germany navigates a complex economic landscape.

German Economic Growth Outlook Brightens as DIW Berlin Revises Forecast Upward

Economic indicators suggest a modest yet promising upswing for Germany in 2025. DIW Berlin’s latest revision, boosting the projected GDP growth to 0.3%, reflects increased confidence driven by stronger industrial output and stabilized consumer spending. Analysts highlight that Germany’s export sector, buoyed by recovering global demand, is expected to play a pivotal role, alongside supportive fiscal policies aimed at fostering innovation and sustainability.

Key factors influencing the outlook include:

- Renewed investment in green technologies and digital infrastructure

- Improved labor market conditions with gradually rising employment rates

- Stabilization of energy prices helping to ease cost pressures on businesses and households

- Positive trade balance driven by exports to emerging markets

| Year | GDP Growth (%) | Inflation Rate (%) | Unemployment Rate (%) |

|---|---|---|---|

| 2023 | 0.1 | 6.2 | 5.4 |

| 2024 (Est.) | 0.0 | 4.0 | 5.2 |

| 2025 (Forecast) | 0.3 | 2.8 | 5.0 |

Key Drivers Behind Germany’s Projected Economic Expansion in 2025

Germany’s economic outlook for 2025 has been brightened by several critical factors fueling growth across multiple sectors. One of the foremost contributors is the resurgence in industrial output, particularly within the automotive and machinery manufacturing industries, which are seeing increased demand both domestically and internationally. Additionally, robust consumer spending supported by improving labor market conditions is helping stimulate the retail and services sectors, providing a much-needed boost to overall economic activity.

Other significant drivers include advancements in green technologies and digital infrastructure investments, positioning Germany as a leader in sustainable industry transformation. The government’s commitment to expanding renewable energy projects and modernizing IT networks underpins this momentum. Key contributors to growth can be outlined as:

- Industrial production rebound fueled by export demand

- Strengthening consumer confidence amid rising employment rates

- Expansion in green energy initiatives and sustainable manufacturing

- Increased capital expenditure on digital transformation

| Growth Driver | Impact Area | Projected Contribution |

|---|---|---|

| Industrial Output | Manufacturing, Exports | +0.12% |

| Consumer Spending | Retail, Services | +0.08% |

| Green Technology | Energy, Innovation | +0.06% |

| Digital Infrastructure | IT, Telecom | +0.04% |

Investment Strategies to Capitalize on Germany’s Moderate Growth Trend

With Germany’s GDP growth forecast nudging up to 0.3% in 2025, investors should consider a balanced approach that leverages stability while seeking incremental gains. Focus on sectors with resilient demand, such as healthcare, renewable energy, and industrial automation, which are likely to outperform amid moderate growth conditions. Additionally, high-quality dividend stocks can provide steady income streams, shielding portfolios from volatility tied to slower expansion.

A diversified asset allocation can enhance returns without compromising risk management. Consider blending

investment vehicles such as:

- Blue-chip equities: Companies with strong balance sheets and global outreach.

- Green bonds: Financing projects aligned with Germany’s energy transition goals.

- Real estate investment trusts (REITs): Particularly those focused on logistics and residential segments benefiting from demographic shifts.

| Strategy | Expected Benefit | Risk Level |

|---|---|---|

| Dividend Growth Stocks | Regular income, inflation hedge | Low to Moderate |

| Green Bonds | Stable returns, ESG alignment | Low |

| Industrial Automation ETFs | Growth potential | Moderate |

Future Outlook

As Germany braces for modest growth in 2025, the revised forecast from DIW Berlin underscores a cautiously optimistic outlook amid ongoing global economic uncertainties. While the projected 0.3% expansion signals resilience, policymakers and investors alike will be closely monitoring key sectors and external factors that could influence the trajectory of Europe’s largest economy in the coming year.