Mastering Medicare: A Comprehensive Guide for Seniors

Navigating the intricate landscape of Medicare can be daunting, particularly for older adults striving to find coverage that suits their specific needs. With a plethora of plans, options, and providers available, it is essential to comprehend which choices best align with personal health requirements and preferences. In this regard, ”Medicare Jeff” stands out as an invaluable resource for individuals aiming to customize their Medicare coverage effectively. Highlighted by WFRV Local 5, this initiative seeks to streamline the enrollment process by providing expert advice and tailored solutions. As more Americans transition into retirement and the demand for extensive healthcare options rises, selecting the appropriate Medicare plan has become increasingly vital. This article delves into how Medicare Jeff can assist you in evaluating and securing ideal coverage that resonates with your lifestyle while ensuring peace of mind in the years ahead.

Customizing Your Medicare Coverage to Fit Your Lifestyle

Making an informed choice about your Medicare coverage is a crucial decision that impacts both your health and financial stability. At Medicare Jeff, we prioritize helping you uncover options that cater specifically to your lifestyle needs. Whether you require frequent medical consultations, have particular medication needs, or are interested in supplementary services like dental or vision care, our team is here to navigate through the vast array of plans available. Our specialists are equipped to evaluate your circumstances thoroughly so you can take full advantage of benefits designed just for you.

Grasping the different types of Medicare plans accessible is fundamental. To facilitate this understanding process, consider these key elements:

- Utilization of Health Services: How often do you visit doctors? Do you need specialized care or therapy?

- Your Medications: Compile a list of current prescriptions along with their costs.

- Your Preferred Providers: Are there specific doctors or specialists you’d like to continue seeing?

- Your Future Health Needs: Anticipate any potential changes in health status or new services required down the line.

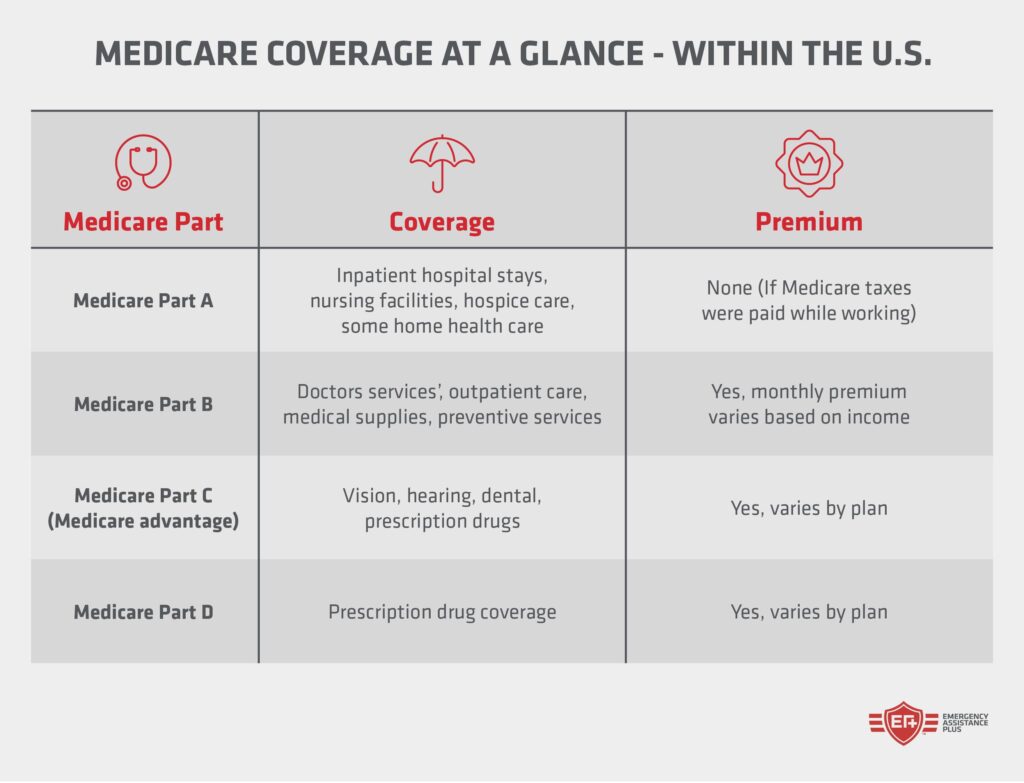

Apart from recognizing these factors, it’s beneficial also to compare various available Medicare plans comprehensively. Below is a straightforward overview contrasting common types of Medicare options:

| Type of Plan | Description |

|---|---|

| Original Medicare (Parts A & B) | Covers hospital stays and outpatient services but requires separate drug coverage plans. |

| Medicare Advantage (Part C) | Packs together Parts A & B along with additional benefits such as vision and dental care. |

Key Differences in Various Medicare Plans

The realm of Medicare encompasses diverse plans tailored for distinct needs and lifestyles; thus understanding core differences between Part A,< strong > Part B strong>,< strong > Part C (Medicare Advantage) strong>,and Part D (prescription drug plan) strong>. Typically,< strong > Part A covers hospital admissions,< /strong>specially skilled nursing facilities,and some home healthcare services.< /p >

< strong >Part B focuses on outpatient treatments,< /strengths >< /b >< b >< u >< i >< s >

| Medicare Plan | Covers | Total Cost Structure |

|---|---|---|

| < b >Part A< b /> td > | Bedsides at hospitals,nursing homes,hospice< td /> | No premium applies;deductible applies< td /> |

| b part b/ td > | b doctor visits,outpatient treatment,b preventive measures/b/ td > | b monthly premium;deductible applies/b/ td /> |

| b part c/ td > | b includes parts a&band extra perks/b/ td /> | b varies;may have lower deductibles than parts ab/b/ dt/> |

| B part d/< dt/>

B prescription medications/dt/> Monthly premium,cost-sharing drugs/dt/> |