In this article, Marquez Comelab will explain how Bitcoin was compromised in 2017 and how these ‘hijackers’ significantly changed Bitcoin’s original design.

In January 2024, a court case called COPA v Wright is scheduled to take place. COPA stands for Crypto Open Patent Alliance, led by Jack Dorsey, the CEO of Block (formerly Square) and co-founder of Twitter. COPA’s members include prominent figures such as Brian Armstrong, Coinbase (NASDAQ: COIN), Kraken, Blockstream, former and current BTC developers, Meta (NASDAQ: META) (the owner of Facebook), and Worldcoin (a project by OpenAI’s Sam Altman). COPA is suing Craig Wright to contest his claim of being Satoshi Nakamoto, the creator of Bitcoin. Their objective is to challenge Craig Wright’s ability to assert his rights as the inventor of Bitcoin.

While COPA was established in 2020, it’s important to note that some individuals and organizations involved were also connected to the events surrounding the takeover of Bitcoin in 2017. This should raise concerns for many people. How could Bitcoin be hijacked or taken over? Such statements contradict what most readers currently understand and believe. However, the background information I provide in this article provides context for the upcoming COPA v Wright trial. It should be known to anyone involved in or interested in Bitcoin.

In this article, I will explain how Bitcoin was compromised in 2017 and how these ‘hijackers’ brought about significant changes to Bitcoin. Yet, individuals buying BTC today often do so under the assumption that it is the same Bitcoin initially described in the Bitcoin white paper by its inventor, Satoshi Nakamoto. This misrepresentation of BTC as Bitcoin could affect people worldwide, including those investing their pension funds in Bitcoin. Therefore, allowing people to hear, learn, and understand this information is essential because the COPA v Wright trial could have far-reaching repercussions in the financial and technological industries that will shape our future.

Segregated Witness (SegWit) and its impact

In 2017, BTC developers implemented a significant alteration to the Bitcoin protocol called Segregated Witness, or SegWit. In this discussion, we will delve into the concept of SegWit, examine its possible drawbacks, and elucidate the reasons behind its resistance, particularly from advocates of larger blocks. To clarify my position, I firmly believe that SegWit has brought such substantial changes to BTC that it has veered away from the original Bitcoin vision. Consequently, many individuals are becoming disillusioned and skeptical about its potential as a truly effective form of digital cash.

The early years and block size constraints

In an earlier article titled “The struggle for the true Bitcoin: BTC, BCH or BSV,” published by CoinGeek on January 7, 2023, I explored the limitations imposed by Bitcoin’s 1MB block size, which restricted transaction capacity to a mere seven transactions per second. Satoshi initially set this limit in 2010 to mitigate the risk of spam transactions. However, he intended to increase the block size before the network became too congested.

Satoshi’s Vision for scaling

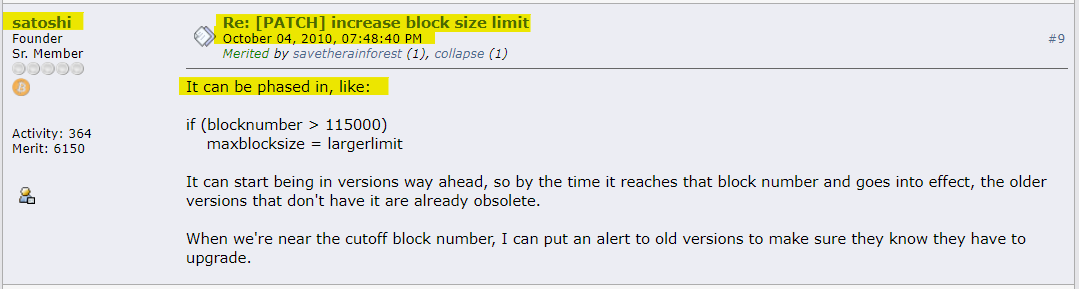

In a 2010 forum post titled “Increase the Block Size Limit” [1], we can see the post from 2010 where Satoshi Nakamoto himself included the code that would allow Bitcoin developers to increase Bitcoin’s block size after a certain period (indicated by the block number) before the Bitcoin network would become congested:

In 2017, Bitcoin experienced a surge in popularity, skyrocketing from just a few cents to over US$1,000. However, this increase in usage led to congestion on the blockchain. Transactions were frequently delayed for several days, highlighting the urgent requirement for scalability solutions.

