Federal prosecutors said they were “seeking detention” for Sam Bankman-Fried, asking a judge to revoke his bond after he shared documents with the New York Times that they allege were meant to harass a fellow executive from the FTX empire and potentially influence her testimony.

You’re reading State of Crypto, a CoinDesk newsletter looking at the intersection of cryptocurrency and government. Click here to sign up for future editions.

FTX founder and former CEO Sam Bankman-Fried appeared in court last week as prosecutors alleged he had “crossed a line” in sharing former Alameda Research CEO Caroline Ellison’s private diary with the New York Times. The U.S. Department of Justice’s request is straightforward: It wants Bankman-Fried behind bars until his trial kicks off on Oct. 2.

We’re closely following Bankman-Fried’s journey through the U.S. legal system. Since his arrest, he’s been released on bond and able to live at his parents’ place. Prosecutors say he’s abused this privilege and should be detained until his trial, while his defense team says he has a First Amendment right to defend his reputation and respond to reporters.

Last week, prosecutors told a federal judge they were “seeking detention” for Bankman-Fried. The defense objected that they had not been warned about the DOJ’s motion, and Judge Lewis Kaplan, of the U.S. District Court for the Southern District of New York, ultimately chose to set a schedule for each party to file written submissions on the motion.

So the question remains: Will SBF go to jail ahead of his trial?

Prosecutors certainly hope so. The DOJ filed a letter Friday saying Bankman-Fried has now twice tried to interfere with witness testimony, saying he tried to tamper with general counsel at FTX.US in January before he “crossed a line” this month in sharing Ellison’s diary with the Times.

Mark Cohen, one of Bankman-Fried’s attorneys, said Bankman-Fried was merely asserting his First Amendment right to defend his reputation, adding that there have been a “million” negative articles about him and “thousands” of articles about his relationship with Ellison.

In a filing on Tuesday, he went further, alleging the DOJ had “mischaracterized” Bankman-Fried’s alleged witness tampering and taken facts out of context to disparage him..

One attorney with experience in white collar litigation, who asked for anonymity to speak candidly about the case, told CoinDesk:

“The difficulty there is ‘what is tampering,’” the attorney said. “I would look specifically at the evidence they’re using and whether it can be viewed subjectively.”

The attorney said they would also expect another hearing on the issue, noting that Bankman-Fried could appeal any revocation of his bond.

Orlando Cosme, the founder and managing partner at law firm OC Advisory, said judges have a lot of discretion with issues like bond revocation.

“Generally people have free speech over what’s called protected speech. Intimidating witnesses is not protected speech,” he said.

Ken White, a founding partner at Brown White and Osborn LLP, told CoinDesk that the judge wouldn’t like a defendant trying to influence or retaliate against a witness.

“The question is how much the judge sees that as attempting to harass and influence a witness versus his lawyer saying [he’s just] putting his story out there and countering the media narrative about how terrible he is,” White said.

He said Bankman-Fried’s choice to speak to journalists and authors ahead of the trial is “astoundingly dumb.”

“He doesn’t know what’s bad and what isn’t,” he said. “… He really doesn’t understand the sort of theories behind the government’s charges and what admissions by him are harmful to him.”

The DOJ will have to be able to convince the judge that Bankman-Fried will continue harassing and intimidating witnesses or otherwise continue violating judicial orders to win its motion, White said.

Prosecutors have until tomorrow to respond to the defense filing.

One added wrinkle is that the DOJ announced it would drop one of the eight charges it brought, campaign finance, due to treaty obligations with the Bahamas.

The announcement spurred a lot of high-profile individuals to claim there was a conspiracy by elite politicians to protect Bankman-Fried.

Quite a bit of ink has been spilled calling this conspiracy theory dumb, but it’s absolutely worth spilling a little bit more to ensure these kinds of things don’t distract from what is looking to be a weeks-long trial beginning in early October that CoinDesk will cover every step of the way.

Cosme – who once interned with the U.S. Attorney’s Office for the Eastern District of New York – said prosecutors are not the type to bend to political games.

While prosecutors may butt heads with the political appointees in their offices at times, typically if there’s a serious disagreement the career prosecutors will resign if they feel uncomfortable, he said.

White said that the campaign finance charge isn’t worth potentially violating an extradition treaty, given all of the other charges Bankman-Fried still faces.

