Asia’s hard-hit tourism sector is recovering, but a full rebound isn’t going to happen without more visitors from China—the world’s largest outbound travel market before Covid-19.

Almost a year after Beijing dropped strict mobility curbs, many countries in the region are yet to see Chinese arrivals bounce back to pre-pandemic levels, as a stumbling economy prompts many to tighten their belts and stay closer to home.

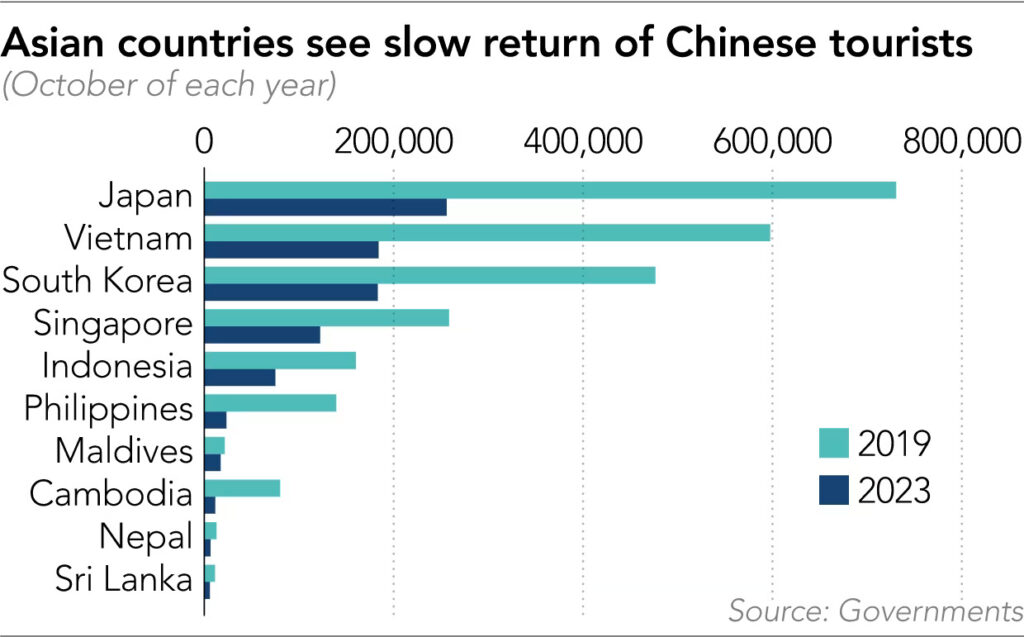

Statistics from ten nations, where a breakdown of tourists by country of origin is available, show that, in October 2023 alone, there were 1.6 million fewer Chinese travelers than the same month in 2019, down 64%.

And that did not even include Thailand, one of their favorite destinations. Official Thai data shows that about 11 million Chinese tourists visited the country in 2019, but barely 2.8 million arrived in the first 10 months of the year.

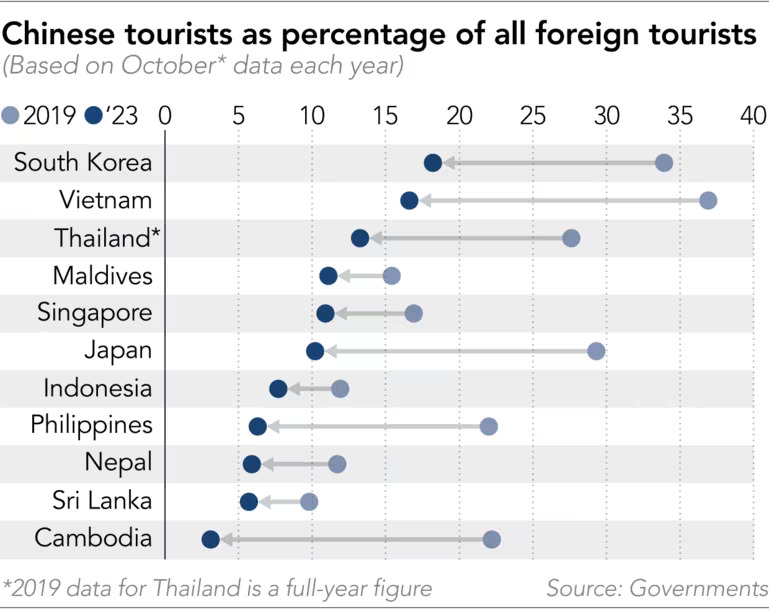

As was the case for Thailand, China used to be the top international tourist market for many Asian countries, so the slowdown has dented their tourism sectors’ post-Covid-19 recovery.