The Big Blockers vs. Small Blockers debate

The response of what was then referred to as the ‘Bitcoin community’ to this congestion was divided into two factions: the Big Blockers, advocating for following Satoshi’s advice to increase block sizes, and the Small Blockers, proposing alternative solutions like ‘Segregated Witness.’ SegWit aimed to optimize the block by segregating the ‘witness’ part of the transaction, essentially the digital signatures, from the rest of the transaction data.

The significance of signatures in contract law

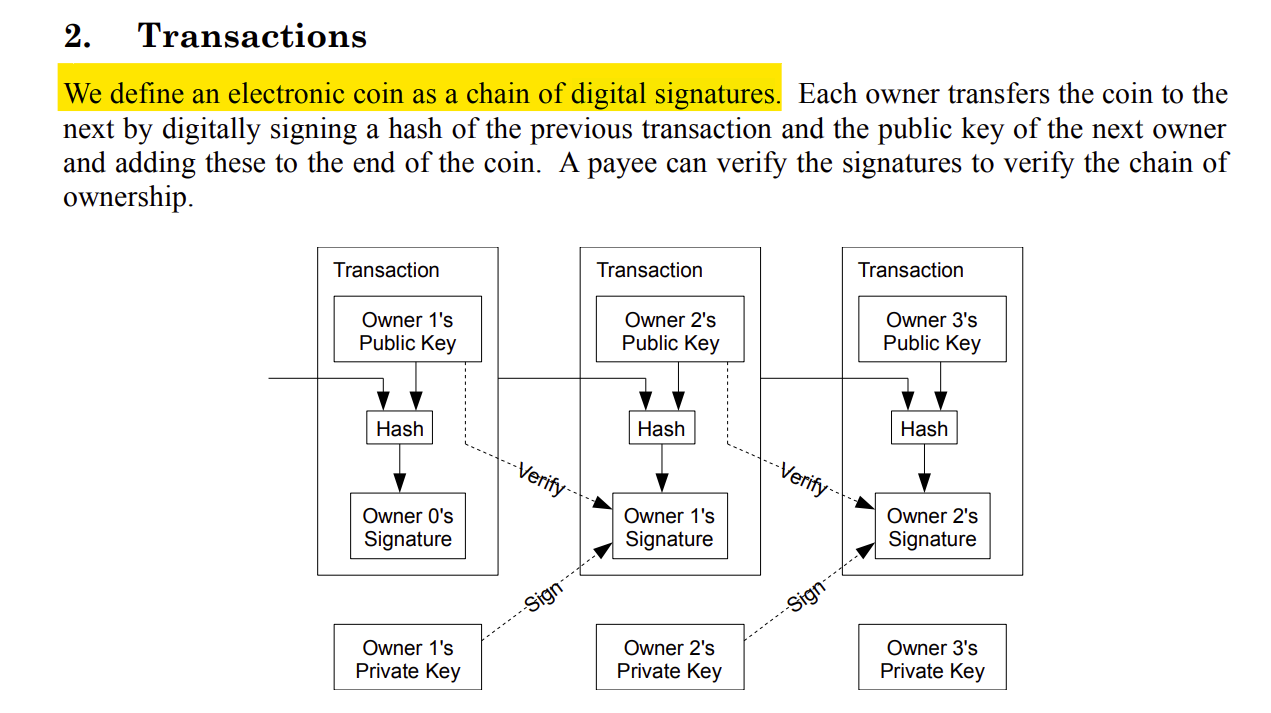

Signatures carry substantial significance in contractual law, symbolizing our agreement to the terms of our agreements with others. This concept struck a chord with me in the design of Bitcoin, which echoes the long-standing tradition of utilizing signed promissory notes as a form of money. Historically, signing a promissory note represented the transfer of ownership or the finalization of a transaction. Bitcoin embraces this principle by treating each transaction as a sequence of digital signatures, a concept articulated in the second paragraph of the Bitcoin white paper under the section titled “Transactions,” which reads: “We define an electronic coin as a chain of digital signatures.”