“People were saying … ‘well, you know, the government breaks various treaties all the time, why don’t they just tell the Bahamas to pound sand?’ And the reason is, there’s absolutely no reason to do it,” White said. “He’s on the hook for fraud in the amount of billions of dollars. The guideline levels are basically an imaginary number, and campaign finance fraud charges are miniscule in comparison, they don’t have any marginal additional weight. So it’s like, the government’s not gonna sweat it if they can’t prosecute a parking ticket while charging murder one.”

Last week, the House Financial Services and Agriculture Committees held three legislation markups, debating on and ultimately voting to advance five crypto-related bills: the Financial Innovation Technology for the 21st Century Act, the Blockchain Regulatory Clarity Act, the Keep Your Coins Act, the Financial Technology Protection Act and the Clarity for Payment Stablecoins Act of 2023.

The question now is whether any of these bills will make it into law. Jesse Hamilton dug into the trials they’ll face – and some of the issues they need to overcome – but for those of you who don’t spend your days immersed in the legislation section of the platform formerly known as Twitter, here’s what’s likely going to happen next:

The House is on recess through August. After lawmakers resume, their immediate focus may be on government funding bills. They could, in theory, attach one of the crypto bills to a “must-pass” bill like funding the government. If the House of Representatives votes to advance one or more pieces of crypto legislation to the Senate, the obvious question is whether the Senate will take it or them up.

So far, the answer doesn’t seem to be yes. The Senate Banking Committee has not indicated it will move on any crypto-specific legislation, let alone the full Senate. And, given House Financial Services Committee Chair Patrick McHenry (R-N.C.)’s assertion that the White House ended negotiations on the one piece of legislation widely seen to have bipartisan support – the stablecoin bill – it certainly doesn’t seem like President Joe Biden will sign any crypto bill just yet.

The Senate did include a provision addressing anti-money laundering rules in the National Defense Authorization Act, sponsored by Sens. Kirsten Gillibrand (R-N.Y.), Cynthia Lummis (R-Wyo.), Elizabeth Warren (D-Mass.) and Roger Marshall (R-Kansas) that now goes to the House.

But a pair of court decisions across recent weeks may support the industry’s view that there needs to be greater legislative direction.

U.S. District Judge Analisa Torres, of the Southern District of New York, ruled earlier this month that Ripple did not violate federal securities laws through programmatic sales of XRP to retail customers. District Judge Jed Rakoff, of the same court, took a different view on whether such sales might violate federal securities laws when he rejected Terraform Labs’ motion to dismiss an SEC lawsuit.

There are important differences between the rulings – the Ripple ruling came after like two years of legal back-and-forth, the Terraform ruling is on a preliminary motion, etc. Nevertheless, the contradiction is likely to feed the industry viewpoint that there just isn’t enough clarity in the law right now to know whether securities laws apply to certain types of token sales.

Anyway: your move, Congress.

