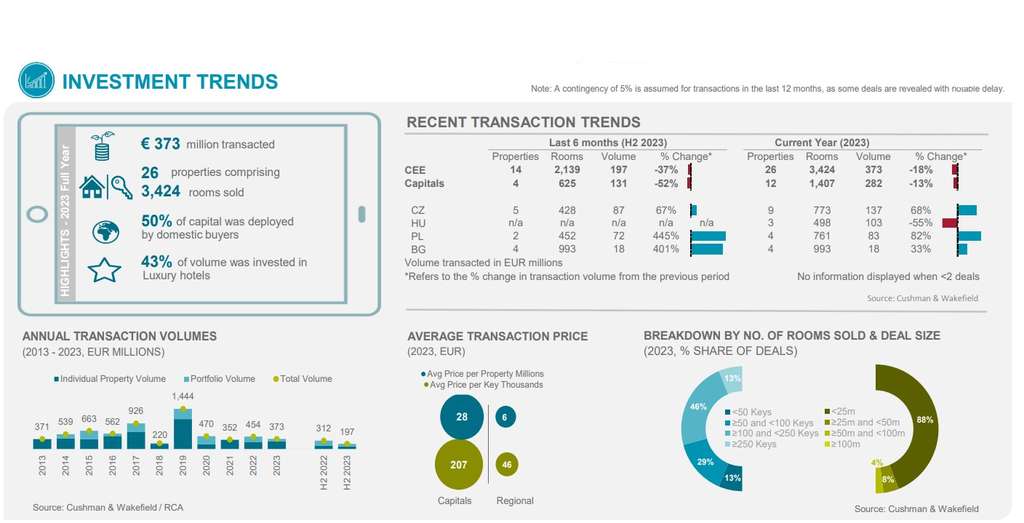

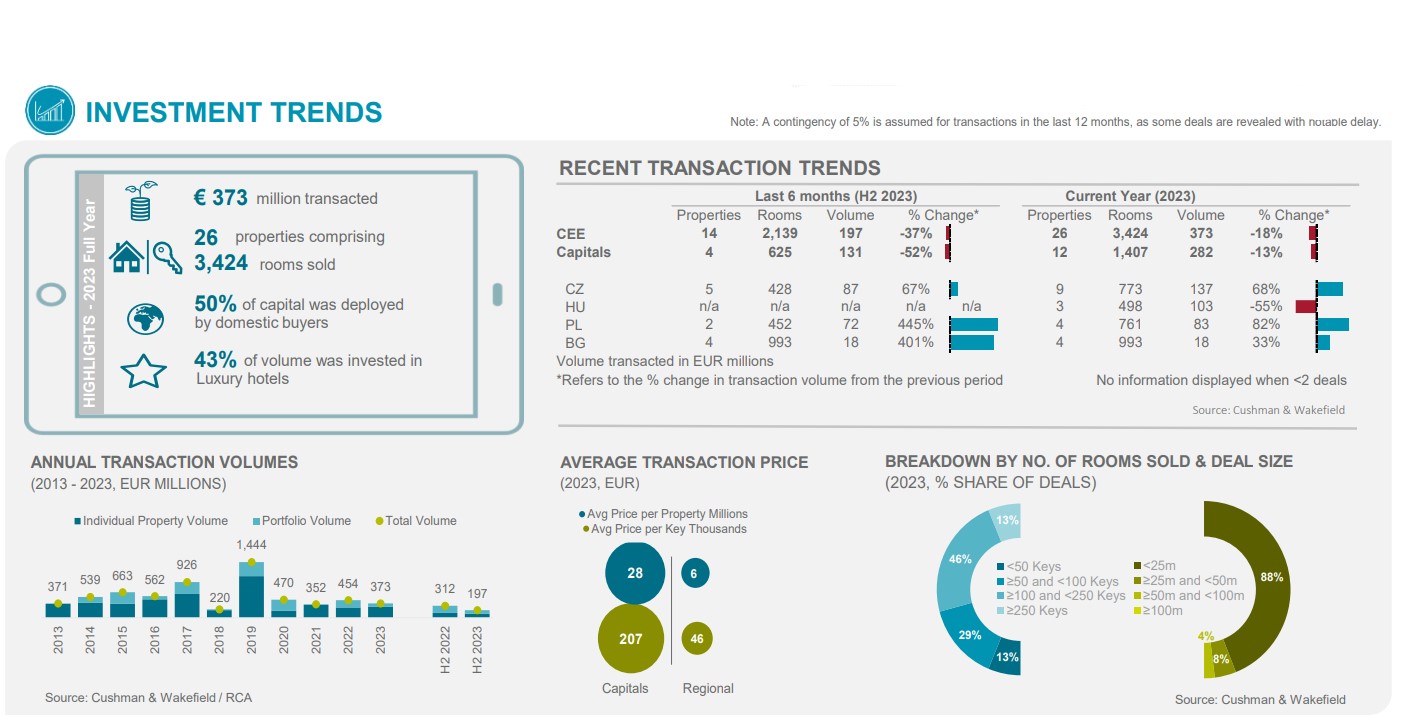

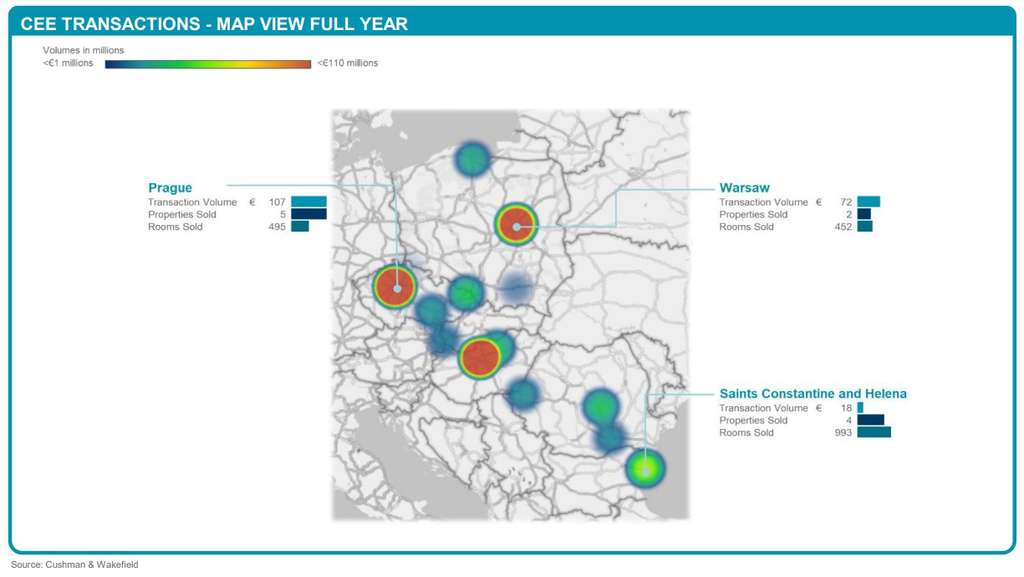

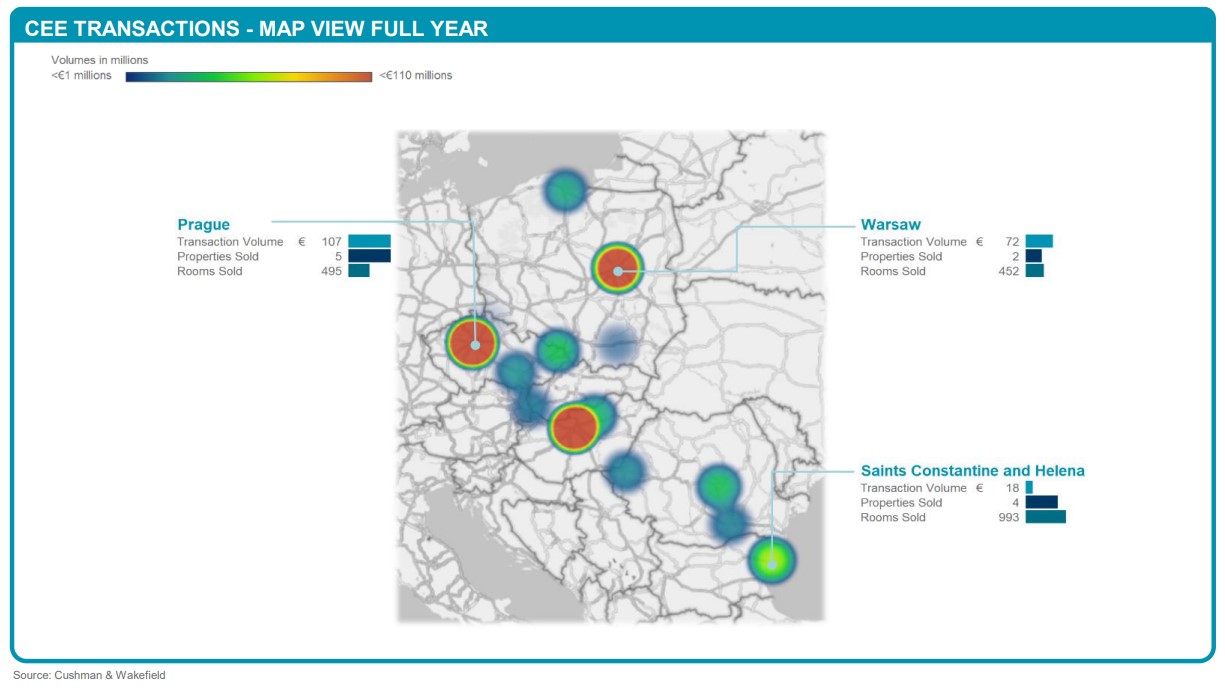

Investment Trends

Increased cost of financing and ongoing economic and geopolitical headwinds in the CEE region, caused 2023 transaction volumes to drop by 18% compared to 2022. However, the volume invested by international buyers increased by 197% over the same period, illustrating the region’s rising attractiveness for inbound capital. Several significant deals are progressing since the year-end 2023 suggesting transaction volumes will rise in 2024.

Investment Trends 2023 – CEE— Photo by Cushman & Wakefield / RCA

Prime Yields

Rising debt costs in 2023 exerted pricing pressure on hotel real estate in all CEE markets, resulting in yield decompression ranging from +25 bps in Warsaw to +75 bps in Bratislava and Sofia compared to 2022. Despite this, the impact was partly offset by improved operating income. The anticipated moderation of interest rates in 2024 is expected to contribute to the yield stabilization.