The diagram shows a snapshot of the Bitcoin Whitepaper that says, “We define an electronic coin as a chain of digital signatures.”

Figure 1: The Bitcoin white paper, Transactions, by Craig Wright.

Figure 1: The Bitcoin white paper, Transactions, by Craig Wright.

Considering the crucial role of signatures in Bitcoin’s infrastructure and the aspiration for Bitcoin to serve as a global digital cash system, it becomes imperative that any alterations to the handling or structure of these digital signatures be subject to rigorous examination. Changes to this fundamental feature carry the potential for significant consequences, potentially rendering Bitcoin vulnerable to manipulation or control by those with vested interests in the system.

How SegWit blocks changed from original Bitcoin blocks

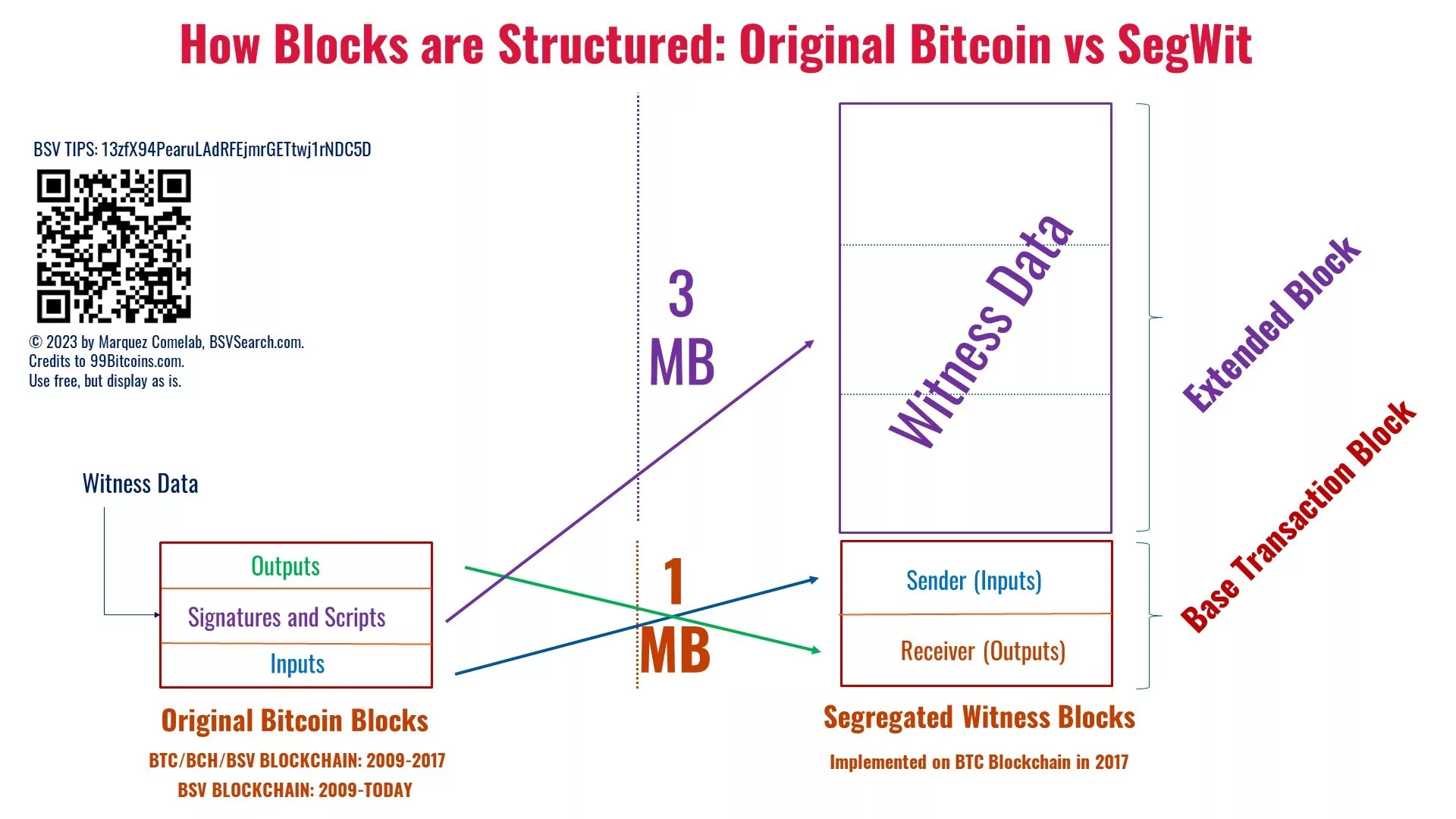

The solution to the ‘Scaling’ issue known as ‘Segregated Witness,’ proposed by the ‘Small Blockers,’ involved separating signature data, often referred to as the ‘witness,’ from the primary transaction data within a block. This signature data would then be organized and stored in a distinct block section. The diagram below provides a visual representation of how SegWit has modified the internal structure of a Bitcoin block:

The diagram below shows the structural difference between the original Bitcoin blocks and SegWit blocks.

Figure 2: How Blocks are Structured: Original Bitcoin vs SegWit, by Marquez Comelab of BSVSearch.com. Credits to 99Bitcoins.com. Free to use as is.

Figure 2: How Blocks are Structured: Original Bitcoin vs SegWit, by Marquez Comelab of BSVSearch.com. Credits to 99Bitcoins.com. Free to use as is.

BTC developers should not have taken over the name and used the original Bitcoin blockchain for BTC after 2017

The implementation of SegWit significantly modified Bitcoin’s block structure, changing how transactions are processed and their hashes are computed. Hashes play a critical role in network security, as they validate the authenticity of transactions and detect any substantial alterations. Under SegWit, this HASH calculation method deviates from the original approach. Additionally, BTC developers introduced new Bitcoin address formats. Previously, addresses started with ‘1,’ but now they commence with ‘3’ for Pay-to-Script-Hash or ‘bc1’ for Bech32. This alteration signifies a departure from traditional Bitcoin addresses.