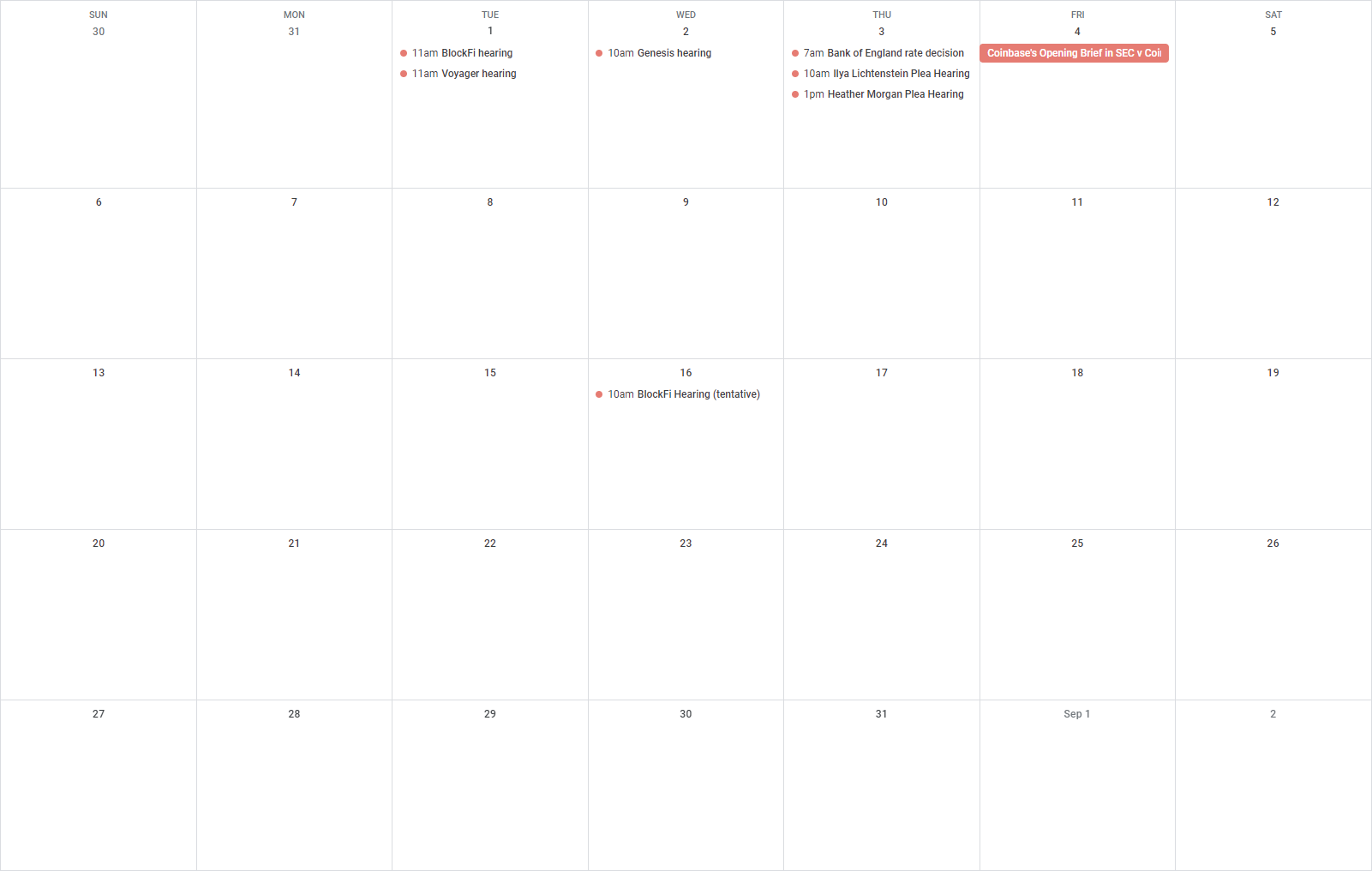

15:00 UTC (11:00 a.m. EDT) There was a hearing in BlockFi’s ongoing bankruptcy case.

15:00 UTC (11:00 a.m. EDT) There was a hearing in Voyager’s ongoing bankruptcy case.

14:00 UTC (10:00 a.m. EDT) There will be a hearing in Genesis’ ongoing bankruptcy.

11:00 UTC (12:00 p.m. BST) The Bank of England will announce its rate decision.

17:00 UTC (1:00 p.m. EDT) Heather Morgan (a.k.a. “Razzlekhan”), the other half of said duo, will also enter a plea deal.

(The Wall Street Journal) I was really curious in the Congressional hearing on unidentified flying objects last week but it turns out one of the key witnesses never had any direct contact, and only said he knew 40 people who did? I’m disappointed.

(SEC) The U.S. Securities and Exchange Commission published a statement last week saying that accounting firms which provide services for cryptocurrency companies may be held liable if the companies publish material misstatements “about the scope of work performed and the nature of the procedures followed.”

(Congressman Gus Bilirakis) Reps. Gus Bilirakis (R-Fla.) and Jan Schakowsky (D-Ill.) – who together lead the House Innovation, Data and Commerce Subcommittee – asked Apple CEO Tim Cook to explain the company’s guidelines for apps that touch crypto.

If you’ve got thoughts or questions on what I should discuss next week or any other feedback you’d like to share, feel free to email me at [email protected] or find me on Twitter @nikhileshde.

You can also join the group conversation on Telegram.

>>> Read full article>>>

Copyright for syndicated content belongs to the linked Source : CoinDesk – https://www.coindesk.com/policy/2023/08/02/is-sam-bankman-fried-going-to-jail/?utm_medium=referral&utm_source=rss&utm_campaign=headlines