By ZeroHedge – Dec 08, 2023, 2:00 PM CST

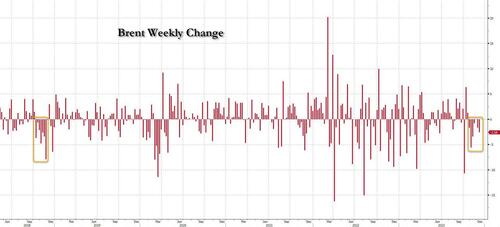

With oil plunging an (almost) unprecedented 7 weeks in a row, the longest such stretch since 2018…

… and many momentum chasing experts – the same ones who two months ago were calling for triple digit oil – already predicting that Saudi Arabia will soon be forced to do what it did in March 2020 when it flooded the market with oil to crush higher cost competitors, this morning we got a reminder of just why oil isn’t trading far, far higher.

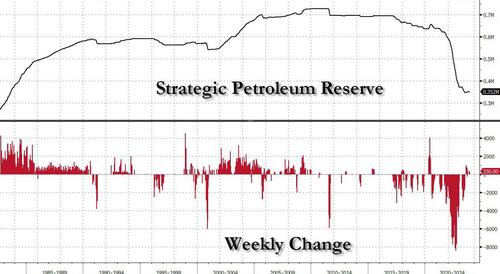

For those confused, the reason why oil is not in the triple digits is the drain of more than 300 million of barrels of oil from the SPR under the Biden administration …

… which slammed oil prices during late 2022 and early 2023 as the initial shock from the Ukraine war faded and as the US slashed its emergency reserve to offset declining global stockpiles as well as to flood the market.

The problem is that having eliminated roughly half of the US strategic petroleum reserve at a time when China has tactically built up its own to over 1 billion barrels (why oh why, would China be doing this, the narrator asked rhetorically), has left the US not only exposed to any true emergency (and there will be plenty) but also threatens to collapse the salt caverns which make up the SPR and which have not been this empty since the 1980s.

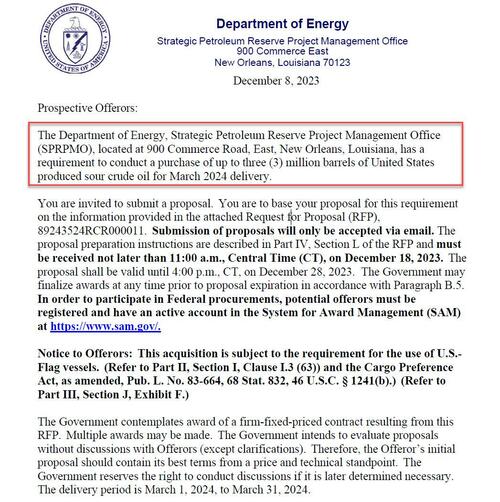

It’s also why there has been pressure on Biden to at least start refilling the SPR. And today, Biden’s DOE announced that it was seeking 3 million barrels for the Strategic Petroleum Reserve for delivery in March, according to a solicitation Friday.

The news pushed oil to session highs, above $71, after trading as low as $68.8 yesterday, the lowest price since July.

And while we applaud the DOE initiative to at least pretend to refill the SPR, we point out that there is a reason why the refilling process is so slow: if 3 million barrels bought over 1 month is enough to push the price of oil almost $2 higher, the DOE – whose primary mandate is to not push oil, and thus gasoline, prices higher in the election 2024 year – may just get cold feet after this latest solicitation and shelve any future refills. And even if the current pace of refilling continues, assuming 3 million barrels per month, it will take 96 months, or just about 8 years, for the SPR to go back to where it was at the start of the Biden administration.

By Zerohedge.com

More Top Reads From Oilprice.com:

EU to Allow Members to Ban Russian Pipeline GasChina’s Oil Demand Growth Is Set for a Significant Slowdown in 2024U.S. Gasoline Prices Continue Falling as Futures Hit Two-Year Low

Download The Free Oilprice App Today

Back to homepage

>>> Read full article>>>

Copyright for syndicated content belongs to the linked Source : OilPrice – https://oilprice.com/Energy/Crude-Oil/Oil-Rebounds-as-DOE-Looks-To-Buy-3-Million-Barrels-For-SPR-In-March.html