Jurisprudence

The NRA’s lawsuit, while couched in the language of free speech, is not about the First or Second Amendment.

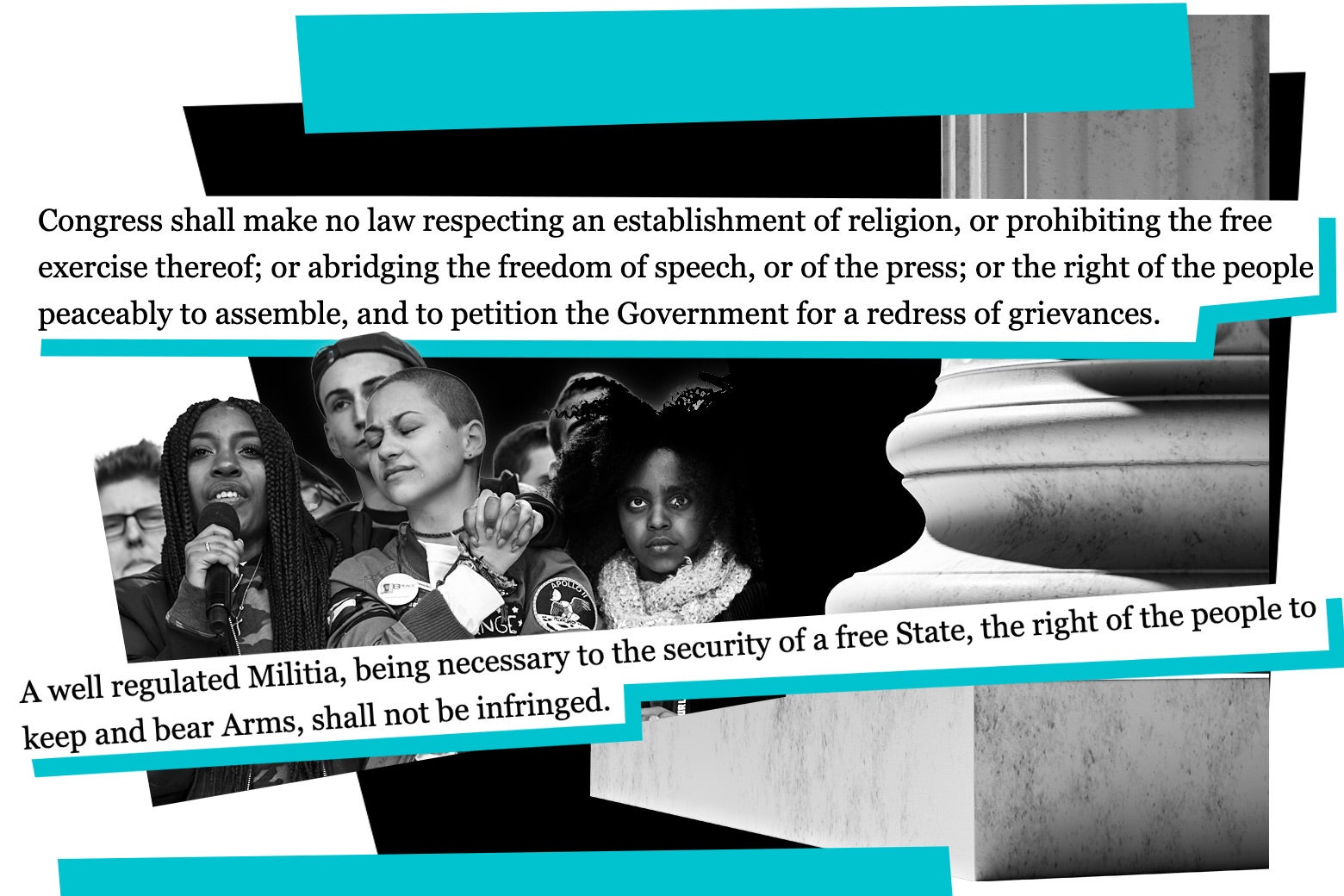

Photo illustration by Slate. Photos by Jim Watson/AFP via Getty Images and Getty Images Plus.