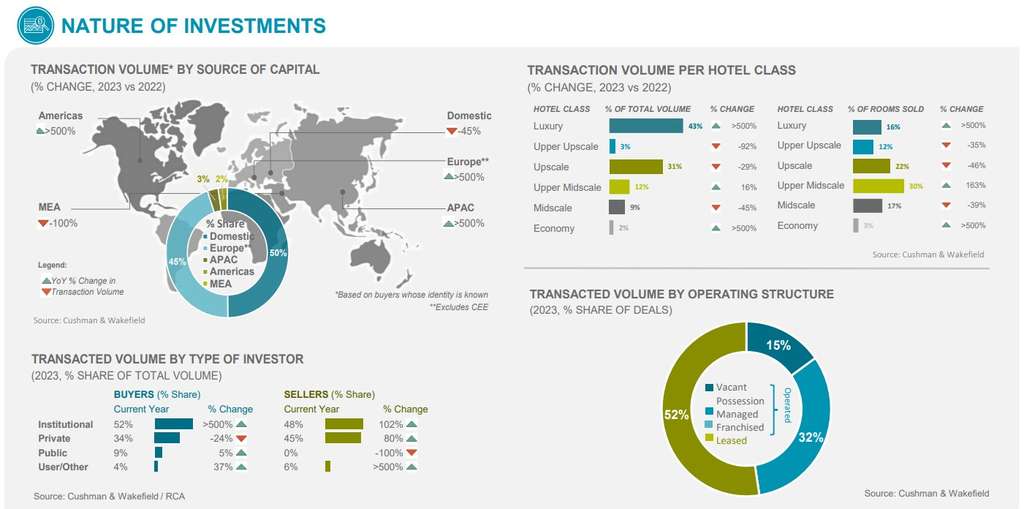

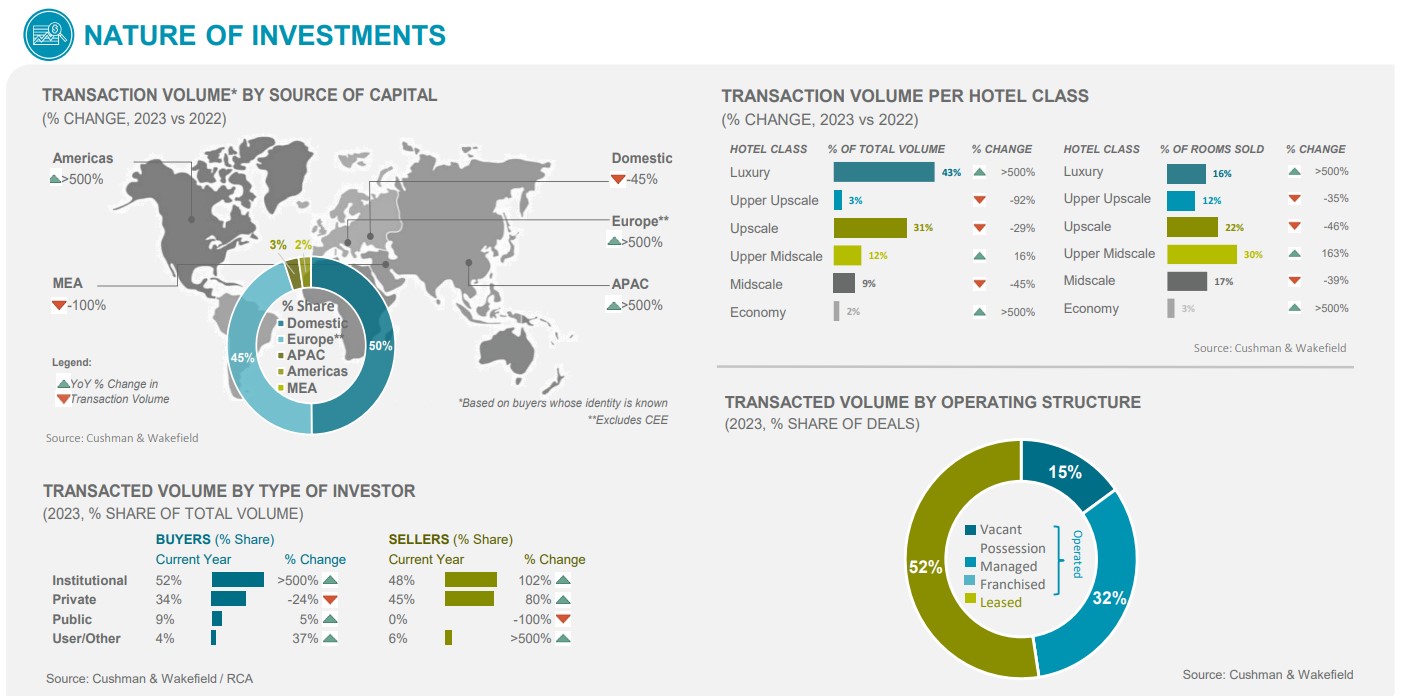

Nature of Investments 2023 – CEE— Photo by Cushman & Wakefield / RCA

Market Performance

While the average hotel occupancy level across the CEE-6 capitals in 2023 lagged behind 2019 by 9%, the ADR surpassed it by 23%, resulting in a 12% RevPAR growth. The strongest increase was recorded in Warsaw and Budapest. The positive trend is anticipated to persist in 2024, albeit at a more moderate pace.

Supply Outlook

In 2023, 20 hotels with a total of 2,658 rooms opened in CEE-6 capitals, including 732 rooms reopening after rebranding or refurbishment. Additional supply includes Ibis, Tribe, Dorothea Autograph Collection in Budapest, and Zleep Hotel in Prague. While Intercontinental Palace Athenee Bucharest and Almanac X in Prague reopened after renovations. Looking ahead to 2024, 22 hotels with 2,570 rooms are set to open, revealing a 2.1% supply increase across CEE-6 capitals (vs. 2023).

Demand Outlook

The demand for hotel accommodation continued to recover in 2023, with international tourist arrivals in CEE increasing by 20% vs 2022, reaching 73% of the prepandemic level (2019). Further growth will be driven by the recovery of corporate and group demand, supported by the ongoing expansion in air connectivity.