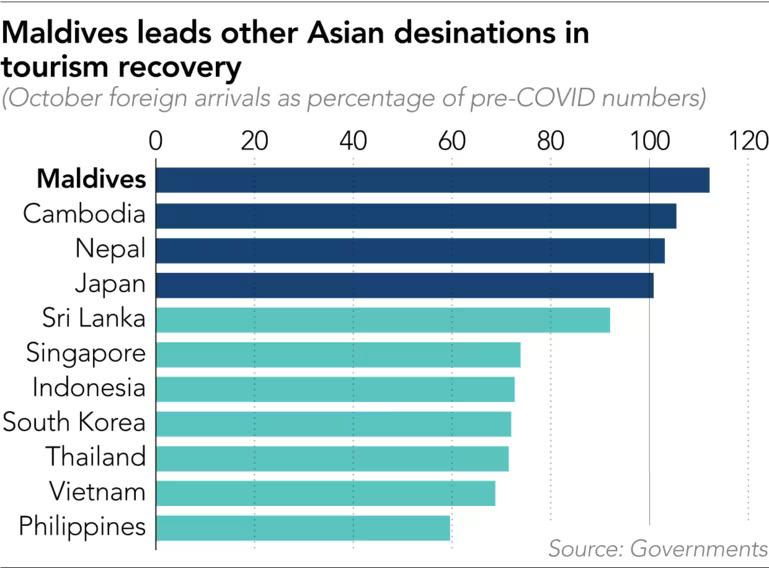

Among them, Vietnam welcomed 1.1 million foreign visitors in October 2023, half a million fewer than the same month in 2019, while Chinese arrivals decreased by 410,000. Similarly, South Korea saw 390,000 fewer international tourists in October 2023 compared to four years ago, with a drop of 290,000 among Chinese visitors. The two countries are falling behind other Asian economies in the sector’s recovery.

Even some countries where overall tourist numbers now exceed pre-pandemic levels are struggling to lure back Chinese travelers. That includes Japan, which saw 470,000 fewer visitors from China in October than the same period in 2019.

Nevertheless, when Chinese people do travel overseas, they prefer destinations closer to home. More than 60% of Chinese outbound tourists chose to visit the Asia-Pacific region in the first half of 2023, with Thailand, Japan and Singapore topping the list of their favorite countries, according to a report by the China Tourism Academy, a government-affiliated institution.

Ying Zhang, a research analyst at the Economist Intelligence Unit (EIU), cited a “weak labor market and uncertainty over future income” as the top reasons for Chinese tourists’ reluctance to go abroad. “Strict COVID restrictions and the property woes have severely eroded household income and wealth,” she told Nikkei Asia in an email, referencing a steep downturn in the real estate market. “The recovery of China’s outbound tourism will be slow and won’t fully recover to the pre-pandemic level until early 2025.”

China is on track to report one of its weakest annual growth rates in decades, with job instability adding to jitters. Youth unemployment hit a record 21.3% in June, before Beijing decided to stop publishing the data altogether.

During an earnings call in November, Jie Sun, CEO of leading Chinese travel company Trip.com Group, mentioned long visa application processes and flight capacity, which “only recovered 50%” as of the third quarter, as the two “major hurdles” in the recovery of outbound business.

Passenger flight capacity between China and most Asian destinations is still well below pre-Covid-19 levels, according to data from aviation analytics company Cirium. Fourth-quarter capacity for flights from China to Indonesia, Japan, the Philippines, Thailand and Vietnam is still below half of the level for the same period in 2019, the data showed, while capacity for carriers to Cambodia stood at just 22% of the earlier period.

Chinese residents made up 3% of Cambodia’s total international holidaymakers in October, down from 22% for the same month in 2019.

Chinese households are also opting to travel within the country for economic reasons, said the EIU’s Zhang. Official statistics showed 3.7 billion domestic trips during the first three quarters of this year, down only 20% from the same period in 2019, while total spending came in at RMB 3.69 trillion (USD 520 billion), 85% of the level four years ago.

“In recent years, I found that for many of the landscapes we see abroad, I can find something similar or even better within China,” said 26-year-old Ivy Li, who has been traveling extensively in Yunnan province.

“My biggest concern is safety while traveling abroad, especially with all those scam activities going on in Southeast Asia,” Li added.

Many Chinese expressed the same worry on social media and said they would avoid traveling to countries like Cambodia, which is now known as a haven for online scam gangs that traffic people into forced labor.

To win Chinese tourists back, Thailand temporarily waived visa requirements for them in late September, though a deadly shooting in central Bangkok shortly after may have weighed on visitor numbers. Malaysia and Singapore have also offered to grant visa-free entry to Chinese citizens staying for no more than 30 days.

Despite the slow recovery so far, China’s outbound travel business is picking up for the holiday season. As of December 5, Trip.com’s bookings for outbound tourism during the New Year and Lunar New Year periods had grown by 5.74 and 20 times from 12 months before, respectively. Places including Tokyo, Seoul, Bangkok, Osaka and Singapore are among the most popular destinations for both periods, the company’s data showed.

This article first appeared on Nikkei Asia. It has been republished here as part of 36Kr’s ongoing partnership with Nikkei.

>>> Read full article>>>

Copyright for syndicated content belongs to the linked Source : KrAsia – https://kr-asia.com/in-charts-how-asias-tourism-recovery-is-held-back-by-stay-home-chinese