After a wild ride over the past two years, Saskatchewan’s potash industry anticipates demand and revenue will grow in 2024.

Published Mar 27, 2024 • 5 minute read

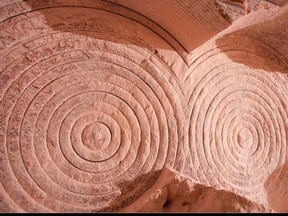

Mosaic’s Esterhazy K3 mine is capable of producing nearly 8 million tonnes of potash annually. SUPPLIED

Mosaic’s Esterhazy K3 mine is capable of producing nearly 8 million tonnes of potash annually. SUPPLIED

It’s been a rollercoaster for Saskatchewan’s potash industry in recent years, leaving producers looking forward to a more stable 2024.

This year is already bearing more resemblance to the long-term growth prospects for potash. That is, growth that is steady and incremental — in line with actual, slow-growing global demand.

Article content

“The last few years have been volatile for the global potash market,” says Jim Reiter, minister of energy and resources for the Government of Saskatchewan.

Advertisement 2

This advertisement has not loaded yet, but your article continues below.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

Unlimited online access to articles from across Canada with one account.Get exclusive access to the Saskatoon StarPhoenix ePaper, an electronic replica of the print edition that you can share, download and comment on.Enjoy insights and behind-the-scenes analysis from our award-winning journalists.Support local journalists and the next generation of journalists.Daily puzzles including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

Unlimited online access to articles from across Canada with one account.Get exclusive access to the Saskatoon StarPhoenix ePaper, an electronic replica of the print edition that you can share, download and comment on.Enjoy insights and behind-the-scenes analysis from our award-winning journalists.Support local journalists and the next generation of journalists.Daily puzzles including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

Access articles from across Canada with one account.Share your thoughts and join the conversation in the comments.Enjoy additional articles per month.Get email updates from your favourite authors.

Sign In or Create an Account

or

Article content

“This (period) has seen prices rising from multi-year lows in 2020 to record highs in spring 2022 to now more historically average levels.”

Price per metric tonne of potassium chloride — the commodity produced from Saskatchewan mines — was about US$200 in 2021. It then spiked to more than US$1,200 in 2022 following Russia’s invasion of Ukraine.

Afterward, potash prices fell steadily before stabilizing at about US$300 this year — more in line with the average price of the decade prior to the invasion.

“That price spike was not driven by fundamental or core need for potash,” says industry consultant and geologist Steve Halabura, the chief executive officer of Buffalo Potash Corporation.

The outbreak of war in Ukraine was the outlier geopolitical event that caused prices to soar largely due to Russia and its close ally Belarus being the world’s No. 2 and 3 producers of potash, respectively.

The world’s largest producer is Canada — or more accurately Saskatchewan — which produces most of the nation’s potash.

Halabura expects that Canada’s share has likely grown modestly since the Ukraine-Russia war, beyond 31 per cent of global production — its share in 2021.

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Advertisement 3

This advertisement has not loaded yet, but your article continues below.

Article content

The war’s outbreak sparked speculation that sanctions against Russia and Belarus would cause global shortages, he adds.

And many Western nations looked to Saskatchewan as an alternative source.

Indeed, Saskatchewan has the reserves to meet growing need. In fact, most of Canada’s potash reserves — about 1.1 billion metric tonnes, the largest in the world — stretch across from Saskatchewan’s midwestern border with Alberta to its southeastern border.

The province is a global powerhouse producer with 11 operating mines run by Nutrien Ltd., Mosaic Company and K+S Potash Canada.

In aggregate, the industry directly employs about 5,800 people “with thousands more in the supply and services sector,” Reiter says.

Price volatility aside, production has remained steady in recent years, ranging from about 20 million to close to 23 million metric tonnes, says Pam Schwann, president of the Saskatchewan Mining Association, based in Regina. “It’s just that the commodity price was so much higher in 2022.”