The substantial alterations in the calculation of hashes for Bitcoin transactions, which have been consistent since the inception of the Genesis Block, coupled with the shift in Bitcoin address formats, unequivocally demonstrate that SegWit has brought about profound changes to Bitcoin. This leads to the compelling conclusion that after 2017, BTC has strayed from the original design and principles outlined in the 2009 Bitcoin white paper. Consequently, BTC should no longer be regarded as Bitcoin because it is not the same Bitcoin that was initially introduced.

As a digital cash system, Bitcoin must be stable, its protocol ‘set in stone’

Bitcoin was originally conceived as a digital cash system, and stability is paramount for such a system to be effective. As a foundation for individuals, businesses, and governments to build upon, it must remain consistent to provide a secure base for all the websites, applications, and software utilizing it.

Consider the internet, constructed upon a TCPIP (Transmission Control Protocol/Internet Protocol). Its core specifications have remained largely unaltered since the 1980s. While not flawless, its stability has enabled tremendous progress. Think about the vast range of activities we can now undertake on the internet, from simple text-based commands to watching cat videos, communicating with family worldwide, and engaging in online gaming. This level of development and acceptance would not have been possible if the TCPIP protocol kept changing at the whims and discretion of a few developers.

Indeed, the same principle applies to Bitcoin. Protocol stability is paramount to serve as an attractive platform for individuals, businesses, and governments to build upon. In this context, consider protocols as the fundamental rules governing Bitcoin’s operation. The method by which the Bitcoin network assesses the trustworthiness of transactions and blocks through hash calculations forms a crucial part of this protocol. Maintaining the stability of Bitcoin addresses and other critical elements is imperative. Frequent changes to the Bitcoin protocol could dissuade serious adoption and disrupt activities like long-term business contracts that may extend across decades or even generations. It is essential that everyone can place their trust in the reliability and integrity of the Bitcoin protocol.

The decision to make big changes to BTC is ultimately decided upon by a small group of unelected developers, being funded by beneficiaries to influence the direction of a cash system on which everybody relies.

BTC (using SegWit and Lightning Network) or BSV (using original Bitcoin protocol and principles)—Which performs better as cash?

Satoshi Nakamoto had emphasized that once the Bitcoin protocol was released, it should remain ‘set in stone.’ However, BTC developers opted for significant changes to the Bitcoin protocol by implementing SegWit.