Transaction Heat Map— Photo by Cushman & Wakefield

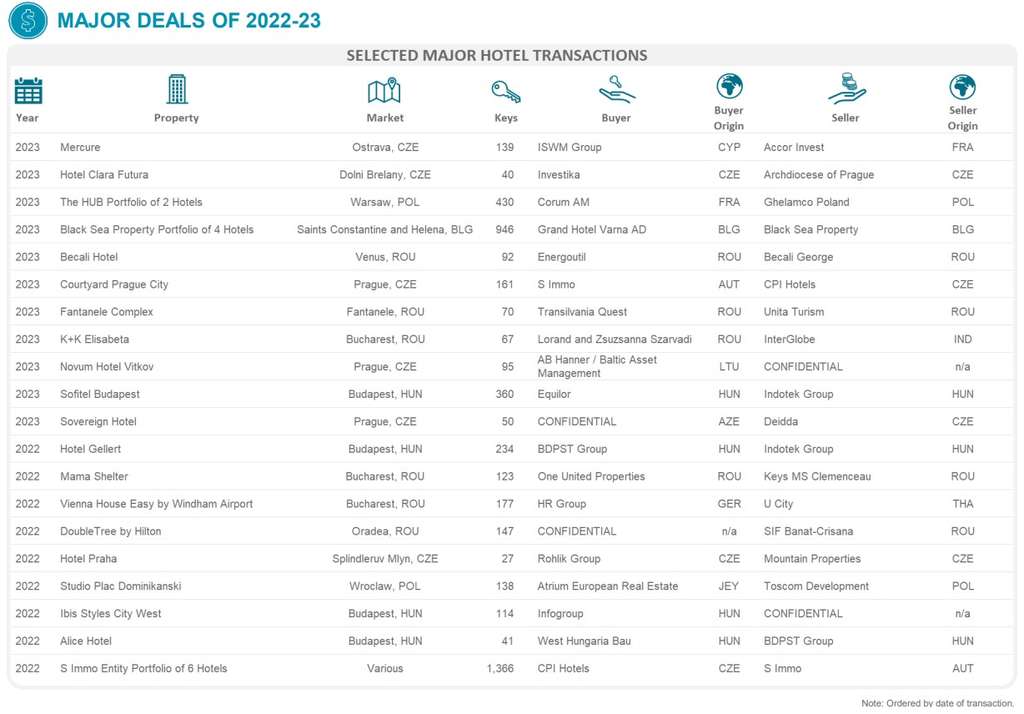

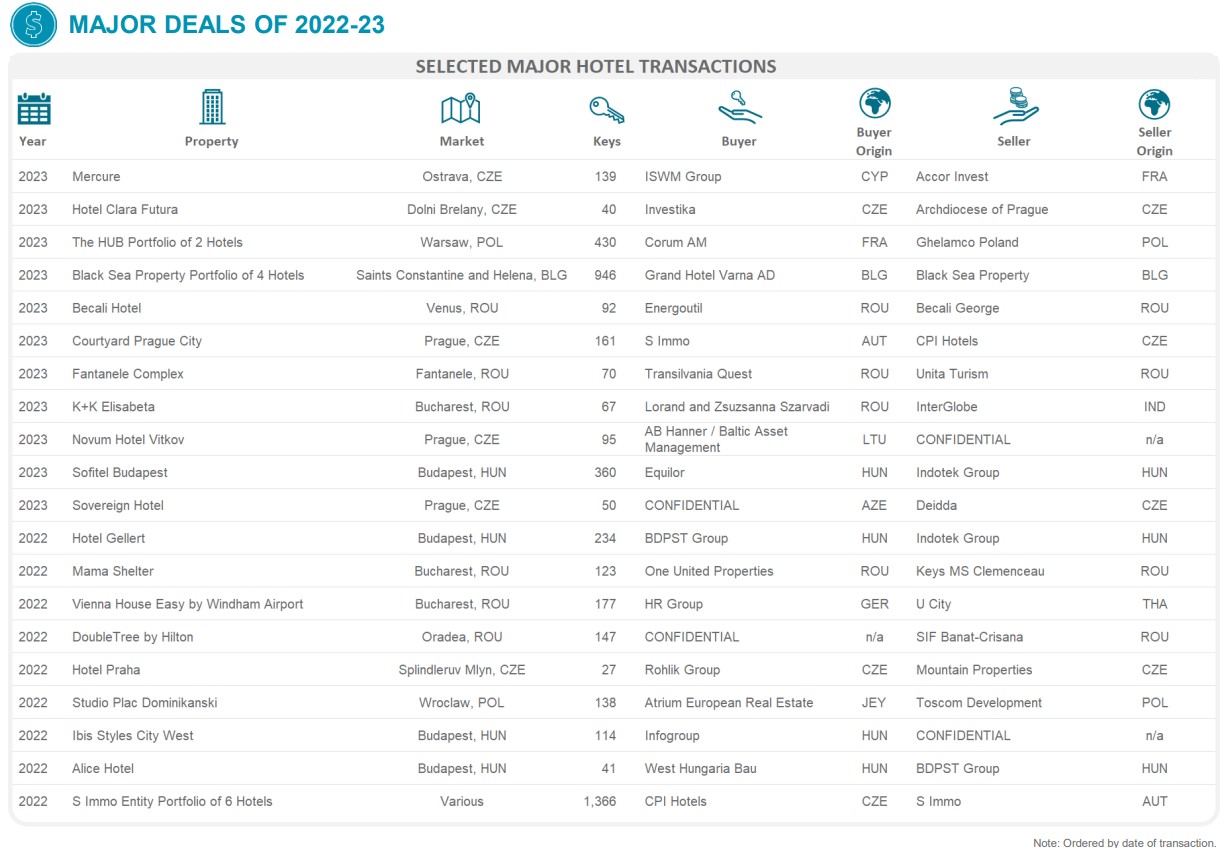

Selected Major Recent Transactions – CEE— Photo by Cushman & Wakefield

Sources: Cushman & Wakefield, STR, Oxford Economics

Note: A contingency of 5% is assumed for transactions in the last 12 months, as some deals are revealed with notable delay.

>>> Read full article>>>

Copyright for syndicated content belongs to the linked Source : Hospitalitynet – https://www.hospitalitynet.org/news/4120699.html