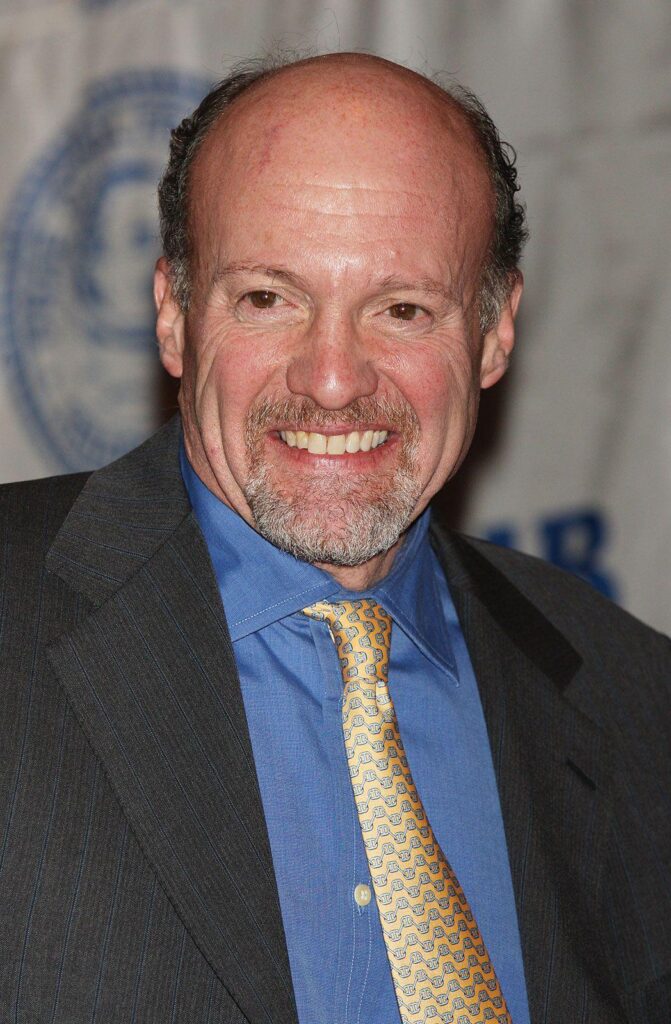

In the fast-paced world of investing, few voices resonate as boldly as Jim Cramer’s, the outspoken host of CNBC’s “Mad Money.” Recently, his spotlight landed on GSI Technology, a semiconductor company quietly powering the future of high-speed memory solutions. With his characteristic enthusiasm, Cramer didn’t mince words, dubbing the stock “a rocket ship” – a vivid metaphor that captures both its impressive growth trajectory and the market’s growing appetite for innovation in tech. This article delves into Cramer’s take on GSI Technology, exploring why he believes this under-the-radar player is poised to make significant waves in the industry.

Jim Cramer Highlights GSI Technology’s Rapid Growth Potential

Jim Cramer’s recent commentary sharply underscores GSI Technology’s impressive trajectory in the semiconductor industry. Highlighting the company’s cutting-edge memory solutions, Cramer likened GSI’s momentum to a “rocket ship,” drawing attention to its accelerating revenue streams and innovative product pipeline. Market watchers are particularly fascinated by how this growth translates into competitive advantages, positioning GSI as a key player in high-speed memory architecture and advanced data storage technologies.

Key factors contributing to the company’s rapid ascent include:

- Robust R&D investment: Continuously pushing the boundaries in content-addressable memory (CAM) and static RAM (SRAM).

- Diversified client base: Serving both enterprise and telecom sectors with tailored, high-performance solutions.

- Strong balance sheet: Enhancing capacity for aggressive scaling and market penetration.

| Metric | Latest Quarter | Previous Quarter |

|---|---|---|

| Revenue Growth | 18% | 12% |

| R&D Spend | $7.2M | $6.5M |

| Gross Margin | 62% | 59% |

In-Depth Look at GSI Technology’s Market Performance and Innovation

GSI Technology has carved a distinct niche in the volatile semiconductor landscape, showcasing a blend of aggressive innovation and steady market growth that keeps investors intrigued. Over the past few quarters, the company’s emphasis on high-speed memory products has not only propelled its revenue streams but has also enhanced its position against larger competitors. Their commitment to specialized solutions in embedded memory and ultra-low latency SRAM has attracted attention from industries reliant on rapid data processing, such as telecommunications and cloud computing. This technical edge translates directly into market momentum, as reflected in sustained share price rallies and growing institutional interest.

Examining GSI’s recent financial and innovation metrics reveals a compelling story of disciplined expansion and forward-thinking R&D investment. The following table outlines key performance indicators that underscore this trend:

| Metric | Q1 2024 | Q4 2023 | YoY Growth |

|---|---|---|---|

| Revenue ($M) | 22.8 | 20.1 | 18.5% |

| R&D Spending ($M) | 4.2 | 3.9 | 15.4% |

| Gross Margin | 58.3% | 56.7% | +1.6 pts |

- Robust revenue growth fueled by niche product demand.

- Increased R&D investment driving technological leadership.

- Improved margins highlighting operational efficiency.

Strategic Investment Insights and Recommendations from Jim Cramer

Jim Cramer’s enthusiasm for GSI Technology transcends typical market chatter, highlighting this company as a dynamic force propelled by innovation and growth velocity. Drawing attention to its rapid earnings acceleration and strong R&D pipeline, he points to how GSI has transformed niche semiconductor applications into scalable business opportunities. Investors should note the company’s ability to capitalize on emerging memory technologies, positioning it as a prime candidate for elevated returns driven by both tactical execution and long-term industry shifts.

Key takeaways shared by Cramer include:

- Consistent product innovation fueling competitive advantages

- Robust financial health with expanding profit margins

- Strategic partnerships that amplify market reach

| Metric | Current Value | Analyst Outlook |

|---|---|---|

| Revenue Growth (YoY) | 35% | Very Positive |

| Profit Margin | 18% | Improving |

| R&D Spending (% of Revenue) | 22% | Final Thoughts

As the dust settles on Jim Cramer’s enthusiastic take, GSI Technology stands poised at an intriguing crossroads. Whether it truly becomes the “rocket ship” Cramer envisions remains to be seen, but one thing is clear: this company has captured the attention of investors and watchers alike. In a market where momentum can shift in an instant, GSI’s trajectory will be a story worth following-propelled by innovation, market forces, and the watchful eyes of those hungry for the next big lift-off. |