China’s industrial recovery has not been up to par and has fared worse than consumer-facing sectors.

Standard Chartered: Speculative funds have continued to amass positions on the short side of the market despite a broader lack of trend.

current oil fundamentals and/or macroeconomics are not weak enough to justify a 31-month high in speculative shorts as well as a 13-year low in net speculative positioning.

Nowadays, the oil bulls can’t seem to catch a proper break. Just when the markets were beginning to warm up to the idea that a large stimulus package by Beijing would boost demand by the world’s largest crude importer (buy on the rumor), oil prices have been badly hammered after the actual thing underwhelmed (sell on the news). The markets have thrown a strop after the People’s Bank of China cut two benchmark lending rates by a mere 10 basis points each, seen as too small to make a difference.

“On their own, 10 bps cuts are too small to make a great deal of difference to monetary conditions, especially since market interbank rates are already below policy rates,” Capital Economics’ Julian Evans-Pritchard and Zichun Huang said in a note

China’s economic recovery has been less than impressive, and the initial excitement in the oil markets has been tamped down by a harsher reality. China’s industrial recovery has not been up to par and has fared worse than consumer-facing sectors. The transport sector has also been unimpressive with trucking activity failing to pick up as expected. Jet fuel demand has been disappointing with international flights from China only at 39% of pre-pandemic levels. Immediately after the Covid rules were relaxed, Chinese refiners went on a crude oil buying spree betting on a quick return to downstream demand. But that has failed to materialize leading to onshore inventories climbing to a two-year high.

The current economic outlook is not good, either. Bloomberg has reported that China’s credit demand weakened in May as the economy’s recovery lost steam. Aggregate financing fell to 1.6 trillion yuan ($224 billion) in May, considerably lower than the median estimate of 1.9 trillion yuan.

And, the shorts have become unrelenting.

A month ago, Saudi Energy Minister Abdulaziz bin Salman sent a warning to speculators, telling them to ‘watch out.’

Apparently, short sellers did not get the memo: commodity analysts at Standard Chartered have reported that speculative funds have continued to amass positions on the short side of the market despite a broader lack of trend. According to the experts, speculative shorts across the four main Brent and WTI contracts climbed by 16.5 million barrels (mb) w/w to a 31-month high of 251.7mb while longs declined by 3.8mb to 451.2mb. The speculative net long represents 4.2% of open interest, the lowest level since November 2009. The analysts have argued that current oil fundamentals and/or macroeconomics are not weak enough to justify a 31-month high in speculative shorts as well as a 13-year low in net speculative positioning.

Oil Experts More Bullish

Luckily, the majority of oil experts are much more bullish on the oil price outlook.

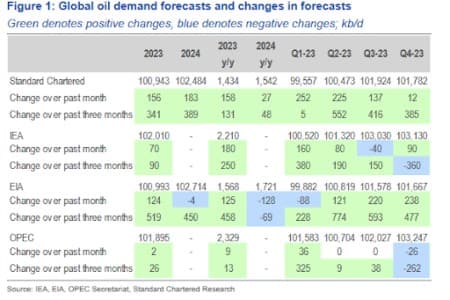

Commodity experts at Standard Chartered have created a heatmap of demand forecast changes, including their own, in the latest reports relative to one and three months ago. You will notice that the heatmap provides a positive view of demand, with most estimates for 2023 quarters and the annual average having moved higher over both time periods. Interestingly, the biggest upwards revisions have come from the more bearish agencies namely StanChart and the EIA, while more bullish ones including the IEA and OPEC Secretariat have not changed significantly.

In sharp contrast, there’s a disconnect between what energy economists are seeing in the data and what speculative traders are acting on. Oil prices have touched multi-year lows on several occasions over the past months, with StanChart speculating that the disconnect could be the result of the increasingly top-down and macro-led nature of oil-market sentiment.

Source: Standard Chartered Research

A week ago, the International Energy Agency (IEA) released its latest Monthly Oil Market Report, including the first MOMR forecasts for 2024. On the demand side, the IEA hiked its 2023 growth forecast by 240K barrels per day (kb/d) to 2.45mb/d, bringing its forecast in the ballpark of the OPEC Secretariat’s prediction of 2.346mb/d. Interestingly, U.S.-based Energy Information Administration (EIA) is more bearish than usual and sees demand growing just 1.591mb/d while Standard Chartered is the least bullish and has predicted growth of 1.508mb/d.

The tables turn when it comes to predicting demand growth for 2024, with the EIA most bullish at 1.695mb/d; StanChart puts it at 1.538mb/d while the IEA is least bullish and sees demand growing just 0.86mb/d. In effect, the IEA has projected that demand will grow rapidly in 2023 followed by a sharp 2024 slowdown, while the EIA and StanChart’s forecasts show a flatter 2023 but no slowdown in 2024. However, readers will note that cumulative demand increase for 2023 and 2024 is very similar across the three forecasts (IEA: 3.31mb/d; EIA: 3.29mb/d; Standard Chartered: 3.05mb/d).

According to the IEA, demand slowdown will come from China (from 1.49mb/d in 2023 to 0.46mb/d in 2024), the Middle East (200kb/d in 2023, 60kb/d in 2024) and the U.S. (70kb/d in 2023, -230kb/d in 2024).

By Alex Kimani for Oilprice.com

More Top Reads From Oilprice.com:

Copper Needs to Be Classified as Critical MetalChina Expands Influence In Latin America Through Belt And Road InitiativeEnergy Regulator Claims Canadian Oil Production Will Plunge 76% By 2050

>>> Read full article>>>

Copyright for syndicated content belongs to the linked Source : OilPrice – https://oilprice.com/Energy/Crude-Oil/The-Bears-Still-Rule-Oil-Markets.html