Fugro has reported revenue of €2.2 billion for 2023, a 27.5% growth from €1.7 billion in 2022, said to be driven by high client demand in energy markets.

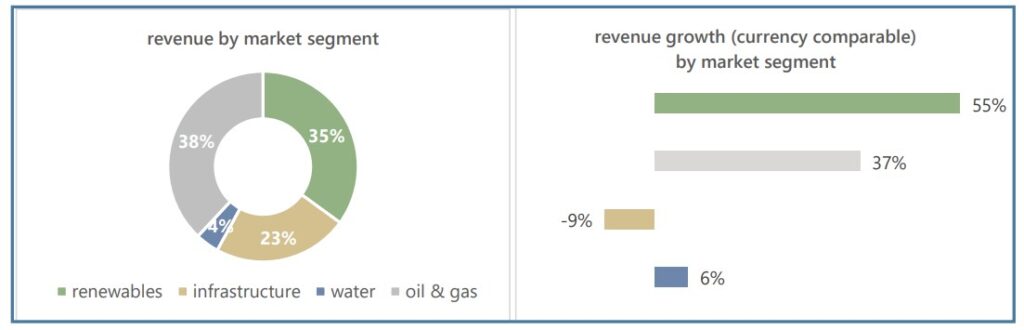

For the full year of 2023, Fugro reported it had realized revenue growth on a currency-comparable basis by capturing high client demand in the offshore wind (+55%) and oil & gas (+37%) markets.

Marine increased by 37.9% while the utilization of Fugro’s owned and long-term chartered fleet amounted to 75% compared to 72% last year. In Land, growth was limited to 3.2% as a result of subdued revenues in the infrastructure market (-9%) in some key geographies and business rationalizations in 2022 (France, Russia).

Source: Fugro

Source: Fugro

A significant step-up in performance in all regions resulted in EBITDA of €397.3 million (18.2% margin) and EBIT of €252.1 million (11.5% margin)

Operating cash flow before changes in working capital increased by €167.9 million to €347.3 million, while capital expenditure amounted to €182 million, below the company’s guidance of €200 million, excluding the impact of the unwind of the sale and leaseback arrangement of the Fugro Scout and Fugro Voyager vessels.

Net debt declined to €110.5 million from €207.4 million in December 2022.

The Dutch company reported a robust 12-month backlog of €1.48 billion, representing a 6.3% increase after steep growth during previous quarters.

“I am excited to announce another quarter of strong performance, concluding a year in which we made great progress in delivering on our strategy, resulting in an EBIT margin of 11.5%. By benefitting from significant investments in energy systems around the world, including offshore wind, we have realised a major step-up in our results,” said Mark Heine, Fugro’s CEO.

“Better contracting conditions, substantially higher activity levels and good project execution resulted in a step change in profitability, in particular in our marine site characterisation activities. We delivered on our Path to Profitable Growth targets, and we also made good progress with our non-financial targets by improving employee engagement and reducing our vessels’ carbon emissions.”

Posted: 3 months ago

In line with the new strategy Towards Full Potential and related mid-term guidance, in 2024 Fugro expects continued revenue growth, primarily driven by the energy markets, EBIT margin within a mid-term target range of 11-15%, ongoing investments in assets, technology, people and execution excellence, and a capex of around €250 million.

“With our unique client solutions, highly skilled people, market-agnostic assets and innovative scalable technology we are ready for the next chapter of our strategic journey: Towards Full Potential. Our key strategic priority is to grow and transform our current business, which will continue to be the most important driver of our revenue and value creation in the mid term,” Heine said.

“In addition, we have defined two other priorities that offer significant potential for the long term: expanding into developing segments with a large requirement for Geo-data such as coastal resilience, and building recurring revenues with Geo-data as a service. We have set targets for 2027 for our financial, social and environmental performance.”

Worth mentioning, Fugro in Novemer 2023 reached a binding agreement for the acquisition of the remaining shares in SEA-KIT International, acquiring the full ownership of the company.

The Dutch player recently opened a new office in South Korea as part of a joint venture with South Korean marine technology company UST21 in support of the local offshore wind sector.

>>> Read full article>>>

Copyright for syndicated content belongs to the linked Source : OffshoreEnergy – https://www.offshore-energy.biz/high-client-demand-brings-strong-2023-to-fugro/