This is part of Opening Arguments, Slate’s coverage of the start of the latest Supreme Court term. We’re working to change the way the media covers the Supreme Court. Support our work when you join Slate Plus.

In November, the Supreme Court agreed to hear a case that threatens the ability of the nation’s regulators to ensure the safety and soundness of our largest financial firms.

This is not the first time in the past year such words have been written; the court is routinely taking cases that threaten to upend the way banks are regulated. This case, however—National Rifle Association v. Vullo—is different because the plaintiffs are disguising it as a First Amendment case rather than one about bank regulation.

Following the tragic 2018 mass shooting at Marjory Stoneman Douglas High School in Parkland, Florida, that left 17 murdered and 17 more injured, Maria Vullo, then the superintendent of the New York State Department of Financial Services, issued alerts to the state’s banks and insurers about potential financial risks associated with providing services to the firearms industry.

The NRA sued on the grounds that this guidance was a “thinly veiled threat,” as settlements with several insurance companies followed soon after the guidance’s publication. This is nonsense. At issue in these cases are insurance policies offered by the NRA to New York members that were illegal under state law. The guidance had nothing to do with them.

Regardless of whether one supports or opposes the NRA, the organization’s argument is concerning. The financial services department’s guidance is grounded in the principles of ensuring that banks and insurance companies are in safe and sound financial positions. Like all companies, these financial institutions may face what is known as reputational risk, leading to financial losses as customers move to competitors. The guidance merely encouraged banks and insurers to evaluate and manage risks, including reputational risks, that arise from their relationships with the NRA and firearms manufacturers. It neither encouraged firms to drop the firearms industry as customers nor threatened penalties if they did not.

The guidance in question is not coercive. What is legal practice for banks and insurers does not depend on the whims of regulators. At the federal level, for example, banks cannot engage in unsafe or unsound practices—activities that pose a “reasonably foreseeable undue risk” or are “contrary to accepted standards of banking operations which might result in abnormal risk or loss.” Importantly, regulators cannot simply snap their fingers and declare that an activity poses an undue risk but must convince judges of that fact. Guidance simply serves as warnings to regulated institutions that some activities may pose risks, not that failure to mitigate particular risks will result in enforcement actions.

It is this fact that makes the NRA’s lawsuit so concerning. Even if one thinks that the financial services department’s guidance was inappropriate—perhaps over free speech concerns or because reputational risk is too “ancillary” to be considered unsafe or unsound—there is no easy way for courts to differentiate this guidance from others that are appropriate, help institutions manage their risks, and protect the American public from the failure of financial firms.

For example, the federal banking agencies last year issued guidance alerting institutions to the risks of having deposits that are overly concentrated in firms engaged with cryptocurrency. This document was issued thanks to the collapse of Silvergate Bank, which failed in late 2022, after its depositors—largely firms in the crypto industry—quickly withdrew funds en masse because of the quick decrease in crypto prices. The crypto industry easily could have alleged that it was being targeted for its support of particular legislative changes pending in Congress but for the fact that the guidance was issued after a bank had literally begun failing.

Similarly, as insurers withdraw from particular geographic regions because of natural disasters exacerbated by climate change, regulators have issued guidance alerting firms to the risk of stranded fossil fuel assets left behind in the shift to a low-carbon economy. Fossil fuel producers could allege that regulators are pressuring financial firms to withhold financing or insurance coverage to a politically disfavored industry. Nevertheless, federal regulators have identified climate-related risks as a danger to the stability of the financial system.

The NRA’s lawsuit, while couched in the language of free speech, threatens the ability of regulators to communicate with the largest banks and insurance companies about the risks they face. If the Supreme Court removes this tool from regulators’ toolboxes, the financial system threatens to put the American economy just that more at risk.

Guns

Jurisprudence

Supreme Court

Opening Arguments

>>> Read full article>>>

Copyright for syndicated content belongs to the linked Source : Slate News – https://slate.com/news-and-politics/2024/01/nra-bad-news-supreme-court-vullo.html?via=rss