Michael Cembalest, chair of market and investment strategy at JPMorgan Asset Management, likes to periodically take aim at gloomy investment predictions, and to be fair the media outlets like this one which publicize them.

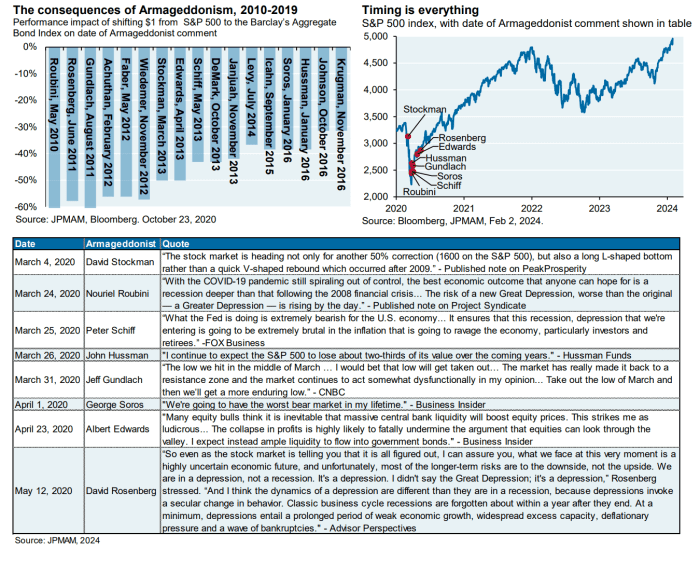

He’s at it again, with an update to a chart showing notable gloomster predictions, and the impact of shifting $1 from the S&P 500 to the Barclays aggregate bond index at the date of the comment.

He cites not just permabears like Albert Edwards and Peter Schiff but even luminaries like George Soros during the depths of the COVID pandemic.

Cembalest himself allows that the stock market might actually be frothy at the moment.

“To be clear, investor sentiment is currently very bullish, leverage is elevated and markets are pricing in a lot of good news. I would not be surprised to see some kind of correction later this year. If history is any guide, the Armageddonists will pick that point in time to tell you that it’s going to get a whole lot worse,” he said.

The S&P 500

SPX

ended on Thursday at a fresh record high of 4,997.91, though it couldn’t hold the intraday high above 5,000.

The iShares Core U.S. Aggregate Bond ETF

AGG

has declined 1% over the last 52 weeks, a period in which the SPDR S&P 500 ETF Trust

SPY

has gained 22%.

>>> Read full article>>>

Copyright for syndicated content belongs to the linked Source : MarketWatch – https://www.marketwatch.com/story/this-chart-shows-the-consequences-of-listening-to-armageddon-type-stock-market-comments-fb48f9c2?mod=mw_rss_topstories