Now, six years have passed since the split between Big Blockers and Small Blockers, giving us the advantage of hindsight to assess the results and determine which path came closer to realizing Bitcoin’s intended purpose as a digital cash system.

Since 2017, BTC developers implemented SegWit in the BTC Blockchain and subsequently introduced the Lightning Network on the same blockchain. So, how have these changes performed?

Well, BTC still falls short of delivering the reliable, affordable, and swift transactions required to effectively function as digital cash. On-chain, BTC can handle just over seven transactions per second. Unfortunately, their scaling solutions, SegWit, and the Lightning Network, have proven to be unreliable and insecure. In recent months, as of the time of writing this article, many Lightning Developers have lost confidence in the feasibility of the Lightning Network. A recent article published by Cointelegraph on November 26, 2023, titled “Lightning Devs Must’ Wake Up’ and Address Security Bugs, Not Prioritize VC Interests,” points out this issue. The article highlights how developers working on the BTC layer-2 Lightning Network have shifted their focus away from security towards generating returns for investors. In October, BTC core developer and security researcher Antoine Riard made headlines after leaving the Lightning ecosystem due to concerns about a new attack vector called “replacement cycling,” which could be exploited to steal funds by targeting payment channels.

On the other hand, since 2017, the Big Blockers have remained committed to working on the original Bitcoin blockchain, known as Bitcoin Satoshi Vision, Bitcoin SV, or BSV. Their aim has been to restore the Bitcoin protocol as closely as possible to its original 2009 state. They reinstated all the op-codes removed by BTC Developers, and most importantly, they removed the block limit as it was in the original version of the protocol release. This approach aligns with the principles outlined in the Bitcoin white paper and is led by Dr. Craig Wright, whose expertise in the technical, legal, philosophical, and commercial aspects of Bitcoin is commensurate with his claim as the inventor of Bitcoin.

So, how have they fared? The BSV blockchain can currently handle a maximum of 100,000 transactions per second on-chain, in stark contrast to BTC’s seven transactions per second. On August 8, 2023, it processed an impressive 128 million transactions in a single day. Transaction fees are extraordinarily low, ranging from one-thousandth to one-millionth of a percent, and transactions are settled within seconds, regardless of the geographical locations of the parties involved. Furthermore, they are in the process of testing the possibility of achieving one million transactions per second in the coming year. These remarkable levels of blockchain performance stand as a testament to Dr. Craig Wright’s profound knowledge and understanding of Bitcoin, surpassing what most people could have imagined just a few years ago.

Conclusion

In this article, I’ve outlined why Bitcoin Satoshi Vision—BSV blockchain—is the true Bitcoin, no longer BTC. We’ve explored the significant protocol change known as SegWit, which BTC developers implemented. This change has been so profound that BTC has deviated from what many would assume it to be—an affordable and reliable digital cash system, precisely as described in the Bitcoin white paper by its creator, Satoshi Nakamoto. BTC’s developers, including those financially supported by entities like Blockstream and other influential figures in “cryptocurrency” organizations, persist in presenting BTC as Bitcoin. This misleads individuals and organizations worldwide who acquire it, believing it to be the same Bitcoin described by Satoshi Nakamoto in the Bitcoin white paper. The very individuals and companies who played a role in what some refer to as the ‘hijacking’ of BTC are now members of COPA (the Crypto Open Patent Alliance). Leveraging the COPA v Craig Wright trial, COPA is currently advancing the next phase of their agenda: they want to deny Craig Wright’s rights over the work he had done to launch Bitcoin in 2009 and the rights over the work he continues to do to support the true Bitcoin—BSV blockchain—today.

[1] Forum post, BitcoinTalk.Org, titled Re: “[PATCH] increase block size limit,” dated October 4, 2010, URL: https://bitcointalk.org/index.php?topic=1347.msg15139#msg15139, last accessed December 1, 2023

Watch: It’s time for Bitcoin ecosystem to grow—here’s how

New to blockchain? Check out CoinGeek’s Blockchain for Beginners section, the ultimate resource guide to learn more about blockchain technology.

>>> Read full article>>>

Copyright for syndicated content belongs to the linked Source : CoinGeek – https://coingeek.com/segwit-forks-and-copa-why-bsv-blockchain-not-btc-is-the-true-bitcoin/