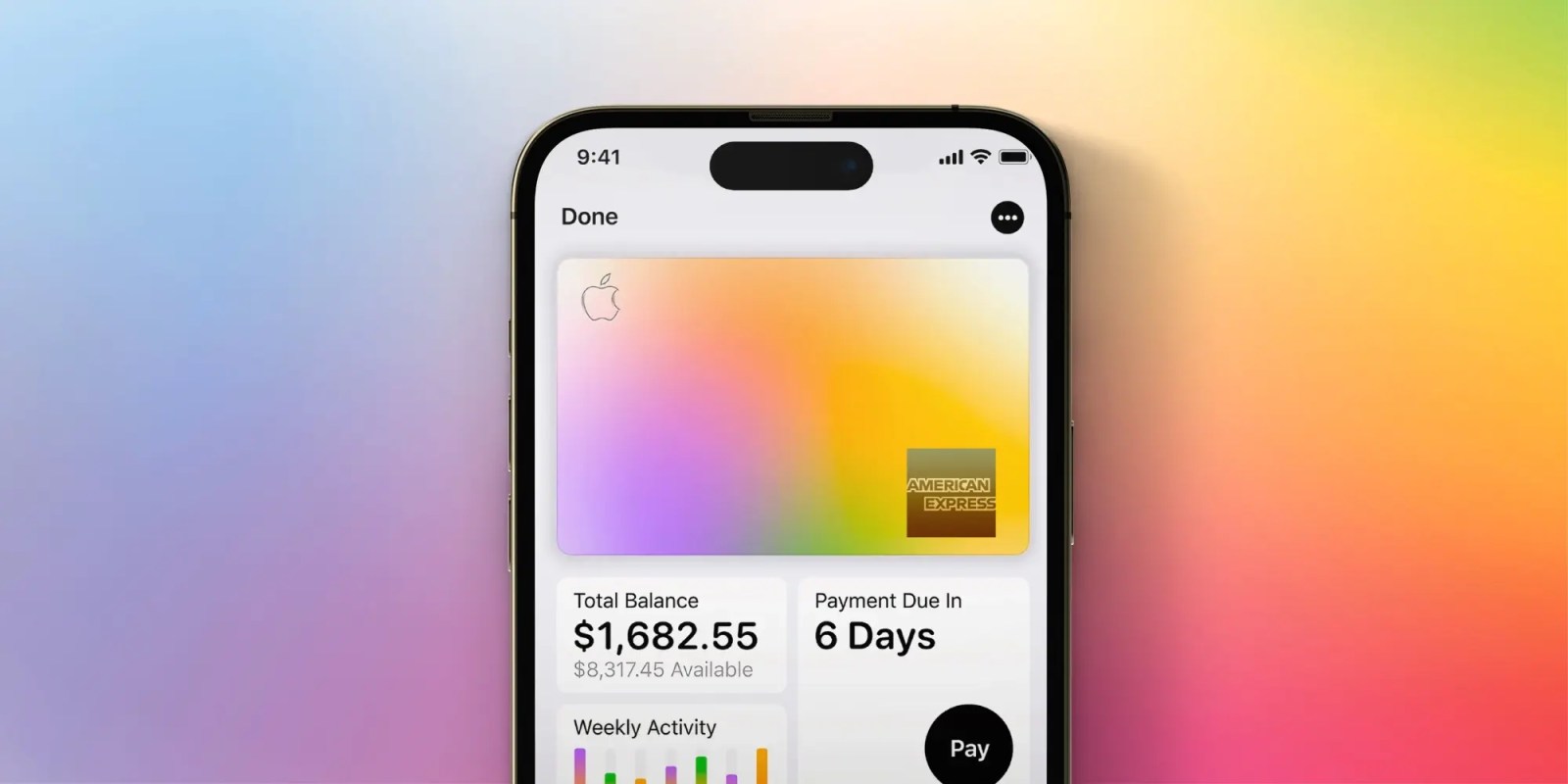

Apple has developed a deep relationship with Goldman Sachs through Apple Card, but apparently, it’s an unhappy marriage. According to the Wall Street Journal, Goldman Sachs is in talks with American Express about transferring its Apple partnership. This comes after Goldman revealed in January that it had lost over $1 billion on the Apple Card deal so far.

Conscious uncoupling and mixed signals

The report explains that Goldman is “in talks to offload those businesses and its credit-card partnership to Amex.” Goldman has already significantly scaled back its efforts to break into the consumer finance industry.

A deal with Amex isn’t imminent or assured, people familiar with the conversations said, and it could take a while to transfer the partnership in any case. Apple would have to agree to a transfer. The tech company is aware of the talks, which have been ongoing for months, the people said.

For those who have been following along, this news isn’t that surprising, but it certainly doesn’t align with recent comments from Goldman Sachs. In October of last year, Goldman Sachs CEO David Solomon said that the company had reached a deal with Apple to extend the partnership through 2029.

In January, Goldman Sachs revealed that it had lost over $1 billion on its Apple Card partnership since 2020. In February, however, the bank said it was still “committed” to the partnership with Apple despite those losses. “It’s a very, very strong partnership where there’s a lot of opportunity,” Solomon said.

If today’s report is to be believed, I wouldn’t exactly say Goldman was “committed.” Talk about mixed signals.

Despite being stuck in an unhappy relationship, Goldman Sachs recently expanded its relationship with Apple with the launch of the Apple Card Savings Account. Goldman Sachs is also the issuer of the Mastercard payment credential used to complete Apple Pay Later purchases.

Bloomberg has also reported on Apple’s ambitions for financial services under the company’s “Project Breakout” strategy to bring more of the finance tech in-house. This would reduce its reliance on companies like Goldman Sachs.

How is Goldman losing so much money on Apple Card?

First, Apple Card doesn’t charge users any fees other than interest. Other card companies nickel and dime with things like late fees and foreign transaction fees, but Apple Card does not.

Second, Goldman has also been very liberal in approving people for Apple Card. This has led to the bank having to charge off balances at a much higher rate than banks like Chase and Bank of America. Here are some numbers from the company’s recent regulatory filings:

Goldman has a 2.93% net charge-off rate, double that of Chase and Bank of America

“Charge-offs” are typically after a customer misses payments for six months

Interest is one of the most lucrative ways credit card companies make money, but if the customer simply stops paying their bill altogether, the bank can’t collect that interest (at least right away).

More than a quarter of Goldman’s card loans have gone to people with FICO scores below 660

Chase says 12% of its loans are to users with scores below 660. Bank of America says that 3.7% of loans are tied to FICO scores under 620.

According to Goldman employees, the company is less aggressive (and less successful) at recovering charge-off debt than other banks.

Follow Chance: Twitter, Instagram, and Mastodon

FTC: We use income earning auto affiliate links. More.

>>> Read full article>>>

Copyright for syndicated content belongs to the linked Source : 9to5Mac – https://9to5mac.com/2023/06/30/amex-apple-card-goldman-sachs/