- Africa’s proptech market is still small compared to the global market, with funding in 2022 reaching $16.7M, while the global market is valued at $18.2B and projected to reach $86.5B in 2032.

- Financing is a major issue affecting Africa’s proptech sector, along with localized property markets and power shortages in some regions.

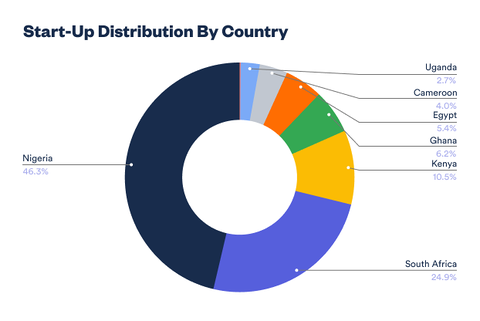

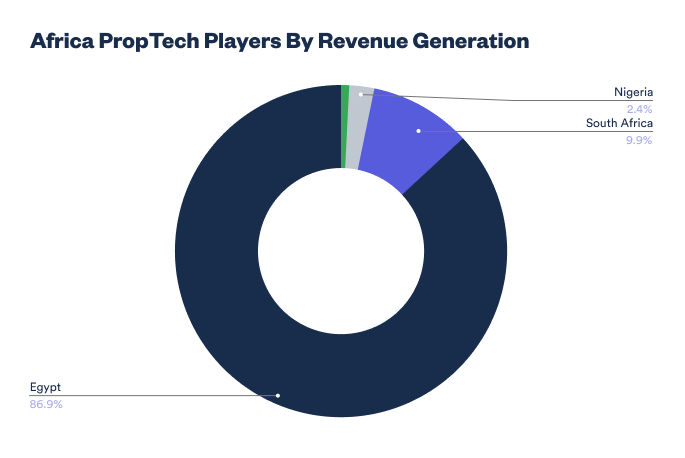

- Nigeria dominates the African proptech market in terms of players, while Egypt leads in revenue generation. East Africa remains an underexplored market with significant potential for growth and the adoption of technology in the real estate sector.

Technology in Real Estate was one of the major topics discussed at the 2023 East Africa Property Investment Summit event that ended on 18th May 2023, at the Radisson Blu Hotel, Upper Hill, Nairobi.

While there were various market dynamics discussed in the proptech forum, below were our key takeaways from the session;

Africa’s Proptech Market Is Still Small When Compared To the Global Market

Africa’s proptech market growth has been gaining momentum across the region in the past ten years. However, the growth has been at a slow pace and as such the market is still very small when compared to the global market. In 2022, Africa’s proptech funding size amounted to $16.7M, whereas the global market had a market size value of $18.2B, and expected to reach $86.5B in 2032. Tilda Mwai, Research Associate at Estate Intel, also added that African startups in general raised a total funding of $3.3 bn in 2022, which is higher than the proptech funding, and a sign that the market still has a long way to go.

On the brighter side, the 2022 proptech performance was five times better than the $3.8M funding realized in 2019, with key companies such as Nawy, Small Small, Spleet, and Estate Intel having raised $5.0M, $3.0M, $2.6M, and, $0.5M, respectively, which is a positive sign in the sector.

In addition to this, Coldwell Banker Egypt recently partnered with Estate Waves to launch a proptech platform dubbed Meta Egypt, which is expected to showcase over 450 projects and over 30,000 residential, commercial, and administrative units from 100 of Egypt’s largest real estate development firms. Notably, the investment amount for Meta came in at EG 150B ($ 4.9M), from an undisclosed source. Despite this, mild activities are still witnessed in the East Africa proptech sector.

Financing Stands Out As A Key Issue Affecting Africa’s Proptech Sector

From the aforementioned outlook, financing stands out as a key issue affecting Africa’s Proptech Sector and as such the market is still small when compared to the global market. Other setbacks witnessed in the sector include but are not limited to power shortages in some regions, coupled with some regions having a localized property market making integration of technology a challenge.

Nigeria Dominates African Proptech Market While Egypt Tops in Revenue Generation

In terms of proptech players distribution, Nigeria stood out strongly out of sampled 225 proptech companies spread across Africa, followed by South Africa, and Kenya, as at 2022. However, in terms of revenue generation, Egypt topped the list with an average sum of $1.8m p.a. This was followed by South Africa, Nigeria and Kenya which generated an average revenue of $205,100, $50,420, and $16,290 p.a, respectively. In terms of category, the majority of proptech players are concentrated on the property listing and management sector.

East Africa, An Underexplored Market

In terms of investment opportunity, Chriscabell Ojuk, co- founder rentscore pointed out that East Africa’s proptech market continues to remain largely unexplored and as such there is a need to establish an ecosystem such as Nigeria’s and South Africa’s.

Additionally, Ciru Okobi, Mi vida homes emphasized on the adoption of technology in property which is the next frontier for real estate, with the global adoption of AI companies increasing as people try to keep up with the rest of the world.

We love your feedback! Let us know what you think about Africa’s Proptech Space by sending an email to [email protected].

Subscribe to ei Pro to access affordable real estate data such as; sales rates, yields, supply drivers, and information on key real estate market participants who are active in the market.