The situation led to record revenues, CAD$18 billion in 2022, far “surpassing the Government of Saskatchewan’s 2030 Growth Plan annual target of CAD$9 billion,” Reiter adds.

Advertisement 4

This advertisement has not loaded yet, but your article continues below.

Article content

This year, the government expects potash revenues to be more in line with fundamentals, driven by steadily expanding demand and global population growth, says Reiter.

It’s a trend that is likely to continue for decades to come, Halabura says. “If you can peer through all the geopolitical noise, the future path is long-term, sustainable, increasing demand.”

Another driver increasing the demand for potash is climate change which, along with sprawling urbanization, is reducing the availability of arable land and its productivity. As a key component of fertilizer, potash is essential to helping farmers grow more on less land, under more adverse and unpredictable conditions.

“Potassium is critical to plant health and availability of water to plants,” Schwann explains, noting it helps crops withstand hot and dry conditions.

Recognizing the long-term global need for more potash, existing producers are increasing their investment in the province’s industry to boost production.

Nutrien has recently completed a multi-year expansion program, which included the introduction of tele-remote/automation technology at its Lanigan mine. SUPPLIED

Nutrien has recently completed a multi-year expansion program, which included the introduction of tele-remote/automation technology at its Lanigan mine. SUPPLIED

Reiter notes that Nutrien and Mosaic have already invested about CAD$13 billion combined over 20 years to build capacity, while K+S has spent another CAD$4 billion to build its Bethune solution mine near Regina.

Advertisement 5

This advertisement has not loaded yet, but your article continues below.

Article content

Other companies are also making investments, including mining giant BHP. The company is investing close to CAD$14 billion to construct its Jansen mine with the first stage slated to be operational in 2026.

“These investments are major drivers of growth and will continue to support the economy in the years ahead,” Reiter adds.

The expected increase in capacity from the Jansen mine, once stage 2 is complete in 2029, is nearly nine million metric tonnes.

“Estimates are that global demand grows about two to three million metric tonnes annually, so that new capacity should easily be absorbed into the marketplace,” Schwann says.

The near- and long-term forecasts are indeed bright, based largely on steadily and slowly growing demand and pricing — hopefully without too many price spikes, she adds.

“When we get situations like in 2022, the price becomes too expensive, which actually dampens demand because the fastest growing markets are developing nations where farmers cannot afford high prices so they cut back.”

Although the war in Ukraine continues with no end in sight, potash demand and pricing this year are expected to be stable, Halabura says.

Advertisement 6

This advertisement has not loaded yet, but your article continues below.

Article content

“The Belarus and Russian producers are lower cost, and they’re still selling,” he says, noting these nations still have access to two of the largest markets: India and China.

“Sanctions have had little impact.”

Still, prices could spike due to other factors, including disruption of global shipping routes, already under pressure with drought affecting the Panama Canal, and the Suez Canal increasingly embroiled in Middle East unrest.

“These factors — should they worsen — could send shipping costs sky-high, affecting the price of the commodity for end-users,” Halabura says.

Yet price volatility is part and parcel to doing business for Saskatchewan’s producers. Schwann notes Nutrien and Mosaic remain very profitable at current prices, and their costs continue to fall due to ongoing investment in technology and innovation.

“That’s key to remaining cost-competitive with competitors like Russia, Belarus and China,” Schwann says.

“As long as Saskatchewan can mine potash at an increasingly lower cost and export it so farmers can apply potash when they need it, our producers should not only be able to maintain market share; they should increase it well into the future given the province’s vast reserves.”

THIS STORY WAS CREATED BY CONTENT WORKS, POSTMEDIA’S COMMERCIAL CONTENT DIVISION

Article content

>>> Read full article>>>

Copyright for syndicated content belongs to the linked Source : Saskatoon StarPhoenix – https://thestarphoenix.com/business/mining/potash-in-our-province/potash-sector-anticipates-a-return-to-stability-in-2024