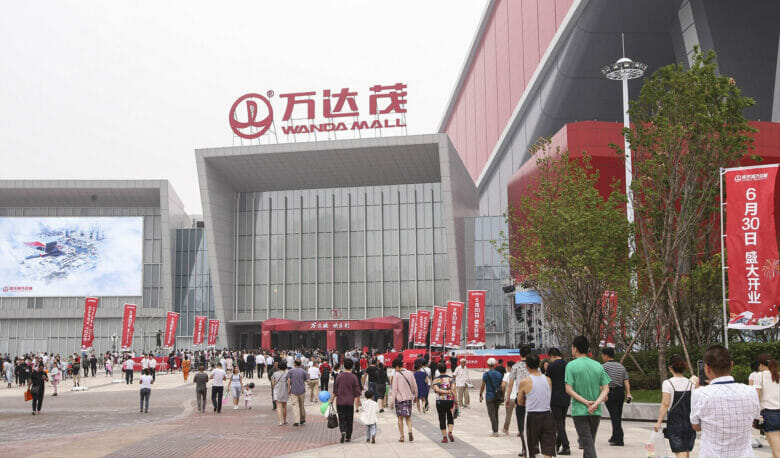

PAG and friends now control 496 Wanda Plazas (Getty Images)

PAG on Saturday joined with partners CITIC Capital, Ares Management, the Abu Dhabi Investment Authority and Mubadala Investment Company in confirming their takeover of Dalian Wanda Group’s primary shopping mall management business.

In a joint announcement the companies said they had signed a joint agreement to invest $8.3 billion in return for a 60 percent stake in Newland Commercial Management, a newly formed holding company of Zhuhai Wanda Commercial Management Group, with Dalian Wanda Commercial Management holding the remaining 40 percent.

The new agreement implements a deal signed in December, with PAG having announced at the time that it had joined with other investors to invest in Zhuhai Wanda Commercial Management, which at that juncture managed China’s largest chain of shopping malls, a portfolio which now numbers 496 assets.

“This investment will facilitate corporate governance independent from its former parent, provide better incentives for its management, and support Newland’s continued operational improvement,” the partners said in the statement. “The investors are committed to further strengthening Newland’s market-leading position in the industry.”

Ready for Returns

The PAG consortium’s takeover of tycoon Wang Jianlin’s mall empire comes after his Dalian Wanda Group failed to list its shopping centre management business on the Hong Kong exchange after taking out $5.9 billion in pre-IPO financing from investors including PAG in 2021.

PAG chairman and CEO Weijian Shan has a history of mega-takeovers in China

Despite Wang’s inability to achieve his stock market goals, Dalian Wanda Commercial Management, the primary holding company for Wanda’s commercial and hospitality assets, ranked as China’s largest commercial developer in 2023 with operating income of RMB 47.3 billion ($6.7 billion), according to data from China Real Estate Information Corporation.

The primary source of that revenue was the malls held by Zhuhai Wanda Commercial Management, and now Newland Commercial Management Group, with Wanda’s 2023 turnover nearly double the RMB 25.2 billion in operating income achieved by number two commercial developer China Resources Land.

In Saturday’s statement the new owners of Wanda’s mall business expressed confidence in their ability to produce returns for their backers from the new acquisition.

“This investment reflects the expectation and recognition of Newland’s long-term growth potential by international institutional investors,” David Wong, partner and co-head of private equity at PAG, said, citing the business’s ability to generate stable and growing cash flow.

The statement noted that since the consortium, including PAG, CITIC, Ares and other investors, provided the pre-IPO financing for Zhuhai Wanda three years ago, the business generated net profit of $800 million in 2021, $1.1 billion in 2022, and $1.3 billion in 2023, representing an annual growth rate of approximately 32 percent.

Shopping for the Future

“As a frontrunner in the industry, Newland has significant competitive advantages and growth prospect,” said Yichen Zhang, chairman and chief executive officer of CITIC Capital. “We are confident that this investment will provide Newland with lasting stability and support, facilitating the company’s robust and rapid growth and drive further value creation.”

Newland Commercial Mangement’s portfolio now spans around 70 million square metres (753 million square feet) of space across 230 Chinese cities with more than 100,000 tenants.

The terms of Wanda’s 2021 pre-IPO financing had required Dalian Wanda and its commercial management arm to buy back the shares issued to the PAG consortium and compensate for investment returns, if the mall business failed to achieve a Hong Kong listing by the end of 2023.

Country Garden had also joined in the Wanda’s 2021 financing, but with the Guangdong-based developer strapped for cash, it announced in December that it was selling back its minority stake to the company, with that statement coming just days after PAG’s takeover announcement.

Where Wanda failed repeatedly in its bid for a listing, PAG has a record of successful takeovers of mainland Chinese companies, with chairman Weijian Shan having written a book on his experience buying out Shenzhen Development Bank more than a decade ago.

Note: This story has been updated to show that Zhuhai Wanda Commercial Management has not owned mall assets. An earlier version indicated that the company owned properties in addition to managing them. Mingtiandi regrets the error.

>>> Read full article>>>

Copyright for syndicated content belongs to the linked Source : MingTiandi – https://www.mingtiandi.com/real-estate/retail/adia-mubadala-join-pag-ares-citic-in-wanda-mall-buyout/