Lehigh County Pension Fund Revises Investment Approach Amidst Tesla Performance Concerns

In a notable change to its investment strategy, the Lehigh County Pension Fund has decided to halt any further acquisitions of Tesla Inc. stock, driven by rising apprehensions regarding the company’s recent performance and its involvement in political controversies. This decision highlights a growing unease among institutional investors about the risks associated with companies that operate at the crossroads of technology and politics. As public pension funds become more vigilant in evaluating their investment portfolios, this stance from Lehigh County may signal a broader trend among similar organizations that are increasingly aware of how corporate governance and social responsibility impact their asset allocations.

This strategic pause raises critical questions about Tesla’s future within institutional investments and emphasizes the challenges faced by funds trying to balance financial returns with political realities.

Factors Influencing Lehigh County Pension Fund’s Decision

The decision to suspend investments in Tesla is influenced by several key factors:

- Market Fluctuations: The volatility of Tesla’s stock has raised concerns regarding its long-term sustainability.

- Governance Issues: Ongoing political controversies surrounding Tesla’s leadership have led investors to question potential reputational risks for the company.

- Evolving Consumer Preferences: The increasing competition within the electric vehicle market necessitates a reassessment of current investment strategies.

| Catalyst | Consequences |

|---|---|

| Market Fluctuations | Pension fund assets face heightened risk exposure |

| Governance Issues | Potential decline in investor trust |

Political Factors Shaping Investment Strategies in Lehigh County

The choice made by the Lehigh County pension fund to cease purchasing shares of Tesla reflects an emerging trend wherepolitical dynamics are increasingly shaping investment decisions. This shift is not solely due to fluctuations in stock performance but also stems from rising concerns over corporate leadership and alignment with community values. Today’s investment choices extend beyond mere financial metrics; they are influenced by various elements such as social accountability, governance practices, and public sentiment towards prominent figures linked with these corporations.

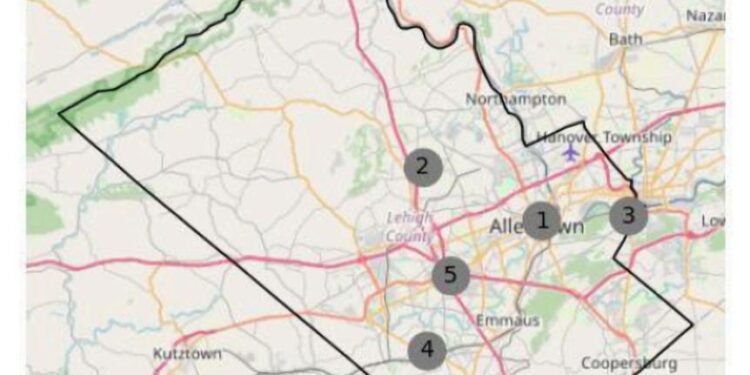

A number of stakeholders within Lehigh County advocate for enhanced scrutiny over investments that may conflict with local ethical standards or communal ideals. Consequently, decision-makers at pension funds are prioritizing investments that resonate with their constituents’ values. This evolving landscape is underscored by reactions from both investors and leaders who feel compelled to align financial success withpolitical responsibility . Below is an overview summarizing key aspects currently influencing investment strategies within the county:

| Main Considerations | Description | ||||||

|---|---|---|---|---|---|---|---|

| Performance Analysis | A thorough evaluation of stock performance leading to reconsideration regarding investing in Tesla. | ||||||

| Community Values | Ensuring alignment between investments and local ethics . | ||||||

| Leadership Impact | Concerns surrounding Elon Musk’s actions affecting company reputation . | ||||||

| Social Accountability | < b >Growing focus on investing only into firms demonstrating strong ESG (Environmental , Social , Governance ) practices .< / b >

< / tr > < / tbody > < / table > Experts Advise Diversification Following Exit from Tesla Stock Investments |

| Asset Category | Allocation Percentage < / tr > < / head > |

|---|---|

| Equities | 40 %

< / tr > |

| Bonds | 30 %

/ tr /> |