As economies around the world face unprecedented challenges and rapid changes, understanding the true state of economic health has never been more crucial. But with a myriad of indicators available-from GDP growth and unemployment rates to inflation and consumer confidence-which metrics truly offer the most accurate snapshot of economic conditions? WOSU Public Media delves into the data and expert analyses to unravel the complexities behind economic indicators, helping the public and policymakers navigate the often-confusing signals of economic performance.

Key Economic Indicators That Provide the Most Reliable Insights

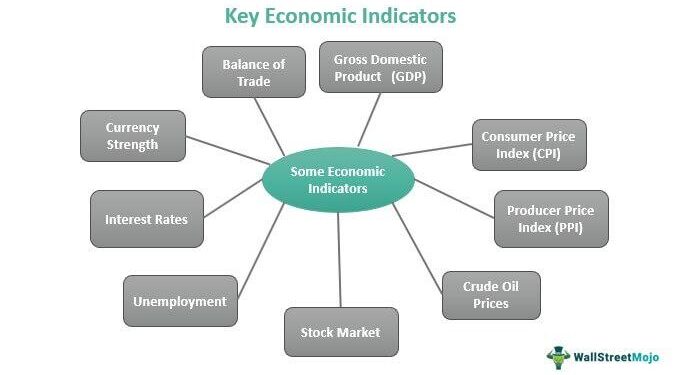

Economists and market analysts rely on a select group of data points to gauge economic health accurately. Among them, Gross Domestic Product (GDP) stands out as the broadest measure, reflecting the total economic output within a country. Alongside GDP, the unemployment rate offers critical insight into labor market conditions, highlighting how many individuals are actively seeking work but unable to find it. Meanwhile, inflation rates, often tracked through the Consumer Price Index (CPI), provide clues about purchasing power and price stability, influencing everything from consumer confidence to monetary policy decisions.

Other indicators often referenced include consumer spending and manufacturing activity, which serve as early signals of economic expansion or contraction. Below is a concise table summarizing these key indicators and what they reveal:

| Indicator | What It Measures | Why It Matters |

|---|---|---|

| GDP | Total economic output | Broad measure of growth |

| Unemployment Rate | Share of jobless labor force | Labor market health |

| Inflation (CPI) | Price changes on consumer goods | Cost of living, purchasing power |

| Consumer Spending | Household expenditure patterns | Economic demand and confidence |

| Manufacturing Index | Industrial production levels | Indicator of business cycle |

Understanding the Impact of Leading and Lagging Indicators on Market Trends

In analyzing economic performance, leading and lagging indicators serve as vital tools for investors, policymakers, and analysts. Leading indicators, such as stock market returns, new business startups, and consumer sentiment indexes, provide foresight into potential shifts in the economy. They often signal changes before the broader market reacts, offering a glimpse into future trends and helping stakeholders make informed decisions. Conversely, lagging indicators, including unemployment rates, corporate profits, and inflation figures, confirm patterns after they have taken shape, offering a retrospective understanding of economic conditions.

Key differences between these indicators highlight their distinct roles:

- Timing: Leading indicators predict upcoming economic movements; lagging indicators reflect past events.

- Purpose: Leading indicators guide proactive strategies; lagging indicators validate trends.

- Volatility: Leading indicators tend to be more volatile and sensitive to short-term changes.

| Indicator Type | Example | Function | Economic Phase |

|---|---|---|---|

| Leading | Building Permits | Predicts housing market trends | Early Expansion |

| Lagging | Unemployment Rate | Confirms labor market status | Post-Recession Recovery |

Expert Recommendations for Using Economic Data to Forecast Future Growth

The predictive power of economic data hinges on selecting indicators that capture both immediate trends and underlying fundamentals. Experts emphasize monitoring leading indicators such as manufacturing activity, consumer sentiment indexes, and new business startups, which often signal shifts in economic momentum before they appear in broader metrics. Coupled with real-time data like payroll employment and retail sales, these signals enable analysts to forecast growth trajectories with greater confidence. However, reliance solely on one category can be misleading; balanced interpretation requires synthesizing leading, coincident, and lagging indicators to paint an accurate picture of the economy’s pulse.

Additionally, advancements in data analytics and machine learning have transformed traditional forecasting models. By integrating alternative data sources such as credit card transactions, satellite imagery of industrial output, and online job postings, experts gain near-instantaneous insights into economic dynamics. The table below outlines key indicators experts recommend for a comprehensive evaluation, highlighting their typical lead time and relevance to economic growth forecasts.

| Indicator | Type | Typical Lead Time | Growth Signal |

|---|---|---|---|

| Manufacturing PMI | Leading | 1-3 months | Expansion/Contraction of industrial output |

| Consumer Sentiment Index | Leading | 1-2 months | Future spending behaviors |

| Payroll Employment | Coincident | Real-time | Current labor market strength |

| Unemployment Rate | Lagging | ||

| Unemployment Rate | Lagging | 3-6 months | Reflection of past economic performance |

If you want, I can help you write more content, fix or enhance this code, or answer any questions about economic indicators or HTML formatting. Just let me know!

The Way Forward

As the economy continues to evolve amid global uncertainties, pinpointing the most accurate indicators remains a critical task for policymakers, investors, and the public alike. While no single metric can capture the full complexity of economic health, a balanced analysis of key indicators-such as GDP growth, unemployment rates, inflation measures, and consumer confidence-provides the clearest picture of where the economy stands. Staying informed through reliable sources like WOSU Public Media ensures that audiences are better equipped to understand these signals and their implications. Ultimately, a comprehensive approach to economic indicators is essential for navigating the challenges and opportunities ahead.