The global economy has demonstrated remarkable resilience amid ongoing challenges, yet its performance remains below expectations, according to the International Monetary Fund’s chief. In a recent statement highlighted by African Business, the IMF head emphasized that while recovery continues, growth rates are sluggish and fraught with uncertainties. This tempered outlook underscores the delicate balance policymakers face as they navigate inflation pressures, geopolitical tensions, and uneven vaccination rollout across regions, including Africa.

World Economy Shows Unexpected Resilience Amidst Global Challenges

Despite a host of unprecedented global challenges-including persistent supply chain disruptions, geopolitical tensions, and fluctuating commodity prices-the international economy has demonstrated a surprising degree of stability. According to recent remarks by the IMF chief, while recovery remains uneven across regions, the underlying economic frameworks have absorbed shocks more effectively than anticipated. Key drivers behind this resilience include:

- Robust fiscal policies enacted by major economies.

- Accelerated digital transformation fueling new growth sectors.

- Adaptive labor markets responding to shifting demands.

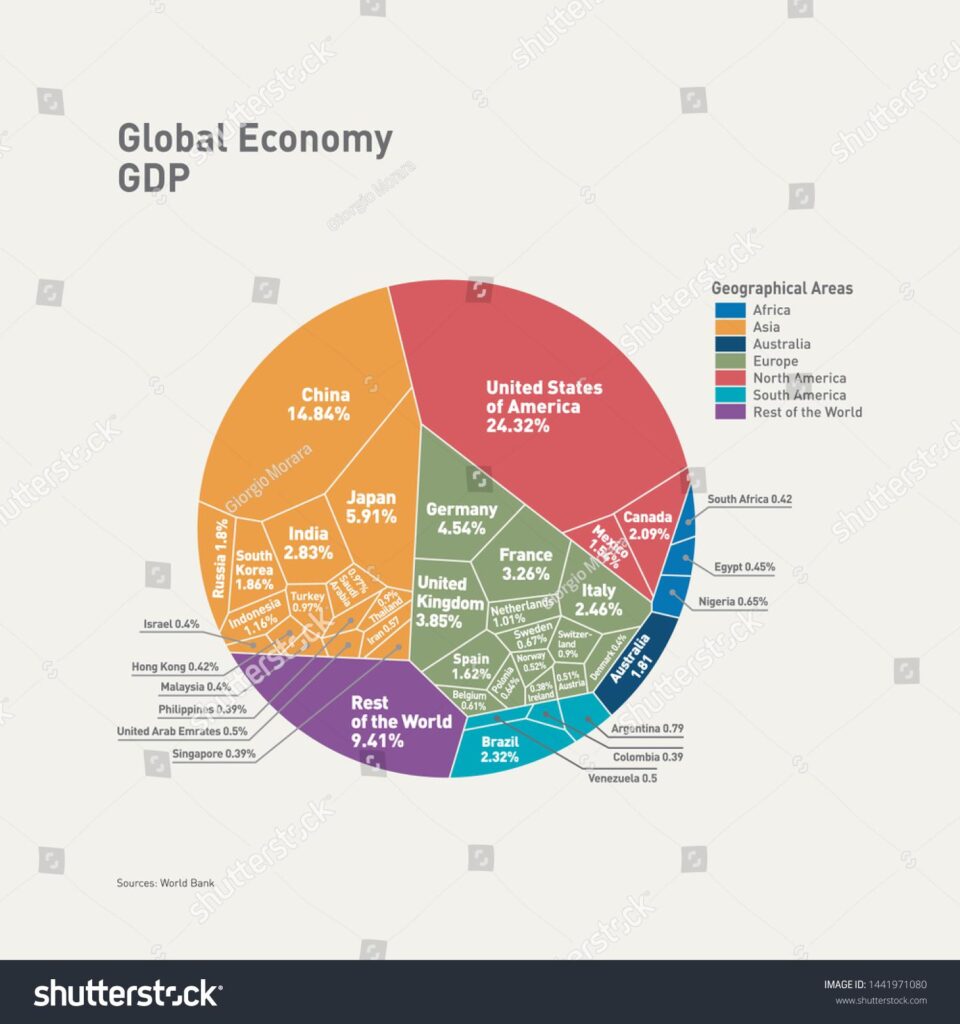

However, growth rates are still falling short of earlier projections, prompting concerns about long-term sustainability. Emerging markets, especially in Africa and parts of Asia, face the brunt of inflationary pressures and limited access to affordable financing. The following table outlines a snapshot of current GDP growth forecasts by region, highlighting disparities that underline the complexities ahead:

| Region | 2024 GDP Growth Forecast (%) | Primary Challenges |

|---|---|---|

| North America | 2.1 | Monetary tightening |

| Europe | 1.4 | Energy price volatility |

| Sub-Saharan Africa | 3.6 | Debt burdens |

| Asia-Pacific | 4.0 | Supply chain recovery |

IMF Chief Highlights Persistent Risks and Growth Concerns Impacting Recovery

The IMF Chief cautioned that despite signs of resilience in the global economy, significant obstacles remain, threatening the pace and sustainability of recovery. Elevated inflation rates, geopolitical tensions, and uneven vaccine distribution continue to exert pressure on developing and emerging markets. These factors collectively contribute to an uncertain outlook, undermining confidence among investors and consumers alike.

Key risks highlighted include:

- Supply chain disruptions prolonging inflationary pressures

- Rising debt levels in low-income countries impeding fiscal capacity

- Vulnerabilities stemming from rapid monetary tightening in advanced economies

- Climate-related shocks exacerbating inequality and economic shocks

| Risk Factor | Potential Impact | Region Most Affected |

|---|---|---|

| Inflation Surges | Reduced Consumer Spending | Global |

| Debt Overhang | Limited Fiscal Stimulus | Sub-Saharan Africa |

| Monetary Tightening | Capital Outflows | Emerging Markets |

| Climate Events | Economic Disruptions | Low-Income Countries |

Strategic Policy Shifts Urged to Boost Investment and Address Structural Inequalities

The International Monetary Fund has emphasized the urgent need for governments worldwide to implement comprehensive reforms aimed at attracting investment to stimulate growth. Current macroeconomic policies fall short in addressing the persistent bottlenecks that deter private sector engagement, particularly in emerging markets. To unlock new avenues of capital inflow, policymakers are urged to prioritize regulatory transparency, streamline bureaucratic procedures, and enhance the protection of property rights. These measures are considered vital to creating an enabling environment where both local and international investors can thrive.

Addressing deep-rooted structural inequalities is equally critical to ensure sustainable economic progress. The IMF chief highlighted disparities in income distribution, education access, and labor market participation as key obstacles to inclusive growth. A strategic focus on targeted social spending and skill development programs could help bridge these gaps. Key policy recommendations include:

- Expanding access to quality education and vocational training

- Implementing progressive tax reforms to fund social safety nets

- Encouraging public-private partnerships for infrastructure development

| Policy Area | Recommended Action | Expected Outcome |

|---|---|---|

| Investment Climate | Regulatory Simplification | Increased FDI Inflows |

| Social Inclusion | Expanded Vocational Programs | Reduced Unemployment |

| Taxation | Progressive Tax Reform | Improved Public Services |

The Conclusion

As global uncertainties persist, the IMF chief’s assessment underscores a cautious optimism about the world economy’s ability to withstand shocks, even as growth remains subdued. For African economies, the report serves as both a reminder of enduring vulnerabilities and a call to leverage resilience-building measures to foster sustainable development. Stakeholders will be watching closely as the global economic landscape continues to evolve amid complex challenges.