Transformative Effects of Recent Tax Reforms on Health Care

The comprehensive tax reforms introduced during the administration of President Donald Trump have sparked extensive discussions regarding their extensive effects, particularly in the health care sector. The tax legislation, which significantly reduced corporate tax rates and removed penalties for individuals who choose not to obtain health insurance, is expected to have profound implications on access to medical services and affordability for millions across the United States. This article examines the potential ramifications of these fiscal policies, focusing on how they may alter health care funding mechanisms, insurance markets, and ultimately influence the well-being of those dependent on these systems. With critical provisions likely impacting both private insurance frameworks and public programs such as Medicaid, it is vital for policymakers, stakeholders, and consumers to grasp these changes.

Effects of Tax Reforms on Health Care Funding and Access

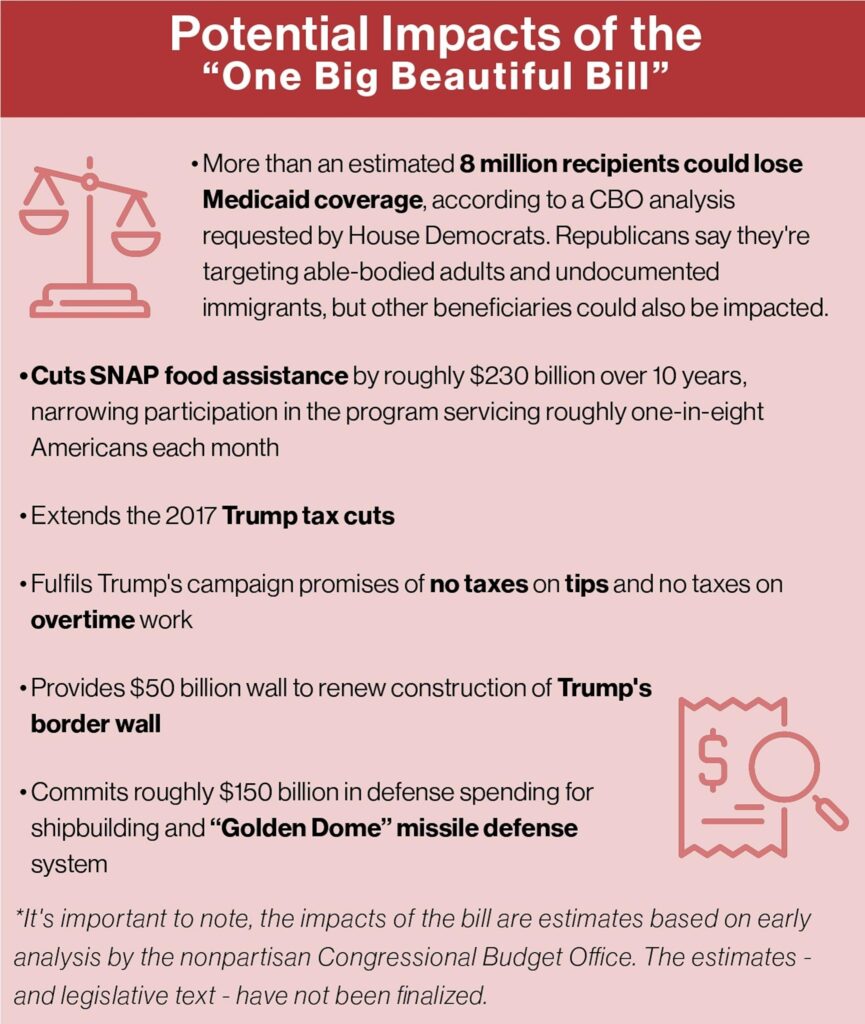

The introduction of recent tax cuts has raised pressing concerns about their impact on health care funding and accessibility. As federal revenue diminishes due to these cuts, essential programs like Medicaid could encounter financial challenges that threaten their sustainability. This situation poses risks for millions of low-income Americans who rely heavily on such services. Additionally, many healthcare providers—especially those serving rural communities—are significantly reliant on government support; any reduction in this funding could hinder their ability to deliver necessary care.

Moreover, states with progressive healthcare financing models may be disproportionately affected by these changes. Faced with budget deficits stemming from decreased federal assistance, states might resort to reducing vital health services or raising premiums for individuals seeking coverage. A shift in financial priorities could also result in less investment in preventive care initiatives that are crucial for curbing long-term healthcare expenses. The consequences can manifest in various ways:

- Increased premiums affecting low-income households

- Longer wait times for essential medical services

- A decline in quality of care available to underserved communities

Long-Term Consequences for Patients and Healthcare Providers

The outcomes stemming from the recent tax reform legislation carry significant implications not only for patients but also healthcare providers themselves. For patients specifically concerned about rising costs associated with Medicaid and Medicare reductions may face higher out-of-pocket expenses along with limited access to critical medical services. As healthcare costs continue an upward trajectory, families might experience heightened financial pressure that raises doubts about affording necessary treatments—a trend that could push them towards relying more heavily on emergency room visits, further straining an already overwhelmed system.

On the provider side of things, while reduced funding presents challenges—particularly concerning service delivery to low-income populations—it may also catalyze a drive toward greater innovation and efficiency. In adapting budgets more stringently than before amidst changing circumstances; stakeholders will need strategies involving telehealth solutions or value-based payment models aimed at enhancing patient engagement alongside improving overall quality of care delivery systems. Key considerations include:

- Acessibility: Will patients still afford necessary treatments?

- Sustainability: How will providers adapt amid diminished resources?

- Pursuit Of Better Outcomes: What effects will adjustments yield regarding public health indicators?

- Catalyst For Innovation: Will there be momentum towards new operational frameworks?

Strategies To Adapt To Evolving Health Insurance Market Dynamics

The ongoing evolution within the realm of health insurance necessitates innovative strategies among stakeholders aiming at maintaining competitiveness within this shifting landscape influenced by legislative changes like Trump’s tax reforms affecting premium structures as well as coverage options available today . Companies must evaluate how such transformations impact consumer behavior while tailoring offerings accordingly through methods including but not limited too :

- User Education Initiatives:: Providing transparent information regarding new taxation impacts related directly back into respective plans offered.

.

.